Last Update 23 Nov 25

Fair value Increased 2.76%SKY: Share Buybacks And Lower Profit Margins Will Shape Fair Price Outlook

Analysts have raised their price target for Champion Homes from $84.67 to $87.00, citing updated fair value estimates and modest adjustments to near-term growth and profitability assumptions.

What's in the News

- Champion Homes, Inc. provided revenue guidance for the third quarter of fiscal 2026, anticipating revenue to be flat compared to the same period last year (Key Developments).

- The company repurchased 710,733 shares, representing 1.26%, for $50 million between June 29, 2025 and September 27, 2025. Overall, 2,395,189 shares have been repurchased for $172.33 million under the buyback program announced on May 21, 2024 (Key Developments).

- On October 30, 2025, Champion Homes increased its equity buyback plan authorization to $150 million (Key Developments).

Valuation Changes

- Fair Value Estimate has risen from $84.67 to $87.00, reflecting a modest upward revision.

- Discount Rate has fallen slightly from 8.44% to 8.42%.

- Revenue Growth expectation has edged down marginally from 2.83% to 2.82%.

- Net Profit Margin estimate has decreased from 8.16% to 7.71%.

- Future P/E Ratio has increased from 24.58x to 25.70x.

Key Takeaways

- Strengthening demand and policy support for affordable off-site housing, coupled with product innovation, expand Champion's market reach and support sustained revenue growth.

- Strategic expansion, acquisitions, and operational efficiencies position Champion for margin improvement and long-term earnings growth in a diversifying market.

- Slowing demand, rising material costs, consumer affordability concerns, inventory risks, and regulatory dependence threaten growth prospects and could pressure both margins and earnings visibility.

Catalysts

About Champion Homes- Produces and sells factory-built housing in the United States and Canada.

- Increasing national focus on housing affordability and supportive policy momentum (such as the bipartisan advancement of the ROAD to Housing Act) is expected to drive structural, long-term demand for manufactured homes, directly benefiting Champion's volumes and revenue growth in coming years.

- Accelerating shifts among first-time buyers and traditional homeowners toward affordable, high-quality off-site construction, supported by targeted marketing and product innovation, should expand Champion's customer base and support sustainable top-line growth.

- Strategic expansion into high-margin multifamily and commercial modular segments, alongside the recent Iseman Homes acquisition and continued integration synergies, positions Champion to structurally improve net margins and drive earnings growth over time.

- Broader adoption of off-site construction solutions among builders and developers, along with growing builder/developer pipelines, increases Champion's share of a diversifying addressable market, supporting revenue and market share gains.

- Ongoing process improvements, cost discipline, and material cost stability, combined with the benefits of increased scale and geographic reach, are expected to maintain gross margins above historical averages and support improved operating income.

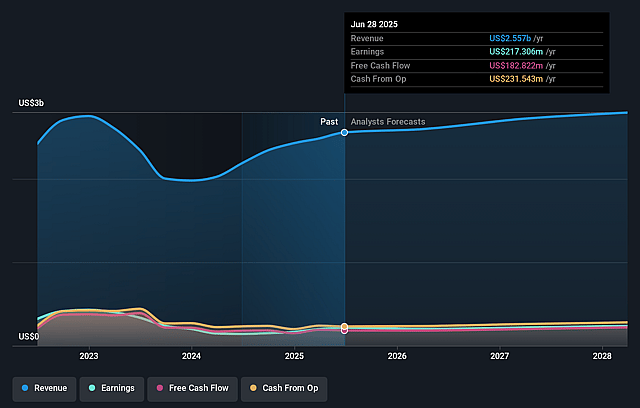

Champion Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Champion Homes's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.5% today to 8.1% in 3 years time.

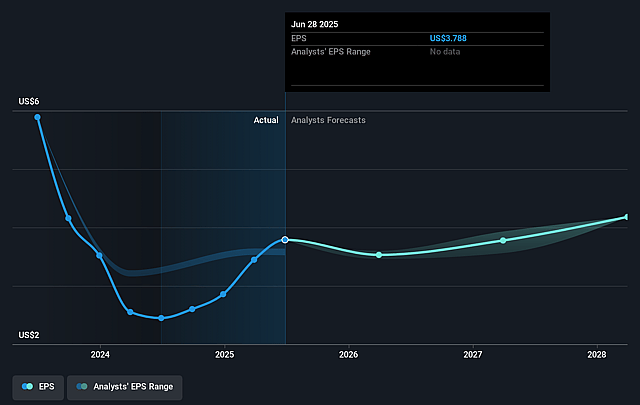

- Analysts expect earnings to reach $228.5 million (and earnings per share of $4.08) by about September 2028, up from $217.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.4x on those 2028 earnings, up from 19.4x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 1.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Champion Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Moderation in order rates and softening demand in certain regions and sales channels, especially in the community channel and among independents, signals a potential slowing of top-line revenue growth and could lead to lower backlogs over time.

- Increased material cost inflation, including exposure to tariffs and rising input component prices, presents an ongoing risk to gross margins and profitability, especially as lower material costs that drove the recent margin beat may not be sustainable.

- The company's exposure to cautious consumer sentiment and affordability issues-particularly among first-time buyers and lower-income customers who are more sensitive to macroeconomic pressures and financing conditions-could limit future sales volume and revenue.

- Uncertainty in inventory management within captive retail channels, where excess inventory is being worked through, poses a risk of additional SG&A expenses or margin pressure if sales pace slows or discounting is needed to clear stock.

- Heavy dependence on favorable regulatory trends and bipartisan legislative support for manufactured housing-such as the progression of the ROAD to Housing Act-creates exposure to legislative or policy reversals that could restrict growth opportunities, impacting both revenue and medium-term earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $82.833 for Champion Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.0, and the most bearish reporting a price target of just $72.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $228.5 million, and it would be trading on a PE ratio of 24.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of $74.54, the analyst price target of $82.83 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.