Narratives are currently in beta

Key Takeaways

- Strategic international expansion and brand elevation enhance profit margins and signal potential revenue growth opportunities in key markets.

- Focused investments in brand building and digital platforms support long-term sustainable growth and improved earnings leveraging operational efficiencies.

- Ralph Lauren's growth strategy faces risks from geopolitical tensions, economic uncertainty, market saturation, and currency fluctuations, which could affect revenue and earnings stability.

Catalysts

About Ralph Lauren- Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

- Strong international performance, particularly in Europe and Asia, with strategic expansion in key cities and markets, suggests increased future revenue growth potential.

- Continued brand elevation efforts, reducing discounting, and increased pricing power are expected to boost gross margins, enhancing profitability.

- Significant efforts in growing high-potential product categories such as women's apparel, outerwear, and handbags could lead to higher revenues and improved product mix margin-wise.

- Ongoing expansion and elevation of retail footprint, both full-price and outlets, especially in underpenetrated markets like Europe and Asia, indicate potential revenue growth opportunities.

- Strategic investments in brand building, digital platforms, and key enablers signal long-term sustainable growth, likely impacting earnings positively by leveraging operating expenses efficiently.

Ralph Lauren Future Earnings and Revenue Growth

Assumptions

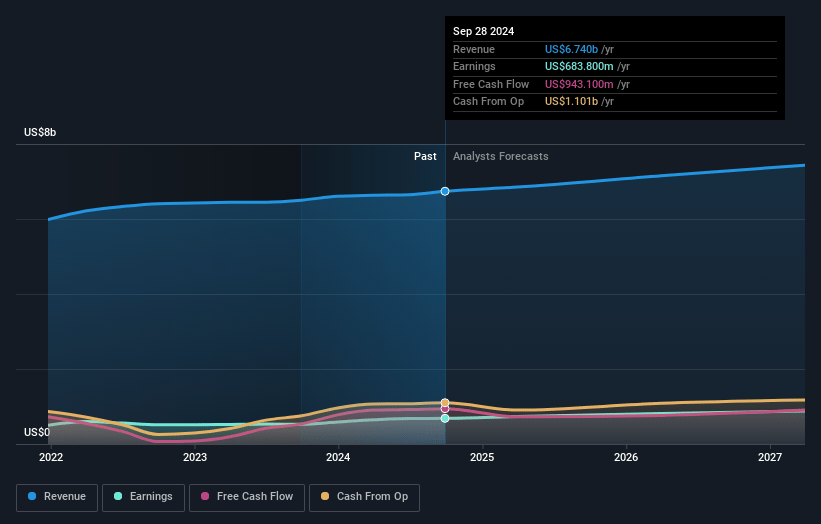

How have these above catalysts been quantified?- Analysts are assuming Ralph Lauren's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.1% today to 11.5% in 3 years time.

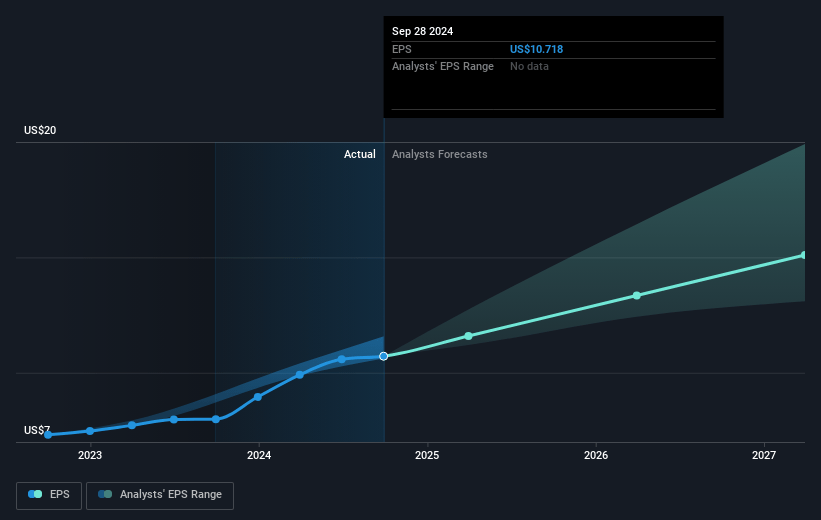

- Analysts expect earnings to reach $873.4 million (and earnings per share of $14.88) by about November 2027, up from $683.8 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2027 earnings, up from 18.7x today. This future PE is greater than the current PE for the US Luxury industry at 18.2x.

- Analysts expect the number of shares outstanding to decline by 1.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

Ralph Lauren Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- While Ralph Lauren has significant growth opportunities in China, geopolitical and macroeconomic uncertainties could impact consumer behavior, potentially affecting revenue from this region.

- The company's dependence on Asia for growth, specifically with 70 planned store openings, may expose it to risks of over-expansion in uncertain economic climates, potentially impacting net margins.

- Reduced discounting to elevate brand positioning might deter price-sensitive consumers, possibly leading to a slowdown in volume growth and affecting overall revenue.

- With a high concentration of stores in key cities, there are risks of market saturation and dependency on a few markets, which could impact earnings if those markets face downturns.

- Currency fluctuations, as indicated by foreign exchange impacts on revenue results, could continue to pose risks, potentially reducing the net earnings that depend heavily on international sales.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $232.01 for Ralph Lauren based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $148.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $7.6 billion, earnings will come to $873.4 million, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $205.53, the analyst's price target of $232.01 is 11.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives