Narratives are currently in beta

Key Takeaways

- TELUS Digital's revenue growth strategy includes new services, cross-selling, and client diversification to positively impact future revenue.

- AI investments and GenAI integration drive efficiency, diversify revenue, and potentially stabilize net margins against competitive pressures.

- Continued challenges and heightened competition may delay revenue growth, pressure net margins, and complicate financial strategy execution for TELUS International.

Catalysts

About TELUS International (Cda)- TELUS International (Cda) Inc. design, builds, and delivers digital solutions for customer experience (CX) in the Asia-Pacific, the Central America, Europe, Africa, North America, and internationally.

- TELUS Digital is focusing on rejuvenating revenue growth through new service offerings, cross-selling to existing clients, and client diversification, which is expected to impact future revenue positively.

- The company's investment in AI and digital solutions, particularly their Fuel iX platform, positions it well in the evolving tech-enabled ecosystem, potentially improving net margins by delivering efficient and higher-value services.

- Efforts to integrate GenAI in operations and client solutions aim to drive operational efficiencies, likely enhancing net margins by reducing costs and improving service quality.

- Expansion into new industry verticals and geographical regions with AI data solutions is expected to diversify and grow revenue streams.

- Ongoing cost efficiency efforts and AI-driven operational improvements are expected to stabilize and potentially enhance earnings and net margins as the company adapts to competitive pricing pressures.

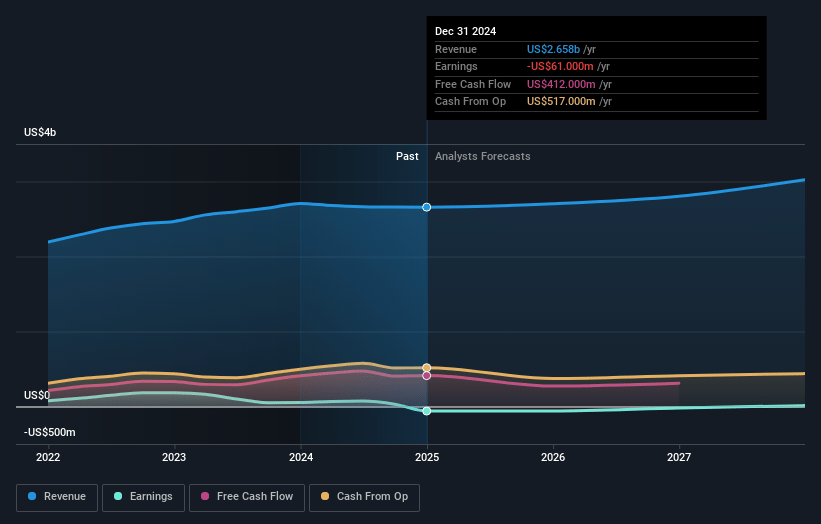

TELUS International (Cda) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TELUS International (Cda)'s revenue will grow by 2.1% annually over the next 3 years.

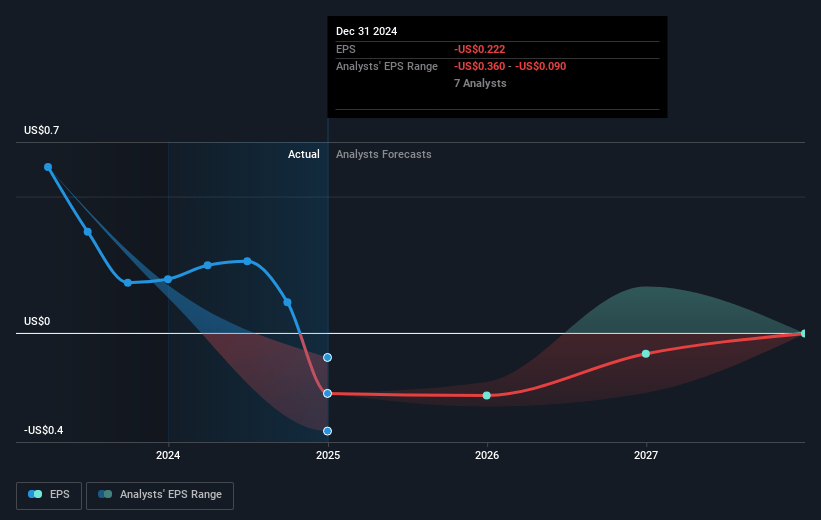

- Analysts are not forecasting that TELUS International (Cda) will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate TELUS International (Cda)'s profit margin will increase from 1.2% to the average US Professional Services industry of 6.1% in 3 years.

- If TELUS International (Cda)'s profit margin were to converge on the industry average, you could exepct earnigns to reach $172.9 million (and earnings per share of $0.87) by about January 2028, down from $31.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, down from 35.1x today. This future PE is lower than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to decline by 10.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

TELUS International (Cda) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The statement regarding the need for time to see the full extent of their turnaround may indicate potential delays in achieving expected revenue growth and stable net margins, as near-term challenges persist.

- With the operating environment hazards ongoing for 18 months, there could be risks impacting future revenue streams and net margins due to the unpredictability of market conditions.

- Heightened price competition in the industry presents a challenge that could impact net margins, as clients are looking to manage their costs vigilantly.

- The company's reliance on achieving stability in operating performance and executing a reliable financial strategy to rejuvenate revenue growth may pose risks if these targets are not met, affecting overall earnings and revenue potential.

- Potential for increased operational costs linked to talent investments and expansion efforts might pressure net margins if the anticipated efficiencies and revenue growth do not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.46 for TELUS International (Cda) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.5, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $172.9 million, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 8.8%.

- Given the current share price of $3.95, the analyst's price target of $4.46 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives