Last Update01 May 25Fair value Decreased 1.26%

Key Takeaways

- Innovation in products and experiences is set to boost member acquisition, engagement, and revenue growth.

- Operational efficiencies and strategic retail expansion are likely to enhance profitability and support revenue stability.

- Peloton's profitability is at risk due to operational challenges, consumer engagement shifts, international execution risks, and reliance on high-margin product strategies.

Catalysts

About Peloton Interactive- Operates integrated fitness platform in North America and internationally.

- Peloton is focusing on innovation in new products and experiences to improve member outcomes, potentially boosting member acquisition and engagement. This strategy is likely to positively impact revenue and subscriber growth.

- The company aims to deepen member connections and engagement through initiatives such as introducing new fitness disciplines and community features, which may increase member retention and reduce churn. This could enhance long-term revenue stability and net margins.

- Improved unit economics and a rightsized cost structure are expected to enhance gross margins. Peloton is focusing on more efficient promotional strategies and higher-margin product sales.

- Peloton's strategic expansion of third-party retail partnerships and international markets could expand their member base, driving revenue growth. Increased presence in non-traditional sales channels like Costco has shown promising initial results.

- Continued operational efficiencies, including administrative cost reductions and tech debt elimination, as well as significant improvement in LTV to CAC ratios, are likely to enhance profitability and support free cash flow growth.

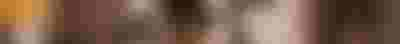

Peloton Interactive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Peloton Interactive's revenue will decrease by 2.5% annually over the next 3 years.

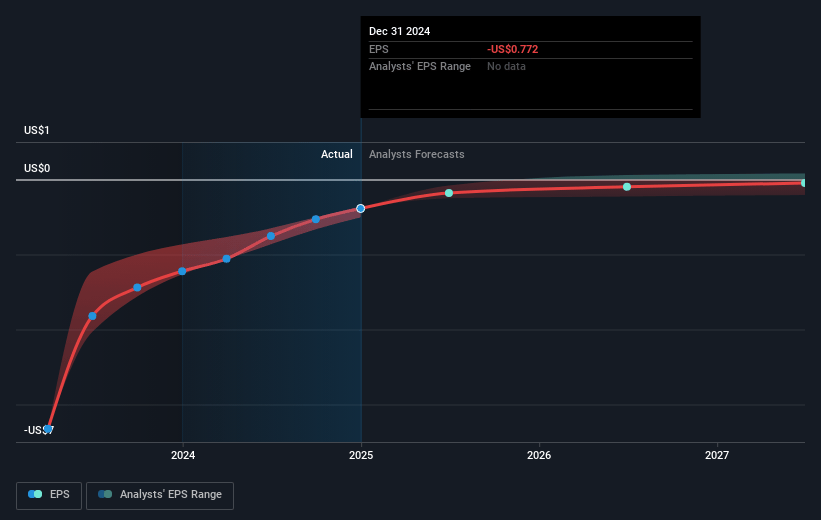

- Analysts are not forecasting that Peloton Interactive will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Peloton Interactive's profit margin will increase from -11.1% to the average US Leisure industry of 6.5% in 3 years.

- If Peloton Interactive's profit margin were to converge on the industry average, you could expect earnings to reach $157.8 million (and earnings per share of $0.35) by about May 2028, up from $-290.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.7x on those 2028 earnings, up from -9.3x today. This future PE is greater than the current PE for the US Leisure industry at 18.7x.

- Analysts expect the number of shares outstanding to grow by 5.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Peloton Interactive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Peloton's financial performance is heavily reliant on achieving its operational and fiscal goals for 2025, yet past challenges such as high operational costs and previous difficulty attaining financial discipline might jeopardize consistent profitability, impacting net margins and earnings.

- The business is susceptible to shifts in consumer interest and engagement, as it has historically relied on innovative product offerings and engagement features to maintain low churn rates; any decline here could significantly affect subscription revenue.

- The company is striving to lower churn and improve member retention through engagement in multiple disciplines beyond cycling, but failure to sustain these initiatives could result in declining revenue per member.

- As Peloton has emphasized expanding global presence, international market dynamics such as local competition and economic conditions pose execution risks that could limit revenue growth potential.

- The dependence on a high-margin product mix and managing promotional discounts are critical for maintaining desired gross margins; misalignment in these strategies could lead to margin pressures and affect profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.162 for Peloton Interactive based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $157.8 million, and it would be trading on a PE ratio of 32.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $6.93, the analyst price target of $9.16 is 24.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.