Key Takeaways

- Digital transformation and new service integrations are expanding RB Global’s buyer base, driving higher-margin revenue streams and improved operational leverage.

- Infrastructure investments and disciplined execution position RB Global for sustained growth, increased earnings, and enhanced global market penetration.

- Deglobalization trends, faster asset turnover, stricter environmental rules, digital rivals, and integration risks from acquisitions threaten RB Global's market position and long-term growth.

Catalysts

About RB Global- Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

- The accelerated digital transformation in equipment transactions, coupled with RB Global’s investments in omnichannel auction capabilities and the launch of a modern platform, is expected to drive higher transaction volumes, expand the buyer base globally, and ultimately increase both revenue and operational leverage as industry participants shift more activity online.

- Rising global investments in infrastructure renewal and industrial expansion, alongside long-term government spending, are projected to fuel higher demand for used equipment, positioning RB Global to capitalize on growing auction volumes and fostering sustained revenue growth across cyclical and non-cyclical markets.

- The company’s ongoing integration of new channels (like Boom & Bucket) and enhanced data analytics, inspection, and transportation services add higher-margin, value-added revenue streams, which are expected to structurally improve net margins and drive long-term earnings growth.

- Recent expansion initiatives, such as the greenfield automotive business win in Australia and additional salesforce investment, point to strong global penetration potential; as these investments mature and the international footprint grows, the business is likely to realize further scale benefits and contribute meaningfully to top-line growth and operating efficiency.

- The focus on operational excellence, evidenced by disciplined SG&A management and process improvements in service delivery, is likely to yield ongoing margin expansion and greater free cash flow generation, supporting reinvestment, debt paydown, and future acquisitions—all of which should benefit earnings and valuation over time.

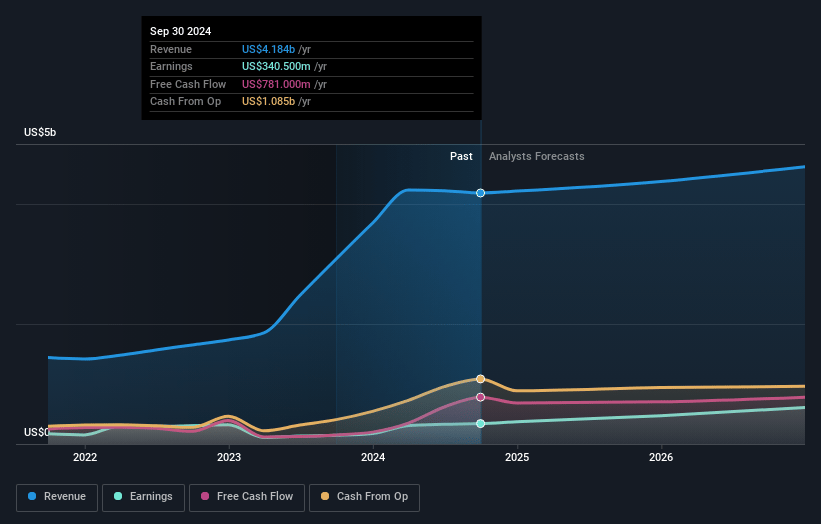

RB Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on RB Global compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming RB Global's revenue will grow by 3.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.7% today to 13.4% in 3 years time.

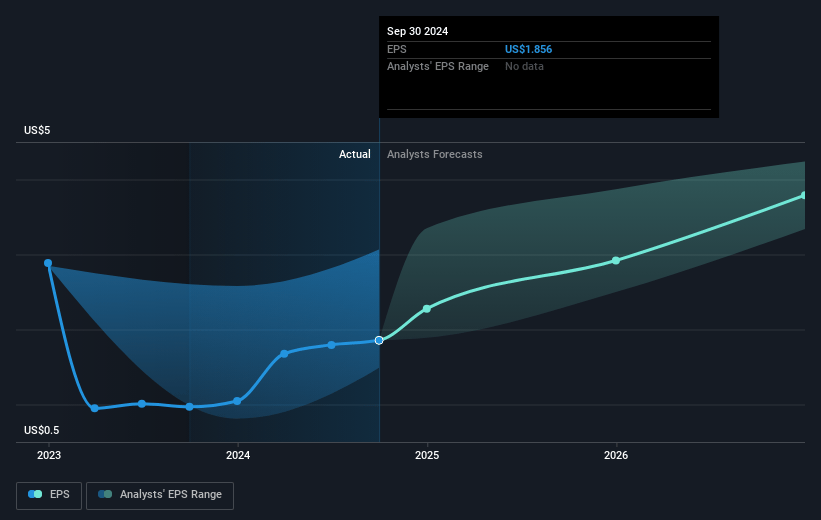

- The bullish analysts expect earnings to reach $629.3 million (and earnings per share of $3.39) by about April 2028, up from $372.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 43.9x on those 2028 earnings, down from 48.0x today. This future PE is greater than the current PE for the CA Commercial Services industry at 28.2x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

RB Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A rise in deglobalization and regionalization could limit RB Global’s ability to grow its international customer base and auction volumes, especially as uncertainty around tariffs and cross-border trade remains high, potentially impacting long-term revenue growth from global operations.

- Increasing automation and electrification in heavy equipment and vehicles may shorten asset lifecycles and shift resale demand, reducing overall gross transactional value and compressing transaction-related revenues over time.

- Escalating environmental regulations and ESG mandates may redirect customer spending toward newer, greener equipment types that fall outside RB Global’s current core offerings, risking a decline in auction platform relevance and future revenue streams.

- Intensifying competition from digital-first resale platforms and direct OEM channels threatens to erode RB Global’s fee take rate and net margins, as evidenced by management’s ongoing need to expand technology investment and continuously refine marketplace offerings.

- High integration risk from large-scale acquisitions, such as IAA and Boom & Bucket, raises the likelihood of cost overruns and complexity, which could impair goodwill and place downward pressure on future earnings growth if synergies and ROI are not fully realized.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for RB Global is $120.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RB Global's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.7 billion, earnings will come to $629.3 million, and it would be trading on a PE ratio of 43.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of $96.58, the bullish analyst price target of $120.0 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:RBA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.