Key Takeaways

- Innovation in tech-driven products and expanding e-commerce presence fuel premium pricing, global reach, and incremental growth in core outdoor recreation categories.

- Strong cost controls, efficient inventory management, and a debt-free balance sheet support margin expansion, stability, and readiness for future opportunities.

- Persistent macroeconomic headwinds, tariff-driven cost pressures, and reliance on promotions threaten margins, while industry weakness and innovation risks challenge long-term revenue and competitive position.

Catalysts

About Johnson Outdoors- Designs, manufactures, and markets seasonal and outdoor recreation products for fishing worldwide.

- Strong momentum in new product launches-especially the positive market response to innovative, tech-centric products like the XPLORE fish finder and award-winning trolling motor-reflects an ability to tap into increasing consumer demand for digitally integrated outdoor experiences, supporting revenue growth and margin expansion as advanced features command premium pricing.

- Continued broad-based growth in market demand for wellness and outdoor recreation, alongside demographic shifts toward younger and more diverse outdoor participants, sustains a robust addressable market for Johnson Outdoors' core categories, positively impacting long-term unit sales and topline growth.

- Effective cost savings initiatives and ongoing supply chain optimizations are driving gross margin improvements and operating expense reductions, with further potential for enhanced net margin and higher free cash flow as these programs continue to scale.

- Expanding e-commerce presence and global reach, coupled with a debt-free balance sheet and strong cash position, provide both resilience and flexible capital to capitalize on future market opportunities, supporting incremental revenue growth and operational stability.

- Reduced inventory levels and disciplined inventory management improve working capital efficiency and further buffer against economic volatility, potentially increasing returns on equity and supporting stronger earnings performance in coming periods.

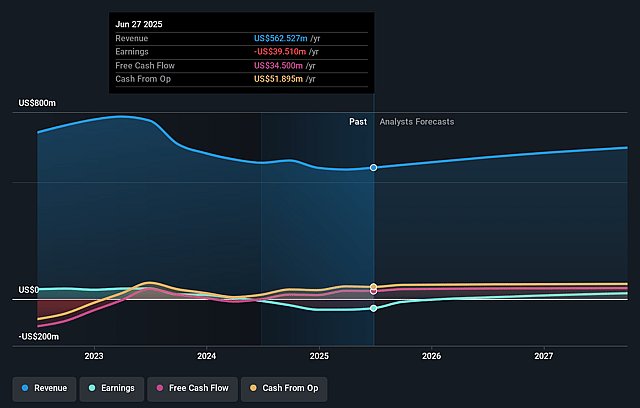

Johnson Outdoors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Johnson Outdoors's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -7.0% today to 6.7% in 3 years time.

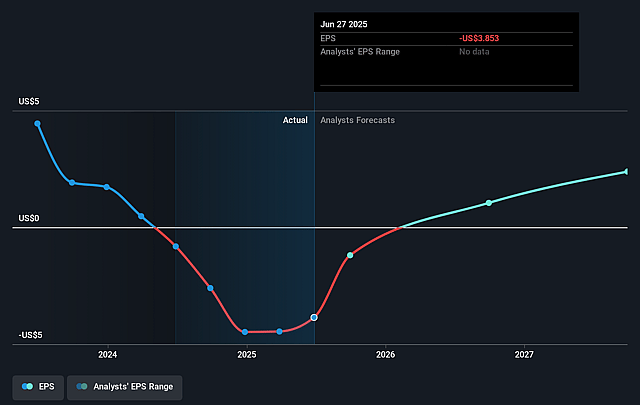

- Analysts expect earnings to reach $45.5 million (and earnings per share of $4.43) by about September 2028, up from $-39.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from -10.1x today. This future PE is lower than the current PE for the US Leisure industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.33%, as per the Simply Wall St company report.

Johnson Outdoors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company highlighted ongoing macroeconomic challenges and global marketplace uncertainties, which present risks to maintaining consistent revenue growth and may lead to volatility in future earnings.

- Tariffs and the volatile tariff environment are expected to result in increased costs flowing through inventory over future periods; if mitigation strategies or pricing power are insufficient, this can erode gross and net margins.

- The Watercraft business continues to operate in a weak and struggling industry environment; prolonged weakness or declining participation could result in revenue declines for this segment and overall company earnings pressure.

- The company's reliance on promotional activity to drive sales in competitive markets implies a possible need to increase discounts or promotions in the future, which could compress margins and impact long-term profitability.

- Despite recent successful innovations and industry awards, continued dependence on tech-driven innovation entails risk-falling behind competitors or failing to meet evolving consumer expectations in smart/connected products could negatively affect revenue growth and market share over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.0 for Johnson Outdoors based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $677.0 million, earnings will come to $45.5 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 7.3%.

- Given the current share price of $39.02, the analyst price target of $52.0 is 25.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Johnson Outdoors?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.