Key Takeaways

- Expansion into high-growth regions and focus on sustainable, premium homes position the company to benefit from shifting demographic and consumer trends.

- Prudent land management, strong liquidity, and aggressive share buybacks enhance resilience, profitability, and long-term shareholder value.

- Heavy reliance on high prices, concentrated markets, and affluent buyers exposes Tri Pointe to local risks, shrinking demand, and margin pressures in softening housing conditions.

Catalysts

About Tri Pointe Homes- Engages in the design, construction, and sale of single-family attached and detached homes in the United States.

- Tri Pointe is positioned to benefit from the sustained U.S. housing supply-demand imbalance and favorable demographic trends, which are expected to provide a long runway for revenue growth as household formation continues to outpace new home supply.

- Ongoing expansion into high-growth Sun Belt and Southeastern markets (Florida, Coastal Carolinas, Utah) broadens Tri Pointe's geographic footprint and capitalizes on migration patterns and hybrid/remote work trends, which should support higher sales volumes and revenue visibility.

- Strategic discipline in land acquisition, strong liquidity ($1.4B), and active inventory management create a robust lot pipeline and flexibility to capitalize on growth opportunities, likely supporting steady backlog conversion, reduced risk of asset write-downs, and improved return on equity.

- Continued prioritization of a premium, energy-efficient product offering aligns with rising consumer demand for sustainable homes, which is expected to enable better pricing power and bolster net margins long-term as regulatory and buyer preferences shift.

- Aggressive share repurchases (over 5% share reduction YTD; trading below book value), along with digital sales/customer experience investments, are expected to drive long-term EPS growth and operating margin improvement, enhancing shareholder returns even if near-term conditions are challenging.

Tri Pointe Homes Future Earnings and Revenue Growth

Assumptions

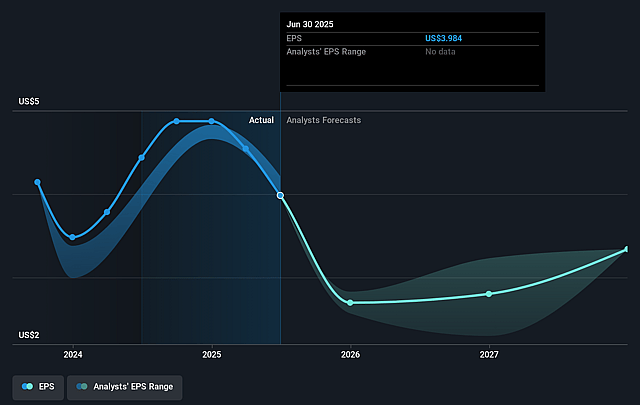

How have these above catalysts been quantified?- Analysts are assuming Tri Pointe Homes's revenue will decrease by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.0% today to 6.0% in 3 years time.

- Analysts expect earnings to reach $193.6 million (and earnings per share of $3.34) by about September 2028, down from $365.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from 8.5x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 6.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Tri Pointe Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tri Pointe's home orders declined 25% year-over-year compared to low single-digit declines for peers, indicating potential loss of market share or diminished demand relative to competitors, which could pressure future revenue and earnings growth.

- The company continues to prioritize price over sales pace, resulting in slower absorption rates and higher incentives, and with absorption trending toward the lower end of its target range (2.5 homes per community/month), this approach could compress gross margins if market demand remains weak and incentives must rise further.

- Geographic concentration in markets such as California and the Western U.S. (where regions like Northern California and Sacramento have shown softness and required inventory impairment charges) exposes Tri Pointe to outsized local risks and potential further margin and asset write-down impacts.

- Persistent affordability issues due to high home prices, increasing incentives, elevated interest rates, and dependence on well-off buyers (average household income $220,000), could limit the pool of potential buyers, diminishing volume growth and pressuring both revenue and net margins in the long term.

- Ongoing investment in land (with a significant portion owned rather than optioned) and the risk of inventory build-up or impairment in slower markets leave Tri Pointe vulnerable to cyclical downturns, which could result in further write-downs or depressed future returns on equity, impacting long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $39.4 for Tri Pointe Homes based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $193.6 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 9.2%.

- Given the current share price of $35.49, the analyst price target of $39.4 is 9.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.