Narratives are currently in beta

Key Takeaways

- The Pursuit business transformation and capital structure reset post-GES sale aim to enhance growth and increase earnings.

- High demand for attractions and travel recovery is set to drive revenue growth despite temporary challenges in hotel room availability.

- The sale and spin-off activities introduce uncertainty, with potential earnings impacts from transition costs and integration risks of recent acquisitions.

Catalysts

About Viad- Provides hospitality, leisure activities, experiential marketing, and live events in the United States, Canada, Europe, the Middle East, and Africa.

- The completion of the GES sale will transform Pursuit into a high-growth, high-margin pure-play business, providing the financial flexibility and balance sheet strength to accelerate its Refresh, Build, Buy growth strategy. This is expected to positively impact Viad’s revenue and earnings.

- The demand for attractions like Sky Lagoon in Iceland and the new FlyOver Chicago continues to outpace expectations, with successful expansions already driving a 13% increase in visitation and a 16% lift in effective ticket prices. These factors are likely to contribute to revenue growth.

- The temporary reduction in hotel room inventory in Jasper due to wildfires is causing market compression. With 18% of hotel rooms offline for several years, Viad anticipates increased demand and higher occupancy rates for its Jasper properties, positively impacting revenue and net margins.

- The upcoming rebound in international travel, particularly from long-haul markets like Asia, is expected to drive increased visitation to Pursuit’s destinations, notably increasing future revenue potential.

- A planned capital structure reset following the GES sale will reduce high-cost debt, enabling Pursuit to deploy excess cash for growth initiatives, potentially enhancing its earnings per share through improved operational efficiencies and strategic acquisitions.

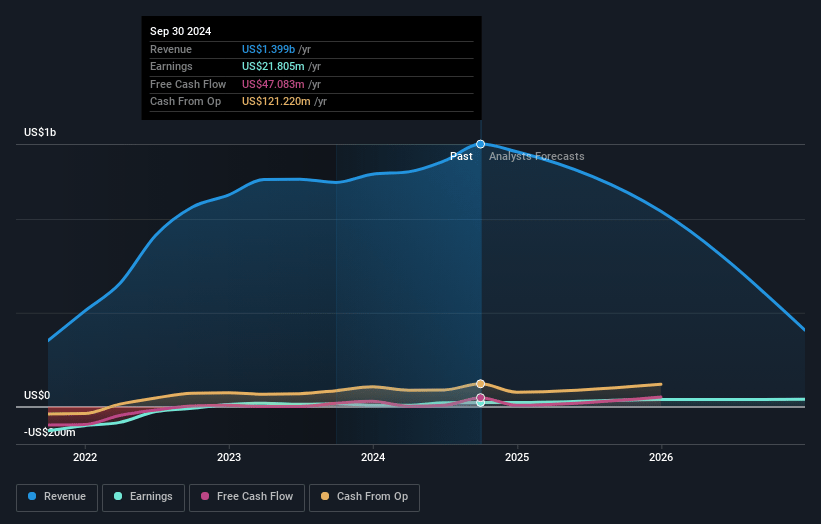

Viad Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Viad's revenue will decrease by -1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.6% today to 6.3% in 3 years time.

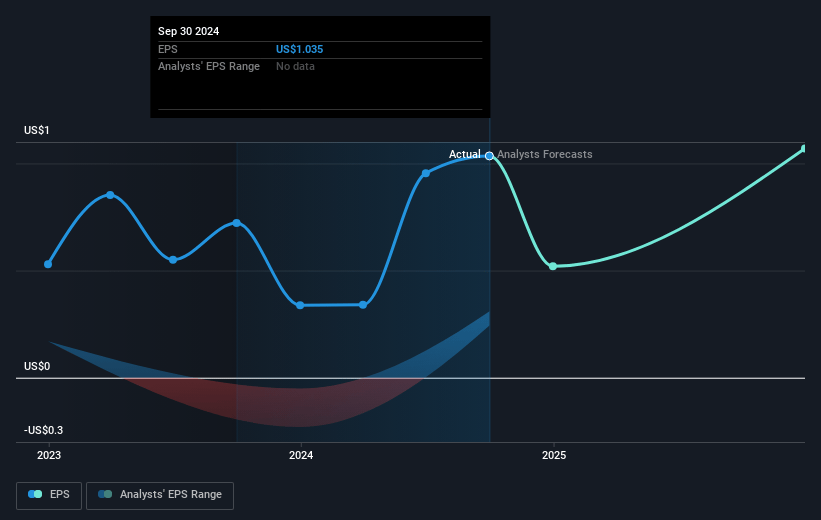

- Analysts expect earnings to reach $84.1 million (and earnings per share of $1.34) by about December 2027, up from $21.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 51.6x on those 2027 earnings, up from 42.0x today. This future PE is greater than the current PE for the US Commercial Services industry at 31.4x.

- Analysts expect the number of shares outstanding to grow by 43.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.5%, as per the Simply Wall St company report.

Viad Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of GES, while potentially beneficial for Pursuit, introduces uncertainty and risk regarding proceeds and transition costs, potentially impacting Viad's consolidated earnings and net margins.

- Wildfire activity in Jasper National Park has already caused significant revenue declines, which could continue to affect future earnings despite anticipated recovery in 2025.

- Long-term risks related to permanent room inventory loss in Jasper could lead to constrained supply, impacting future net margins and room revenue.

- There is a reliance on successful integration and execution of acquisitions, such as the Jasper SkyTram and Glacier Park Collection, which pose potential risks for earnings if not realized as anticipated.

- Significant transition and restructuring costs related to the spin-off and reorganization could temporarily reduce net income and financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.33 for Viad based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.3 billion, earnings will come to $84.1 million, and it would be trading on a PE ratio of 51.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of $43.21, the analyst's price target of $56.33 is 23.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives