Key Takeaways

- Strong global expansion and pivot to Direct-to-Consumer are driving improved margins, enhanced brand control, and greater resilience to geographic risks.

- Diversification beyond denim, premium positioning, and omnichannel investments are boosting brand relevance, increasing order values, and fueling sustained earnings growth.

- Heavy dependence on the core Levi's brand, tariff exposure, and volatile apparel trends threaten profitability and growth amid ongoing cost pressures and challenging international expansion.

Catalysts

About Levi Strauss- Designs, markets, and sells apparels and related accessories for men, women, and children in the United States and internationally.

- Ongoing robust growth in international markets, particularly Europe (up 15% with double-digit gains in France, UK, Italy, and Spain) and Latin America (up 18%), shows that Levi's is successfully capturing rising demand from an expanding global middle class and urbanization, which directly supports sustainable revenue expansion and reduced geographic risk.

- Levi's decisive shift to a Direct-to-Consumer-first business, now representing over half of sales, is delivering higher margins (DTC EBIT up 400bps YTD), greater control over brand experience, and faster innovation cycles-driving sustained improvements in net margins and future earnings.

- Rapid expansion in lifestyle categories beyond core denim (e.g., tops, dresses, outerwear, non-denim bottoms), with tops up 16% and women's up 14%, is diversifying revenue, increasing average order value (AUR), and positioning the brand to benefit from the long-term global trend toward casualization in workplace and lifestyle attire.

- The brand's premium positioning is reinforced by collaborations (e.g., Beyoncé, NIKE, Sacai), fabric/fit innovation, and increasing full-price sell-through, all of which support higher average selling prices and margin expansion while capitalizing on consumer willingness to pay more for quality and sustainable brands.

- Investment in omnichannel experiences-including double-digit e-commerce growth (up 13%), enhanced loyalty programs, store network expansion, and personalized marketing-positions Levi's to capitalize on digital integration trends in apparel retail, supporting both revenue growth and margin accretion.

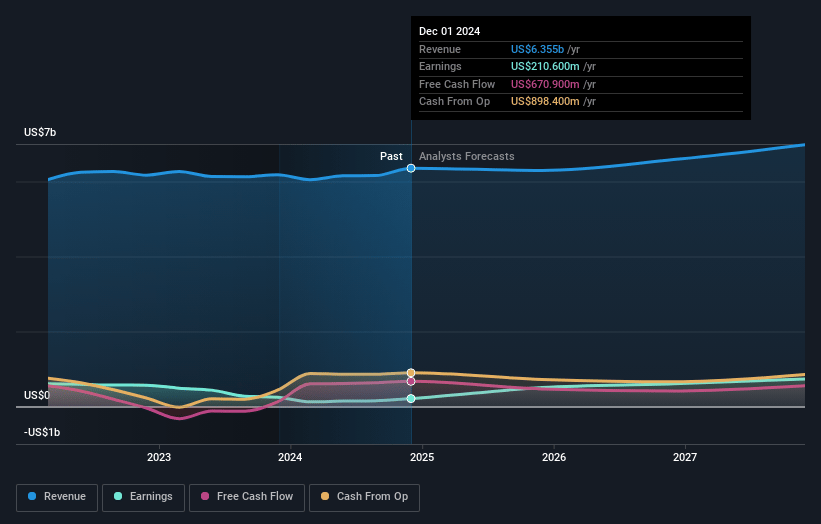

Levi Strauss Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Levi Strauss's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 11.0% in 3 years time.

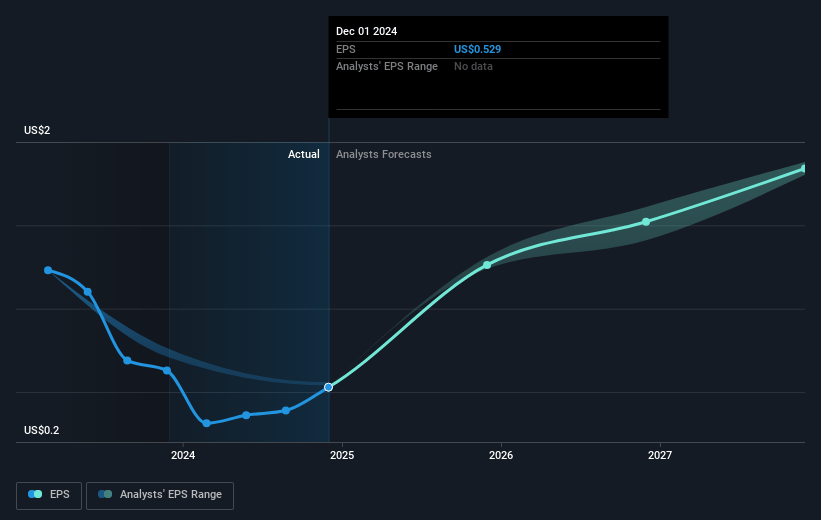

- Analysts expect earnings to reach $735.6 million (and earnings per share of $1.88) by about July 2028, up from $423.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $580.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 19.9x today. This future PE is about the same as the current PE for the US Luxury industry at 15.7x.

- Analysts expect the number of shares outstanding to decline by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.55%, as per the Simply Wall St company report.

Levi Strauss Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Levi Strauss's exposure to U.S. and global tariffs-including an assumed additional 30% tariff on goods from China and 10% from all other countries-poses an ongoing risk; while mitigation efforts are in place, structural cost increases may pressure gross margins and overall profitability over time.

- The company's recently completed and ongoing exits from brands like Dockers, Denizen, and footwear narrow its revenue base and increase overreliance on the Levi's core brand; if denim trends shift or if brand preference wanes, net sales and earnings growth could be constrained.

- Growth in Asia was flat in Q2 and faces ongoing challenges, including a reset in China and rationalization of franchise partners in various markets; slow progress or underperformance in this underpenetrated and potentially high-growth geography could limit long-term revenue and international diversification.

- Consumer preferences in apparel are volatile, and while Levi's is expanding into lifestyle categories, denim remains its primary revenue driver; shifts toward athleisure, fast fashion, or non-denim trends can rapidly erode relevance, threaten market share, and weaken future sales growth.

- Higher SG&A as a percent of revenues (around 50%), significant investments in DTC, and the need for omnichannel distribution network upgrades may limit operating leverage and slow margin expansion, especially if revenue growth moderates or if store and e-commerce productivity gains stall.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.981 for Levi Strauss based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.7 billion, earnings will come to $735.6 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 8.5%.

- Given the current share price of $21.3, the analyst price target of $22.98 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.