Narratives are currently in beta

Key Takeaways

- New game experiences and targeted promotions at Topgolf are expected to drive long-term traffic growth and boost same-venue sales, positively impacting revenue.

- Expansion plans and operational improvements aim to boost Callaway's market share, revenue, and margins, positively impacting net margins and EBITDA.

- Decreasing same venue sales and slow market conditions could impact Topgolf's revenue and margins, amid exchange rate volatility and international expansion challenges.

Catalysts

About Topgolf Callaway Brands- Designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally.

- The introduction of new game experiences, like the Sonic the Hedgehog game, and enhanced consumer experiences at Topgolf are expected to drive long-term traffic growth and improve same-venue sales, which could positively impact revenue.

- The targeted promotions through a new consumer data platform, aimed at lapsed or new visitors, along with outbound sales efforts for corporate events, could increase customer visits and spending, enhancing overall earnings.

- Expansion plans, including the addition of new domestic and international Topgolf venues, are likely to increase the company's revenue base and contribute to growth in earnings.

- The strong market position of Callaway golf equipment, driven by product launches like Ai Smoke line in woods and a new putter model Square to Square, could boost market share and revenues in the golf equipment segment.

- Operational improvements, such as cost management and improved venue operating efficiencies at Topgolf, are likely to lead to margin expansion, positively impacting net margins and EBITDA.

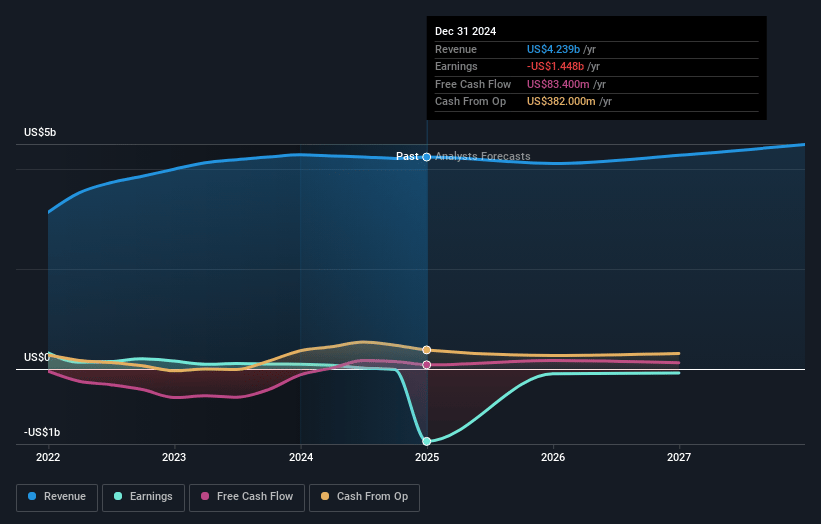

Topgolf Callaway Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Topgolf Callaway Brands's revenue will grow by 4.2% annually over the next 3 years.

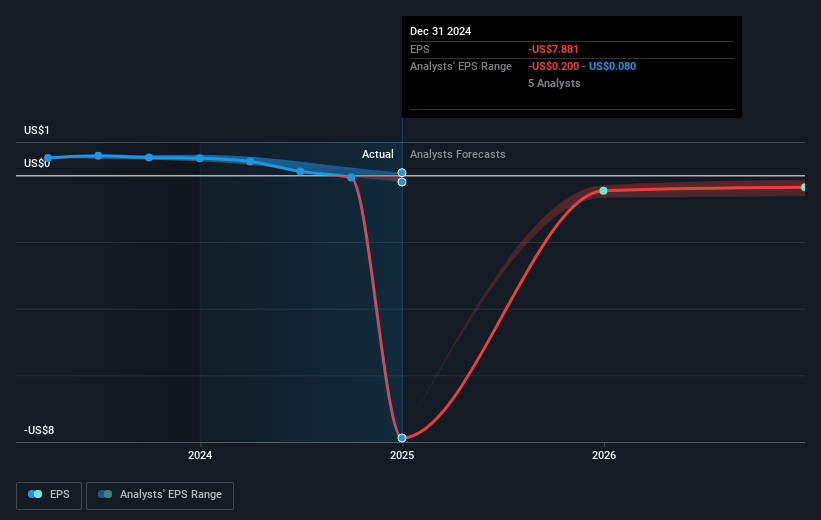

- Analysts assume that profit margins will increase from -0.3% today to 1.2% in 3 years time.

- Analysts expect earnings to reach $55.6 million (and earnings per share of $0.31) by about November 2027, up from $-12.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $124.2 million in earnings, and the most bearish expecting $36 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 65.9x on those 2027 earnings, up from -129.1x today. This future PE is greater than the current PE for the US Leisure industry at 17.8x.

- Analysts expect the number of shares outstanding to decline by 0.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Topgolf Callaway Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in same venue sales for Topgolf, with expectations of being down from high single digits to low double digits, could affect overall revenue and EBITDA if the trend persists longer than anticipated.

- The company's Golf Equipment segment experienced slightly slower market conditions than expected in Q3, leading to a reduction in full-year revenue guidance by $30 million. This could impact earnings if the market does not rebound.

- Depressed corporate demand in the 3+ bay events segment at Topgolf is a notable weakness, with a significant decline in this area possibly affecting revenue expectations if it does not show consistent improvement.

- The volatility in foreign exchange rates is highlighted as a continuing headwind, potentially affecting net margins and earnings as cost structures and revenue streams are impacted by currency fluctuations.

- Execution risks related to the international market expansion, as observed with Jack Wolfskin facing difficulties in Europe, may affect the overall profitability and global revenue growth if not addressed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.79 for Topgolf Callaway Brands based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $9.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.8 billion, earnings will come to $55.6 million, and it would be trading on a PE ratio of 65.9x, assuming you use a discount rate of 10.9%.

- Given the current share price of $8.5, the analyst's price target of $14.79 is 42.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives