Key Takeaways

- JAKKS Pacific's international growth and FOB sales approach are enhancing margins and providing better consumer and licensor value.

- Strategic focus on evergreen brands and expanding operations in Europe drive sustained revenue growth and operational efficiency improvements.

- Reliance on China FOB sales and declining margins pose profitability challenges, amid revenue drops in toys and costumes businesses.

Catalysts

About JAKKS Pacific- Designs, produces, markets, sells, and distributes toys and related products, consumer products, kids indoor and outdoor furniture, costumes, and sporting goods and home furnishings space products worldwide.

- JAKKS Pacific's integration of toy and costume teams outside the U.S. has shown continued international growth, particularly with the Disguise business achieving new highs for the fourth consecutive year. This expansion is likely to drive revenue and margin improvements internationally.

- The company's efforts to encourage customers to adopt FOB (Free on Board) sales have grown significantly, reaching over 75% in 2024. This approach, which involves selling larger quantities at sharper prices, is expected to improve net margins and provide better value for both consumers and licensors.

- The expansion of European operations, including holding inventory in multiple EU facilities and reducing fulfillment times, is set to improve operational efficiency and could lead to increased revenues and improved margins in the region.

- The introduction of a quarterly dividend signals a strong financial position and is designed to attract long-term-minded shareholders, potentially stabilizing earnings per share through an increased shareholder base valuing predictable results.

- The strategic focus on evergreen brands and long-term partnerships, exemplified by success with licenses like Sonic the Hedgehog, positions JAKKS for sustained revenue growth and product line longevity, impacting both top and bottom line positively.

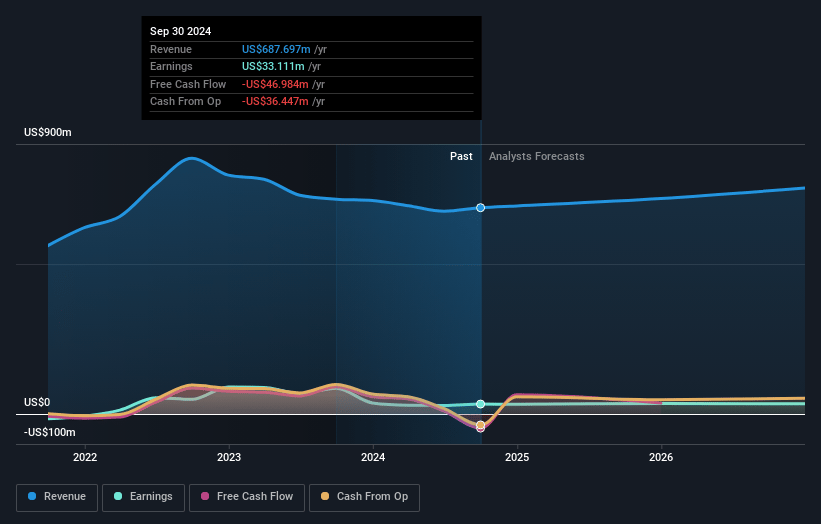

JAKKS Pacific Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming JAKKS Pacific's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.1% today to 4.9% in 3 years time.

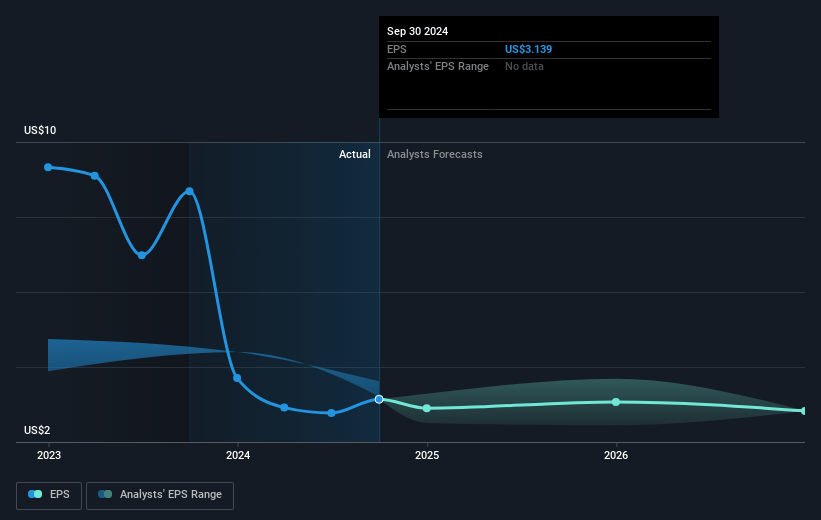

- Analysts expect earnings to reach $37.2 million (and earnings per share of $2.87) by about March 2028, up from $35.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, up from 7.9x today. This future PE is lower than the current PE for the US Leisure industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 3.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

JAKKS Pacific Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- JAKKS Pacific's Toys/Consumer Products division experienced a decline in revenue by 1-2% across all divisions for the full year, which might challenge revenue growth expectations.

- The Costumes business saw a significant decline of 7.5% due to a softer U.S. market, impacting overall revenue negatively.

- The dependency on FOB sales from China (over 75% of sales) exposes the company to potential tariff changes, which could impact gross margins and profitability.

- Operating margins decreased significantly from 8.3% in 2023 to 5.7%, indicating a potential struggle to maintain profitability levels.

- Adjusted earnings per share for the full year decreased from $4.62 in the prior year to $3.79, reflecting challenges in maintaining earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $43.0 for JAKKS Pacific based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $765.5 million, earnings will come to $37.2 million, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of $25.05, the analyst price target of $43.0 is 41.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.