Last Update 01 May 25

Fair value Increased 2.65%Supply Chain Upgrades And Flagship Stores Will Improve Delivery Efficiency

Key Takeaways

- Enhanced integration and strategic expansions are driving substantial growth in users, order volume, and revenue, bolstering the company's market position.

- Improved operational efficiencies and partnerships are setting the foundation for better net margins and future earnings growth through increased economies of scale.

- Challenges in profitability and investor confidence are coupled with risks from operational costs, competitive pressures, and sensitivity to consumer sentiment impacting revenue.

Catalysts

About Dada Nexus- Operates a platform of local on-demand retail and delivery in the People’s Republic of China.

- JD NOW experienced over 100% year-on-year growth in monthly transacting users and orders through the JD App, supported by increased product offerings and strategic integration within the JD ecosystem, which is expected to drive substantial future revenue growth.

- The introduction of JD NOW brand flagship stores and enhanced supply chain capabilities are anticipated to attract more high-quality users and increase the order volume, positively impacting net revenues.

- Optimized cost efficiencies and improved consumer subsidy efficiency have resulted in a narrowed non-GAAP net loss margin, setting the stage for enhanced net margins as operational efficiencies continue to develop.

- The expansion of Dada NOW's partnerships with chain merchants, specifically in restaurants and beverage KAs, is driving significant order volume growth, expected to bolster revenue streams.

- The continued synergy and integration between the JD NOW and Dada NOW platforms are positioned to improve delivery efficiency and user experience, potentially increasing earnings through economies of scale and market share expansion.

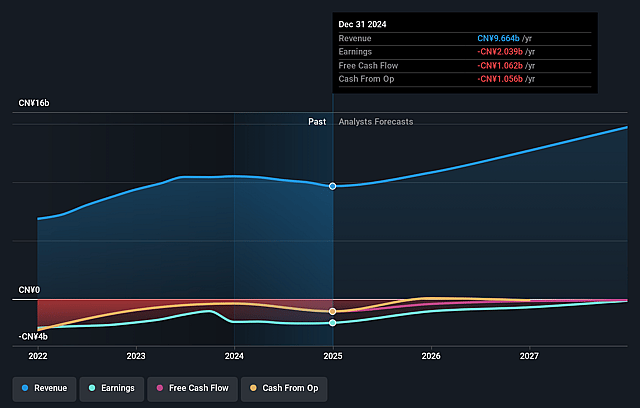

Dada Nexus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dada Nexus's revenue will grow by 15.0% annually over the next 3 years.

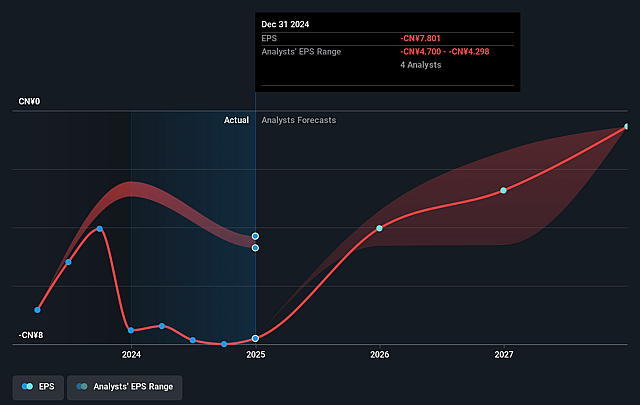

- Analysts are not forecasting that Dada Nexus will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Dada Nexus's profit margin will increase from -21.1% to the average US Consumer Retailing industry of 2.6% in 3 years.

- If Dada Nexus's profit margin were to converge on the industry average, you could expect earnings to reach CN¥383.1 million (and earnings per share of CN¥1.59) by about May 2028, up from CN¥-2.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 2.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Dada Nexus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in online advertising and marketing services revenues and fulfillment services due to the delivery fee waiver program could negatively impact net revenues and overall profitability.

- There was an increase in provision for credit loss and litigation-related expenses, which could place additional pressure on net margins and net earnings.

- Despite the increase in order volume, the non-GAAP net loss indicates continued challenges in achieving profitability, which could affect investor confidence.

- The aggressive expansion in store coverage and strengthening of user engagement may lead to higher operational costs and thin margins if execution is not managed efficiently.

- The reliance on continued integration with the JD ecosystem, and sensitivity to consumer preferences for immediate convenience, could be impacted by changes in consumer sentiment or competitive pressures, potentially affecting revenue trajectories.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.392 for Dada Nexus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.2, and the most bearish reporting a price target of just $1.49.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥14.7 billion, earnings will come to CN¥383.1 million, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $1.91, the analyst price target of $2.39 is 20.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.