Key Takeaways

- Growth in digital shipping and e-commerce is offsetting declines in traditional mailing, supporting future revenue stability and predictability.

- Cost-saving initiatives and improved capital allocation are strengthening margins, cash flow, and overall return of value to shareholders.

- Secular decline in mailing, operational challenges, reliance on USPS, and fierce competition threaten long-term growth despite efforts in shipping and cost-cutting.

Catalysts

About Pitney Bowes- Operates as a technology-driven company that provides SaaS shipping solutions, mailing innovation, and financial services to small businesses, large enterprises, and government entities around the world.

- Ongoing growth in e-commerce and the shift toward digital shipping are driving the expansion of Pitney Bowes’ shipping business, which management expects will more than offset declines in traditional mailing revenue within SendTech over the next 12–24 months; this trend should underpin future revenue stability and eventual growth.

- Continued digital transformation among business clients is boosting adoption of Pitney Bowes’ digital shipping and mailing platforms, leading to higher recurring subscription and service revenues and improving long-term earnings predictability.

- Strong cost rationalization efforts—with the company raising its cost savings target to $180–$200 million in annualized net savings—are expected to meaningfully enhance net margins and cash flows throughout 2025 and beyond.

- Expansion of the Pitney Bowes Bank Receivables Purchase Program is accelerating cash generation and lowering borrowing costs, directly supporting free cash flow and overall profitability.

- Disciplined capital allocation, including debt reduction and a shift to meaningful share repurchases and dividend increases once leverage targets are hit, is expected to drive higher EPS and return of value to shareholders.

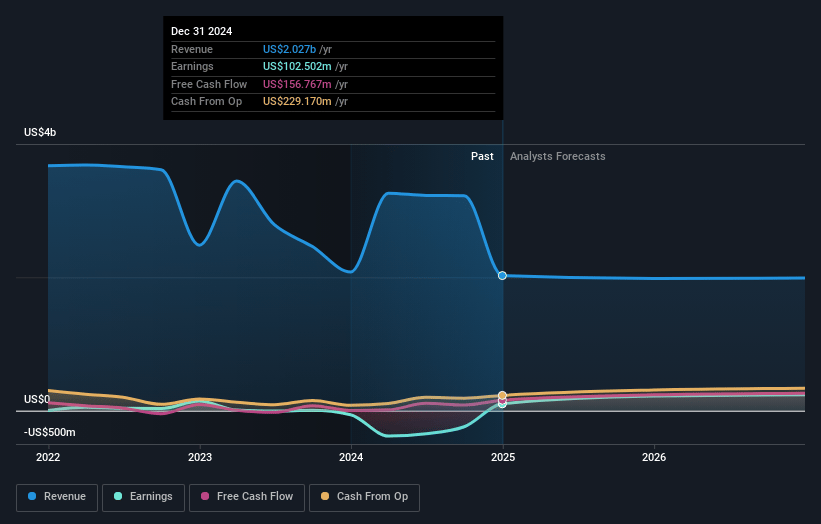

Pitney Bowes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pitney Bowes's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.3% today to 22.2% in 3 years time.

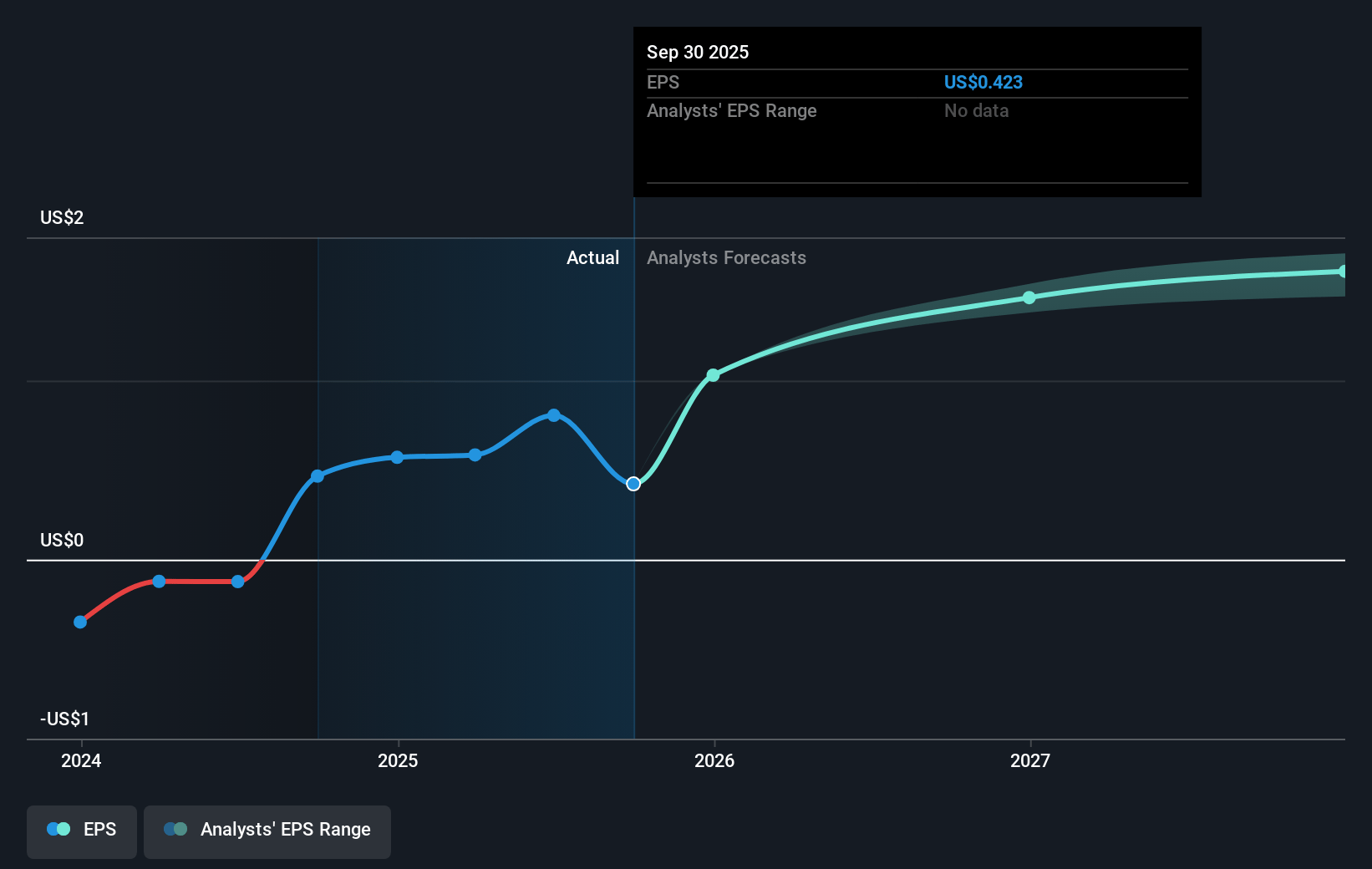

- Analysts expect earnings to reach $435.7 million (and earnings per share of $2.34) by about May 2028, up from $105.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.3x on those 2028 earnings, down from 15.8x today. This future PE is lower than the current PE for the US Commercial Services industry at 26.1x.

- Analysts expect the number of shares outstanding to grow by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

Pitney Bowes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent revenue decline in core mailing and equipment business due to ongoing digitalization and customers shifting from physical mail to digital communication channels, resulting in continued top-line pressure and narrowing recurring revenue streams.

- Risk that higher revenue growth in shipping and SendTech may not be sufficient to fully offset structural declines in traditional mailing revenues over the long term, limiting the company’s ability to achieve sustained net margin expansion and predictable earnings growth.

- Dependence on USPS stability and policies introduces uncertainty; adverse operational, regulatory, or pricing changes at USPS could disrupt Pitney Bowes’ service model and negatively impact volumes, revenues, and profitability.

- High ongoing cost-cutting requirements and focus on lean operations may create operational fragility and limit strategic investment capacity, potentially impeding necessary technology upgrades or innovation—especially critical as the logistics industry faces rapid technological disruption.

- Continued intense competition and commoditization within e-commerce logistics and shipping, including the shift toward asset-light models and the build-out of captive networks by major online retailers, threaten long-term market share, pricing power, and thus sustainable earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.0 for Pitney Bowes based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $435.7 million, and it would be trading on a PE ratio of 9.3x, assuming you use a discount rate of 8.6%.

- Given the current share price of $9.25, the analyst price target of $17.0 is 45.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.