Narratives are currently in beta

Key Takeaways

- Strategy in AI investments and employee upskilling enhances efficiency, client outcomes, and potentially supports margin expansion.

- Robust deal pipeline across verticals and technology focus signals accelerated future revenue growth and sustainable earnings expansion.

- Slow revenue growth, lower employee utilization, and high attrition rates may pressure WNS's profitability and operating efficiency if not addressed.

Catalysts

About WNS (Holdings)- A business process management (BPM) company, provides data, voice, analytical, and business transformation services worldwide.

- The company anticipates a return to high single to low double-digit revenue growth in fiscal '26, driven by steady conversion of existing opportunities and a robust pipeline of traditional process management deals, which indicates potential revenue expansion.

- WNS' large deal pipeline, involving strategic initiatives with captive carve-outs, remains robust and healthy, with opportunities across verticals that could accelerate growth and ramp up revenue more rapidly than traditional deals, impacting future revenue positively.

- Continued investments in AI and Gen AI capabilities, including the creation of more than 30 Gen AI use cases and 13 unique digital assets, are expected to drive improved client outcomes and higher efficiency, potentially enhancing net margins.

- The company's focus on employee upskilling with over 51,000 training courses completed in AI and Gen AI could enhance operational efficiency and customer outcomes, potentially supporting margin expansion and profitability.

- Healthy sequential revenue growth and operating margin expansion are expected in fiscal 2025, with strategic priority on technology-enabled offerings, which should bolster sustainable earnings growth in the future.

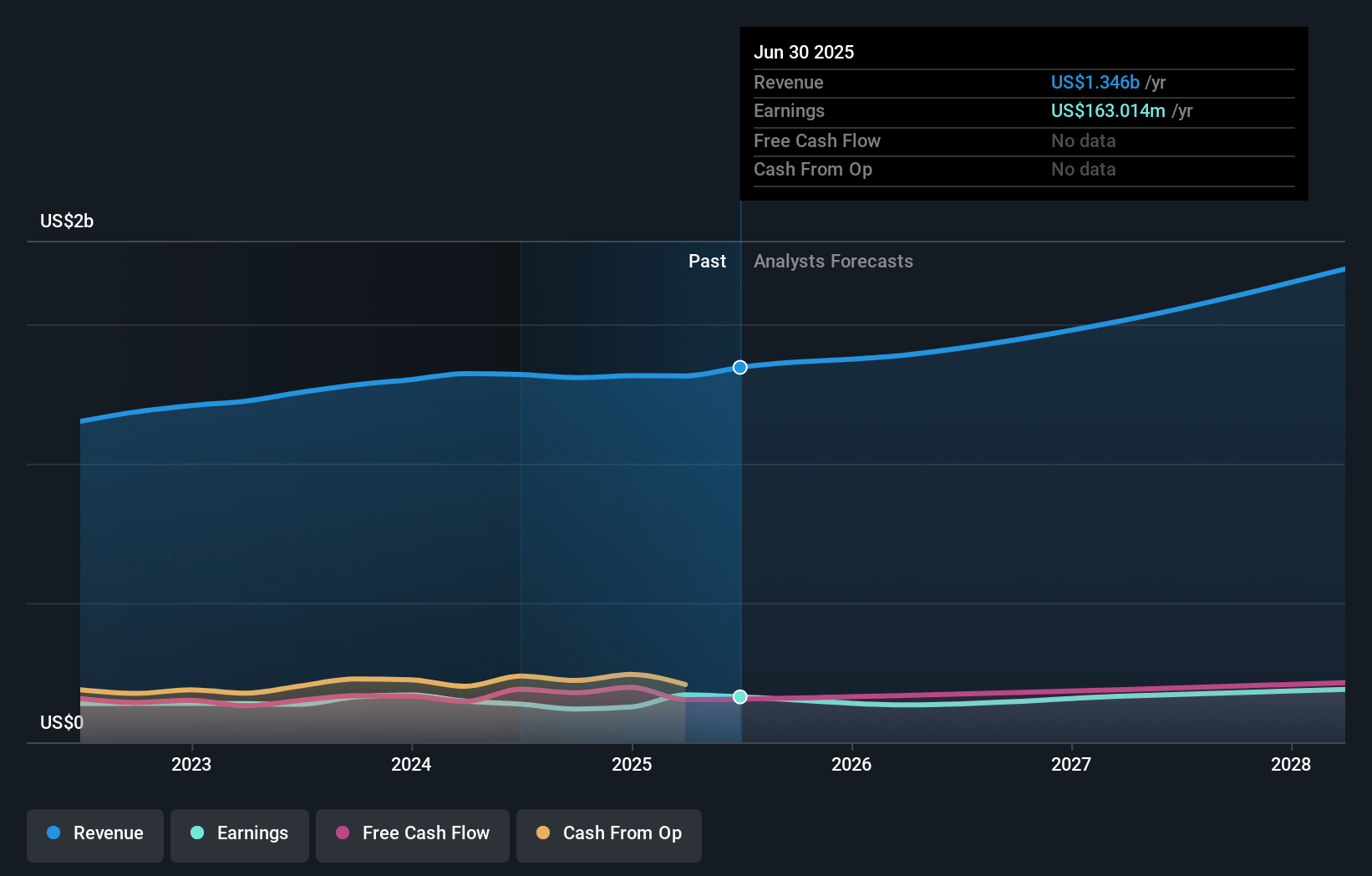

WNS (Holdings) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming WNS (Holdings)'s revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.8% today to 11.8% in 3 years time.

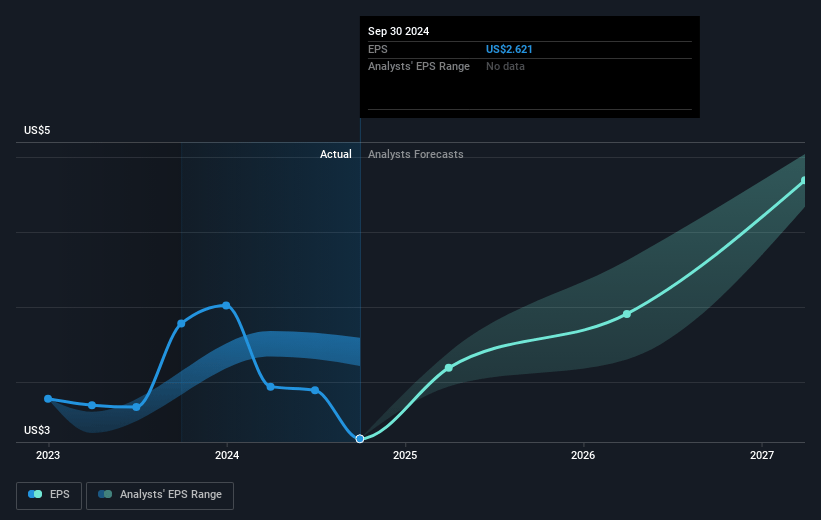

- Analysts expect earnings to reach $183.6 million (and earnings per share of $4.48) by about January 2028, up from $128.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $157.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, down from 21.4x today. This future PE is lower than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to decline by 1.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

WNS (Holdings) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The net revenue growth for WNS was only 1% year-over-year on a reported basis and flat on a constant currency basis in the fiscal third quarter, which signals potential stagnation and could negatively impact future revenue growth if this trend continues.

- WNS is experiencing lower employee utilization and increased investments in infrastructure and sales, which have led to a year-over-year decrease in adjusted operating margins from 19.7% to 19.3%, potentially pressuring net margins and profitability.

- The anticipated reductions in online travel volumes have been impacting revenues, and this persistent trend might continue to weigh down on future revenue growth if not offset by other verticals.

- Large deal contributions remain uncertain as WNS continues to exclude them from guidance until signed, implying that potential fluctuations in timing could lead to unpredictability in revenue recognition.

- High attrition rates, reported at 32% which fluctuates quarter-to-quarter, may lead to increased costs for hiring and training new employees, potentially impacting operating efficiency and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $64.25 for WNS (Holdings) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $73.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $183.6 million, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 9.0%.

- Given the current share price of $63.26, the analyst's price target of $64.25 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

RY

rynetmaxwell

Community Contributor

WNS's Margins Improve w/ Automation and Outcome-Based Pricing

Meaning WNS began operations as an internal-service unit within British Airways in 1996. After separating from British Airways in 2002, WNS began to operate as a Business Process Outsourcing (BPO) company servicing several clients including insurance companies, British Airways, and a few other diversified companies.

View narrativeUS$88.48

FV

29.7% undervalued intrinsic discount7.50%

Revenue growth p.a.

5users have liked this narrative

0users have commented on this narrative

23users have followed this narrative

4 months ago author updated this narrative