Key Takeaways

- Strong product innovation, global expansion, and software upgrades are driving brand differentiation, revenue growth, and deeper customer engagement across core and emerging markets.

- Operational efficiencies and supply chain shifts are improving profitability, reducing risk, and supporting more stable earnings amid geopolitical uncertainties.

- Cost-cutting measures and narrowed product focus heighten risks of weakened innovation, limited market reach, and greater exposure to trade volatility and ongoing legal disputes.

Catalysts

About Sonos- Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- The company is capitalizing on the growing consumer demand for premium, integrated home audio and smart home systems—demonstrated by strong home theater share gains in the U.S. and Europe, positive customer response to new products (like Arc Ultra and Era 100), and continued double-digit growth in international “growth markets”—all pointing to future topline revenue expansion as the smart home category matures worldwide.

- Sonos is successfully leveraging efficiency initiatives (restructuring, headcount reduction, and cost optimization) which have already decreased operating expenses by 12–15% on a run-rate basis and are expected to further improve net margins and EBITDA profitability as these savings are fully realized in future periods.

- Ongoing software improvements—including rapid release of upgrades for reliability, user experience, and feature enhancement—are helping drive customer loyalty and system expansion, strengthening Sonos's platform differentiation and supporting higher customer lifetime value, which should positively impact future revenues and reduce customer acquisition cost.

- Geographic expansion is delivering tangible results, with emerging international markets contributing double-digit revenue growth; continued investment and focus on broadening distribution are set to unlock new revenue streams and mitigate dependence on mature, slower-growth regions, supporting sustainable long-term revenue growth.

- Strategic supply chain adaptation (shifting U.S. production out of China, operational flexibility in manufacturing location) has largely insulated Sonos from tariff-related cost headwinds, preserving gross margins and ensuring better cost predictability even as geopolitical risks persist, which should support more resilient earnings.

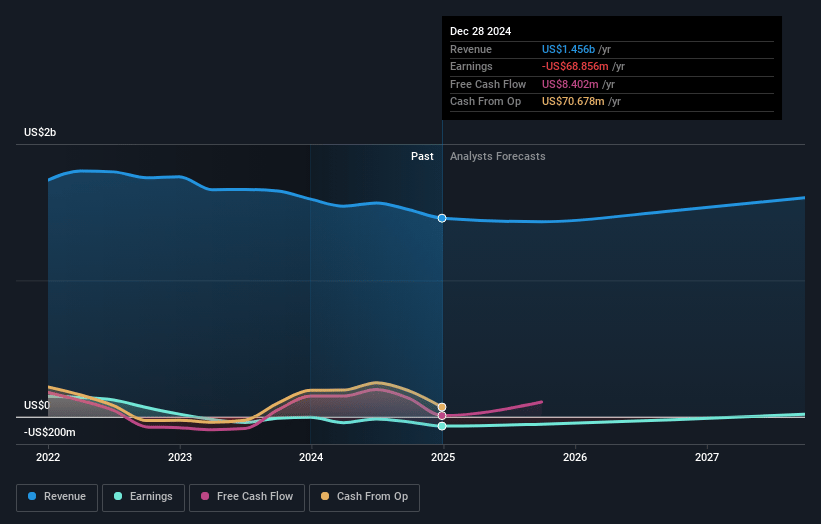

Sonos Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sonos's revenue will grow by 1.2% annually over the next 3 years.

- Analysts are not forecasting that Sonos will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Sonos's profit margin will increase from -4.7% to the average US Consumer Durables industry of 7.5% in 3 years.

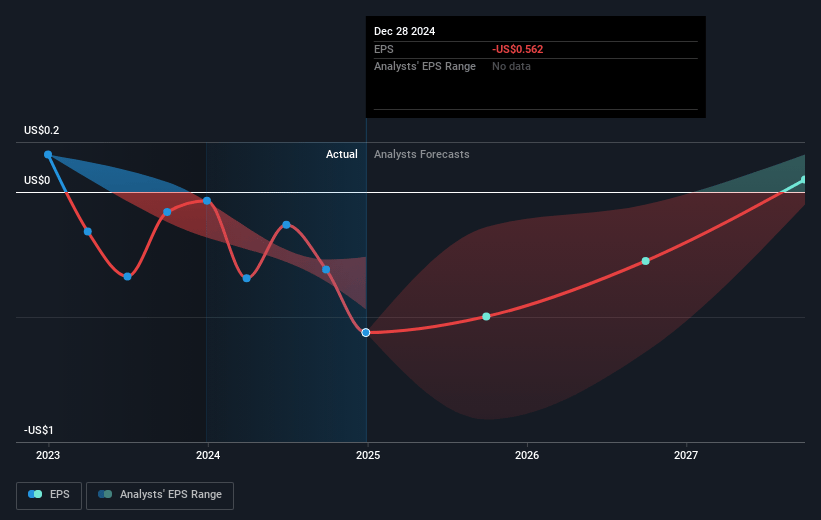

- If Sonos's profit margin were to converge on the industry average, you could expect earnings to reach $113.8 million (and earnings per share of $0.97) by about July 2028, up from $-69.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, up from -18.2x today. This future PE is greater than the current PE for the US Consumer Durables industry at 9.6x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.7%, as per the Simply Wall St company report.

Sonos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing exposure to global tariff and trade volatility, particularly with tariffs potentially rising in Q4 and the need for complex inventory and pricing strategies, poses long-term risks to net margins, gross profit dollars, and financial predictability.

- A decline in overall revenue for the first half of the fiscal year (-6.3%), despite targeted promotions and new product launches, indicates that organic growth may be slowing in Sonos’s core categories, raising concerns about topline revenue sustainability.

- The company’s restructuring and significant cost cutting, including reductions in R&D and headcount, may deliver short-term margin gains but risk underinvestment in innovation and future product cycles, which could negatively impact long-term competitive positioning and future earnings.

- Termination of partnerships (e.g., IKEA) and an explicit shift toward cost efficiency and tightened product focus could reduce market reach and limit Sonos’s ability to diversify revenue streams, potentially increasing vulnerability to category-specific downturns and impacting revenue resilience.

- Persistent legal disputes with major technology players (such as Google) remain unresolved and could result in significant legal costs or adverse outcomes, introducing prolonged risk to net income and margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.625 for Sonos based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $113.8 million, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 7.7%.

- Given the current share price of $10.53, the analyst price target of $11.62 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.