Key Takeaways

- Potential market saturation in North America and declining HEYDUDE revenues could hinder revenue growth and impact earnings negatively.

- Elevated SG&A expenses and uncertainty in HEYDUDE and wholesale growth could compress margins, reducing overall profitability.

- Crocs' strong brand strategies and international growth expansion, supported by high gross margins and effective cash management, suggest sustained revenue growth and enhanced shareholder returns.

Catalysts

About Crocs- Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

- Revenue growth for the Crocs brand in North America is only expected to be slightly up for the year, reflecting a possible saturation in the market, which could impact overall revenue growth negatively.

- With HEYDUDE revenue projected to decline by 7% to 9% for the year, Crocs could face challenges in achieving revenue growth targets, impacting overall earnings adversely.

- The anticipated negative impact of foreign currency exchange and tariffs, which collectively could lower the enterprise adjusted gross margin by around 60 basis points, might compress net margins leading to reduced profitability.

- Increased SG&A expenses, driven by higher investments in DTC, talent, and marketing, are likely to continue, leading to potential operating margin compression, which could affect earnings negatively.

- The outlook for HEYDUDE and wholesale growth remains uncertain, as no wholesale growth is embedded in guidance. Prolonged stagnation in the wholesale channel might affect net sales and EPS growth expectations.

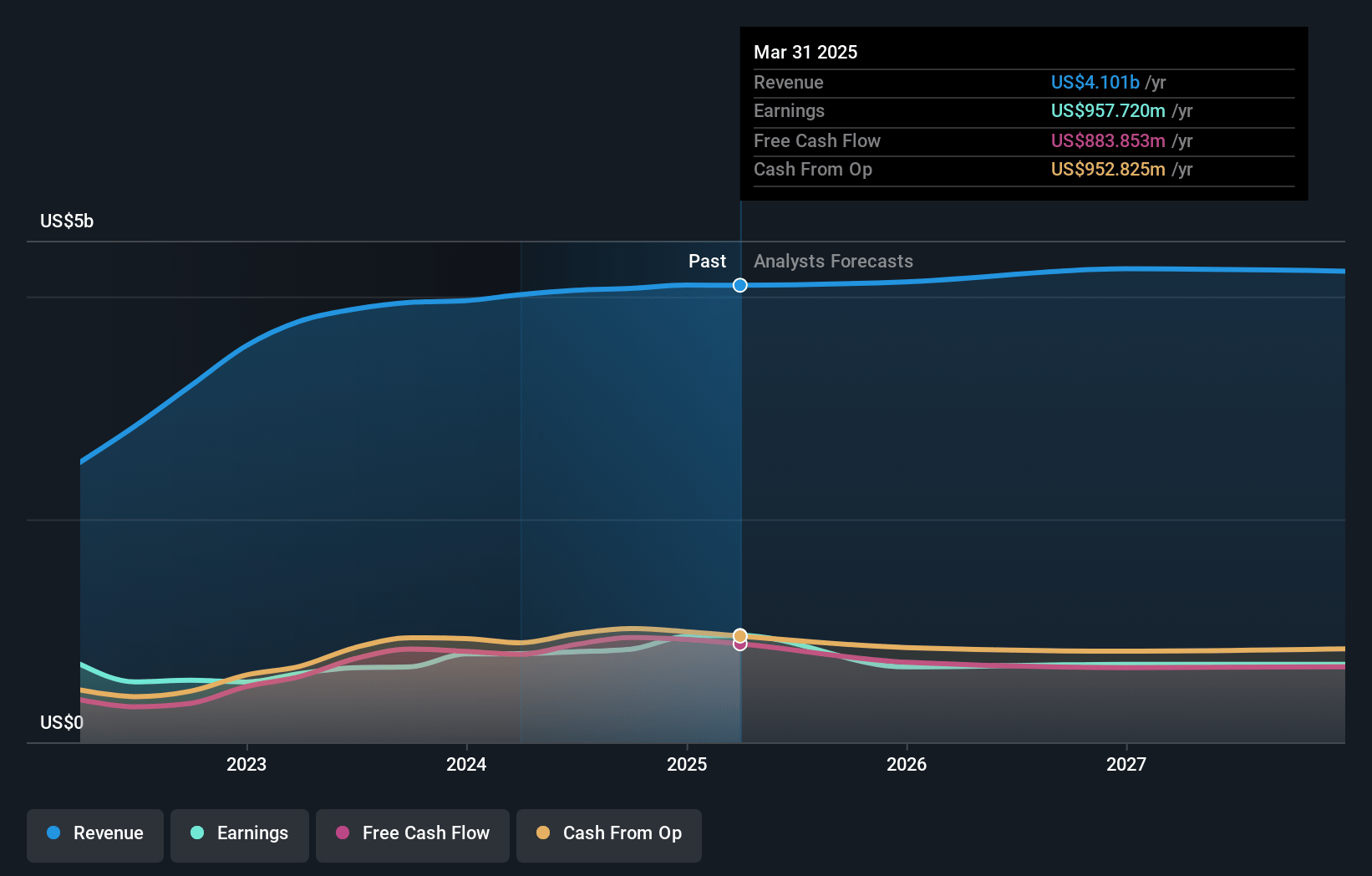

Crocs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Crocs compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Crocs's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 23.2% today to 13.0% in 3 years time.

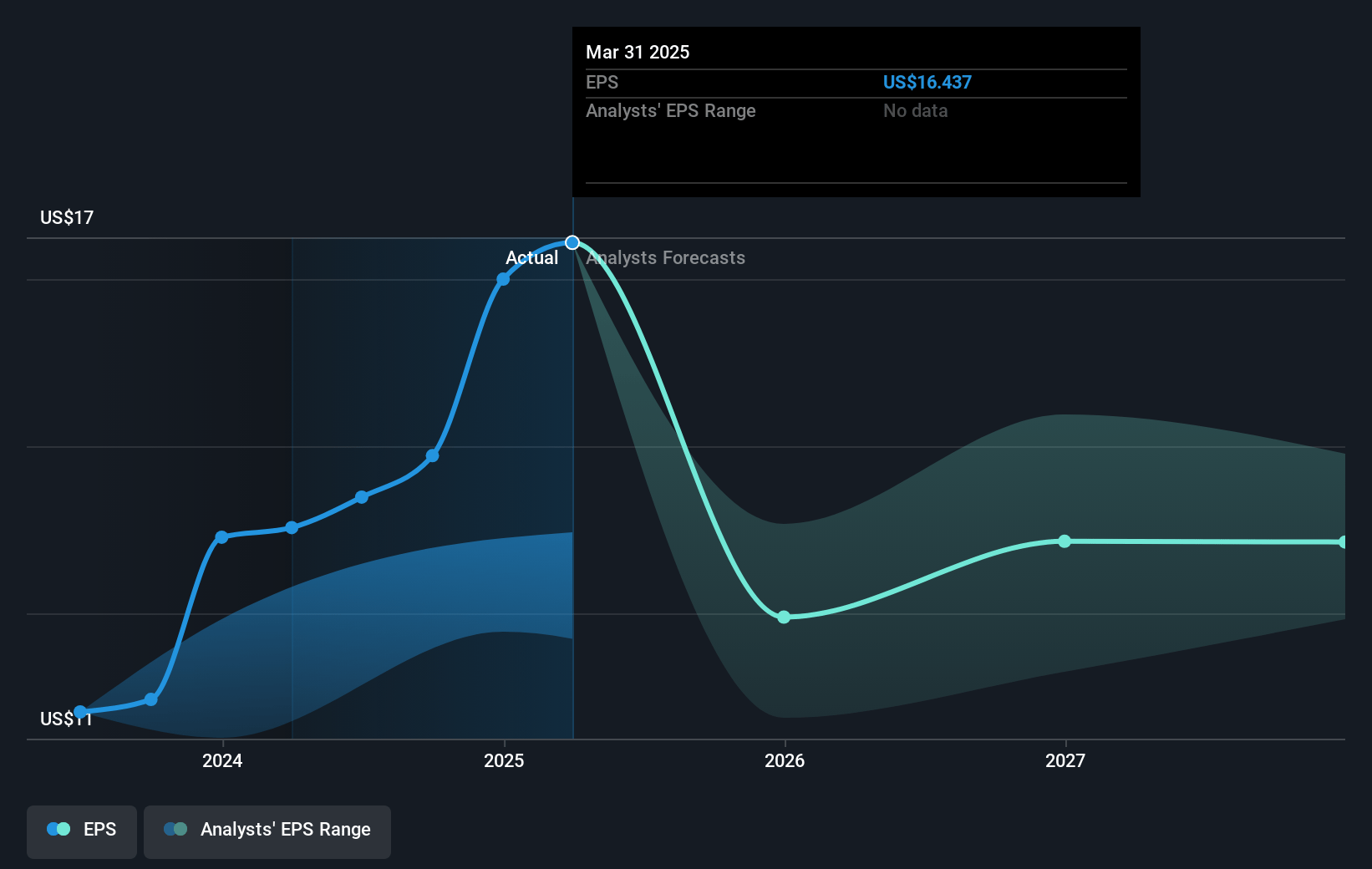

- The bearish analysts expect earnings to reach $540.9 million (and earnings per share of $10.5) by about May 2028, down from $950.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, up from 5.8x today. This future PE is lower than the current PE for the US Luxury industry at 15.6x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

Crocs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Crocs has demonstrated consistent revenue growth across multiple years, with a 4% increase in 2024 and low double-digit growth projected internationally over the medium term, suggesting potential for sustained revenue growth.

- The company is executing strong brand strategies, including expanding the relevance of their Classic Clogs globally and leveraging brand ambassadors, which could bolster brand recognition and support revenue.

- Crocs' international growth appears robust, with 19% growth in 2024 and plans to expand their footprint in key markets such as China and Southeast Asia, which could lead to increased revenue contribution from international operations.

- The company maintains high gross margins, with an adjusted gross margin of 58.8% in 2024 and strategic efforts to mitigate cost increases, which can support steady profit margins.

- Crocs' effective cash management and significant share repurchasing indicate a strong capital return to shareholders, potentially enhancing earnings per share over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Crocs is $84.2, which represents two standard deviations below the consensus price target of $121.55. This valuation is based on what can be assumed as the expectations of Crocs's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $153.0, and the most bearish reporting a price target of just $83.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $540.9 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 8.4%.

- Given the current share price of $98.78, the bearish analyst price target of $84.2 is 17.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.