Key Takeaways

- Strategic retail expansion and new product development are expected to drive revenue growth and improve customer experience.

- Improved financing collaborations and operational efficiencies may boost sales and enhance net and gross margins.

- Economic uncertainty and rising costs, including interest rates and tariffs, may threaten Champion Homes' future revenue growth and margin stability.

Catalysts

About Champion Homes- Engages in the production and sale of factory-built housing in North America.

- Expansion of retail and direct-to-consumer capabilities, including strategic investments to support various customer channels, is likely to boost revenue.

- The ongoing development of new products and solutions to enhance customer experience and attract new buyers may result in higher sales and revenue growth.

- Collaborations with ECM Capital and Triad Financial Services, through Champion Financing, are expected to drive affordability and improve financing options, which can enhance sales and revenue.

- Turning insights from completed projects into efficiencies and streamlining local government processes for builder developer projects is anticipated to boost operational efficiencies and potentially improve net margins.

- Adjustments in manufacturing capacity utilization and leveraging a playbook from past experiences with tariffs to manage costs and production effectively might help in maintaining or increasing gross margins.

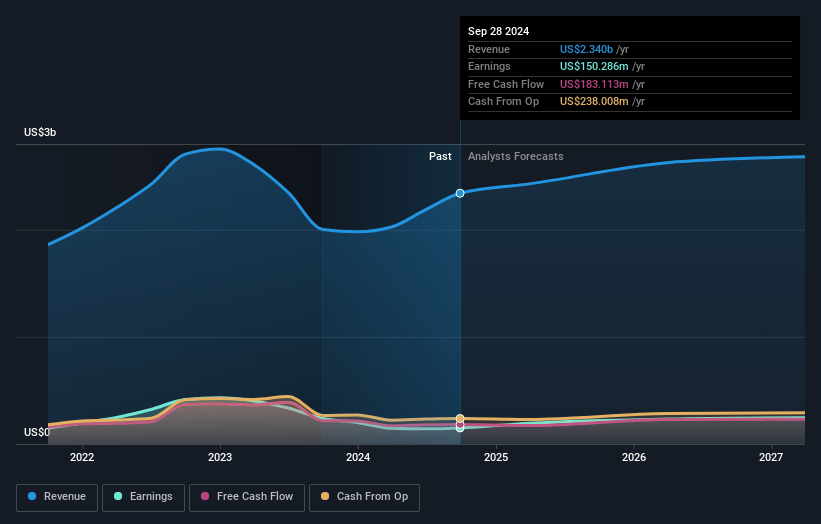

Champion Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Champion Homes's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.8% today to 9.5% in 3 years time.

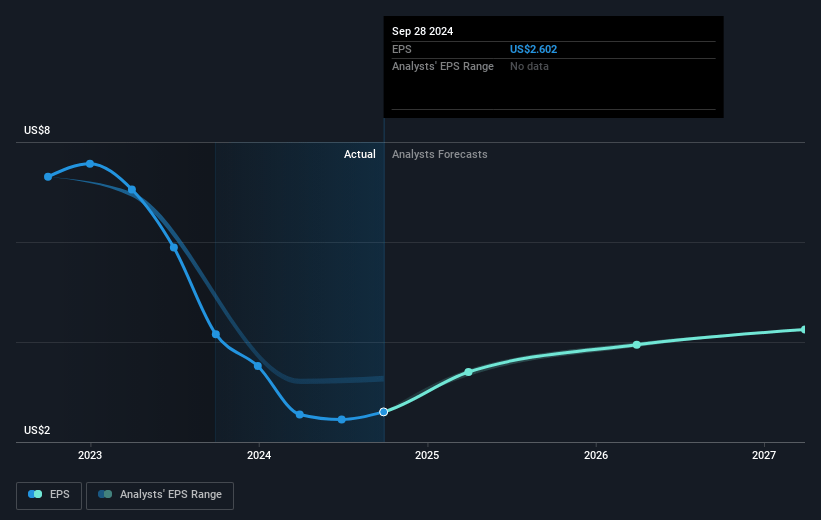

- Analysts expect earnings to reach $285.9 million (and earnings per share of $4.77) by about April 2028, up from $164.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.2x on those 2028 earnings, down from 28.5x today. This future PE is greater than the current PE for the US Consumer Durables industry at 8.4x.

- Analysts expect the number of shares outstanding to decline by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

Champion Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High interest rates and economic uncertainty in Canadian markets are dampening buyer enthusiasm, potentially affecting future revenue and sales volume in Canada.

- A sequential decline in backlog was noted, as well as a normal seasonal slowdown in order rates, which could indicate potential risks to future revenue growth.

- Input costs are expected to increase due to fluctuations in forest product costs and potential tariffs, which might compress gross margins.

- Increases in SG&A expenses driven by investments in personnel and technology could pressure net margins if revenue growth doesn't keep pace.

- Market demand affected by tariffs and supply chain concerns could impact revenue stability and operational costs, posing a risk to profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $96.6 for Champion Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $285.9 million, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $81.94, the analyst price target of $96.6 is 15.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.