Key Takeaways

- Inventory management challenges may limit short-term sales growth and negatively impact revenue if consumer demand doesn't align quickly with inventory levels.

- High promotional expenses and limited attractive M&A opportunities could compress margins and hinder strategic growth plans.

- Strengthened balance sheet and operational efficiencies position Marine Products well for growth, buoyed by potential consumer demand resurgence and positive dealer sentiment.

Catalysts

About Marine Products- Designs, manufactures, and sells recreational fiberglass powerboats for the sport boat and sport fishing boat markets in the United States.

- Channel inventory issues in 2024 have been challenging, requiring conservative inventory management, which may limit sales growth in the short term. This situation could impact revenue negatively if consumer demand doesn't align swiftly with existing inventory levels.

- The resolution of political uncertainty and mixed interest rate signals suggest cautious optimism, but consumer sentiment is still fragile. If consumer demand does not rebound as hoped, it could suppress future revenue growth.

- Investments in operational efficiencies and solar panels aim to improve margins and reduce costs. However, if these efficiencies don't materialize or lead to significant savings, it could result in lower than expected improvement in net margins.

- With competition and incentive programs continuing to be necessary to move existing inventory, promotional expenses might remain high, potentially compressing gross margins and reducing profitability.

- M&A opportunities are currently limited to distressed brands, which may not align with strategic growth plans. This lack of attractive acquisition targets could prevent the company from enhancing revenue streams and market position.

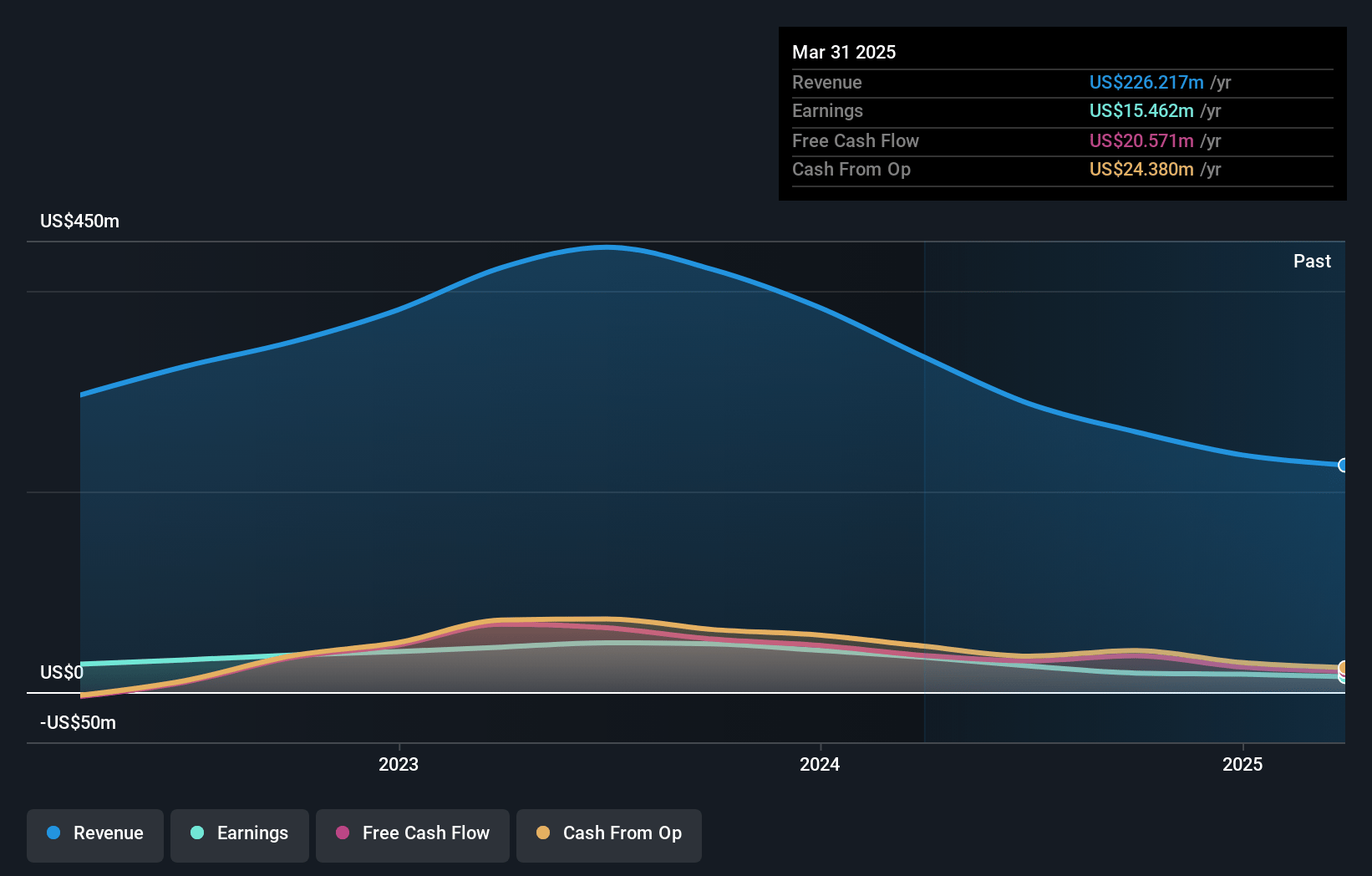

Marine Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Marine Products's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.5% today to 5.7% in 3 years time.

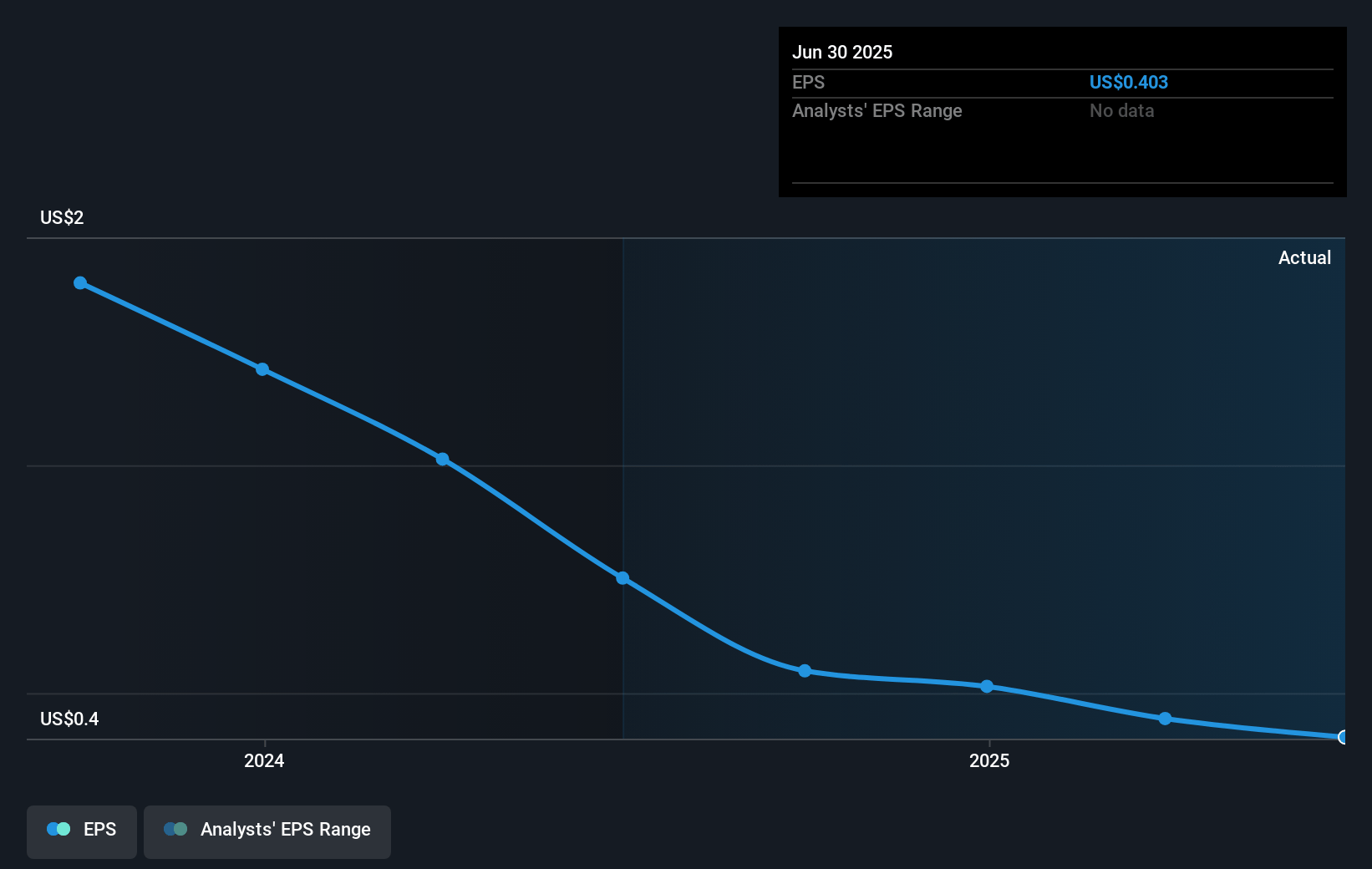

- Analysts expect earnings to reach $16.9 million (and earnings per share of $0.49) by about March 2028, down from $17.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from 16.5x today. This future PE is greater than the current PE for the US Leisure industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.69%, as per the Simply Wall St company report.

Marine Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Marine Products has seen a stabilization in field inventory levels, with a 15% decline compared to the previous year, which positions it well to meet future demand without excess inventory costs, potentially improving revenue and profit margins.

- Positive dealer and consumer sentiment, coupled with strong attendance and interest at boat shows, suggest a potential rebound in consumer demand, which could positively impact sales and revenue growth.

- Despite interest rate fluctuations, the overall sentiment from dealers is optimistic about future consumer demand, and potential interest rate reductions could enhance consumer purchasing power, contributing positively to revenue and sales growth.

- Investments in operational efficiencies, like improvements on the shop floor and the installation of solar panels, could lead to cost savings and improve operational effectiveness, which would positively impact net margins and profitability.

- Marine Products maintains a strong balance sheet, with significant cash reserves and no debt, enabling continued investment in strategic initiatives and the potential for ongoing dividends, which supports strong financial health and investor returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.0 for Marine Products based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $296.3 million, earnings will come to $16.9 million, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 6.7%.

- Given the current share price of $8.44, the analyst price target of $8.0 is 5.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.