Last Update 01 May 25

Key Takeaways

- Strategic acquisitions and project expansions, such as in Texas, focus on increasing market share and revenue growth in high-potential areas.

- Cost reductions and financial restructuring efforts aim to improve margins and earnings through efficient resource management and interest cost reductions.

- High mortgage rates and buyer hesitancy force Landsea Homes to offer incentives, straining margins and signaling cash flow management challenges.

Catalysts

About Landsea Homes- Engages in the design, construction, marketing, and sale of suburban and urban single-family detached and attached homes in Arizona, California, Colorado, Florida, Texas, and Metro New York.

- Expansion into key markets, such as Texas, through strategic acquisitions like DFW-based Antares Homes, is expected to drive revenue growth by increasing market share and sales volume in high-potential areas.

- The High Performance Homes series, focusing on affordability and functionality, provides a competitive advantage in attracting buyers and could positively impact net margins by differentiating Landsea Homes from competitors.

- The shift towards a more balanced approach between spec and build-to-order homes, aiming for a 50-50 target, may enhance margins as build-to-order homes typically carry better margins.

- Cost reduction efforts, such as rebidding labor and material components and transitioning to a more land-light strategy, aim to mitigate margin pressure and improve earnings by 2026.

- Refinancing 11% private notes to reduce interest costs by approximately 200 basis points is expected to benefit gross margin and overall earnings by reducing financial expenses, starting later in the year.

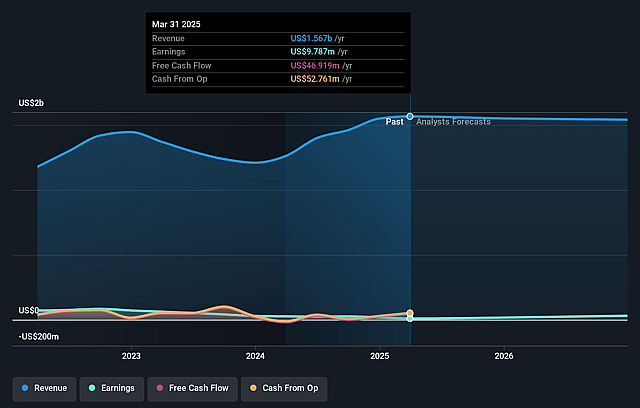

Landsea Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Landsea Homes's revenue will decrease by 0.6% annually over the next 3 years.

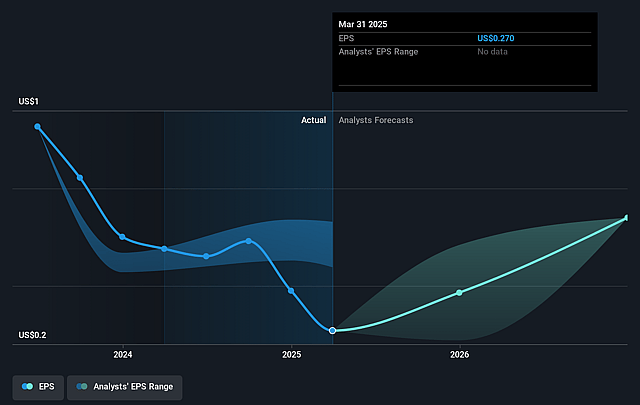

- Analysts assume that profit margins will increase from 1.1% today to 2.0% in 3 years time.

- Analysts expect earnings to reach $31.1 million (and earnings per share of $0.62) by about May 2028, up from $17.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.1x on those 2028 earnings, up from 12.9x today. This future PE is greater than the current PE for the US Consumer Durables industry at 8.9x.

- Analysts expect the number of shares outstanding to grow by 0.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Landsea Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high mortgage rates and buyer hesitancy have required Landsea Homes to increase incentives to compete and move inventory, which has pinched profitability, impacting net margins and earnings.

- The company's strategic decision to reduce standing inventory to generate additional cash suggests a potential struggle with cash flow management if inventory levels are not effectively balanced in the future.

- Financing incentives remain a key driver of demand due to higher mortgage rates and property tax and insurance increases, which negatively affect margins by increasing the cost of sales.

- The rising proportion of build-to-order homes might not fully offset the margin pressure from incentives, as gross margins were slightly below guidance due to rising discounts and incentives, impacting future net margins.

- The purchase price accounting impact from acquisitions will continue to affect financial results through 2025, adding complexity to financial reporting and potentially distorting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.667 for Landsea Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $31.1 million, and it would be trading on a PE ratio of 17.1x, assuming you use a discount rate of 11.4%.

- Given the current share price of $6.1, the analyst price target of $10.67 is 42.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.