Key Takeaways

- Diversification with new product launches is set to strengthen Garmin's portfolio and drive revenue growth across multiple segments.

- Anticipated revenue growth in Marine and Auto OEM segments could enhance margins through manufacturing efficiencies and cost management.

- Increased R&D and auto OEM losses may pressure Garmin's margins, while competition and global supply risks could threaten revenue growth.

Catalysts

About Garmin- Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

- Upcoming product launches in 2025, including new categories, are expected to strengthen Garmin's portfolio, driving an anticipated consolidated revenue increase of 8% to $6.8 billion, which could enhance future revenue growth.

- New product introductions in the Fitness and Outdoor segments, such as the Lily 2 Active and adventure watches, are anticipated to contribute to approximately 10% revenue growth in these segments, potentially improving net margins due to a favorable mix and operating leverage.

- Recovery and growth anticipated in the Marine segment could lead to approximately 4% revenue growth for 2025, supported by outperforming broader market trends, which may positively impact operating margins through improved manufacturing efficiencies.

- Expansion in the Aviation segment, with new aircraft platforms entering production and the growth in OEM markets, is expected to result in a 5% revenue increase for 2025, likely enhancing earnings through the scaling of higher-margin products.

- The Auto OEM segment’s increased revenue expected from new program wins and achieving maximum potential from the BMW program could lead to about 7% revenue growth in 2025, advancing towards profitability and improving net margins through cost efficiencies.

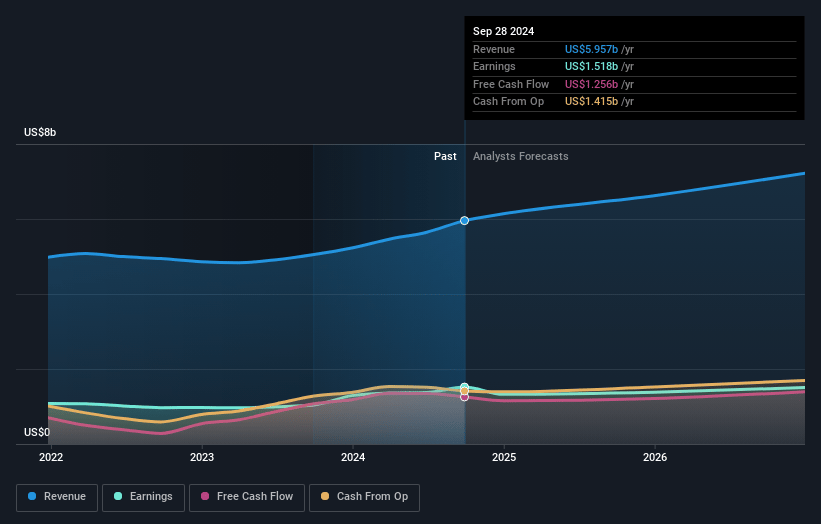

Garmin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Garmin's revenue will grow by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.4% today to 22.8% in 3 years time.

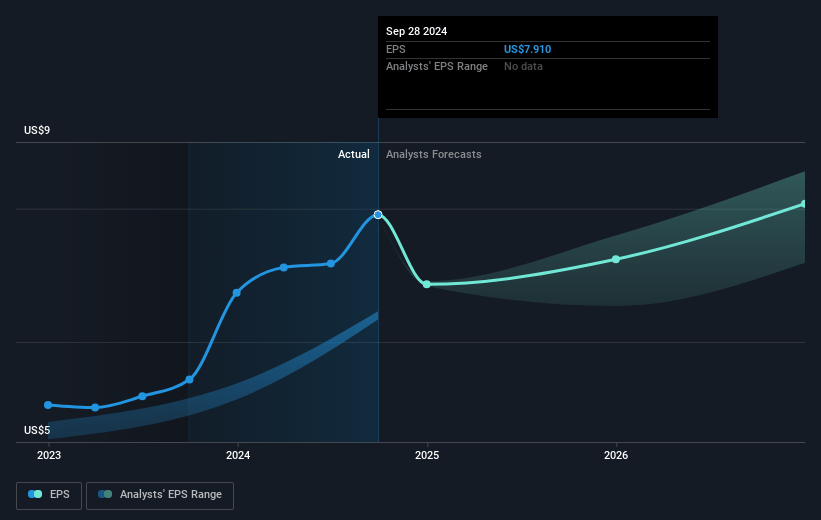

- Analysts expect earnings to reach $1.9 billion (and earnings per share of $9.66) by about March 2028, up from $1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, down from 29.9x today. This future PE is greater than the current PE for the US Consumer Durables industry at 10.9x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.16%, as per the Simply Wall St company report.

Garmin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- As the auto OEM segment is currently not profitable and has been impacted by the softening outlook of automakers, especially higher-end ones in China, this could influence Garmin's revenue growth trajectory and overall profit margins negatively.

- Increased R&D expenses, particularly seen in the Aviation and Auto OEM segments, may limit Garmin's operating margins as they invest heavily in new product innovations and platforms.

- While Garmin has successfully gained market share in several segments, increased competition and the potential for faster-than-expected market saturation, especially in the fitness wearables market, could pose risks to revenue growth and sustaining high profit margins.

- Although the Marine segment achieved growth and outperformed the broader market, a continued soft or slow-recovering marine market could restrain revenue growth and limit margin expansion.

- The potential for tariff impacts, given the global nature of their supply chains and manufacturing operations, could increase costs and hurt gross margins if not managed effectively or if trade conditions worsen unexpectedly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $211.89 for Garmin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $285.0, and the most bearish reporting a price target of just $181.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.2 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $219.34, the analyst price target of $211.89 is 3.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives