Narratives are currently in beta

Key Takeaways

- Strategic partnerships and AI investments are expected to boost revenue, efficiency, and client retention, leading to enhanced earnings and net margins.

- Sales initiatives and market stabilization efforts aim to improve growth acceleration and profitability through improved client acquisition and retention.

- Declining worksite employees and economic uncertainty, coupled with rising healthcare costs and significant spending, could pressure Insperity's revenue, margins, and client retention.

Catalysts

About Insperity- Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

- The strategic partnership with Workday is expected to create growth opportunities through a unique PEO solution, which will likely enhance revenue streams by offering advanced HR services integrated with new technologies. This should appeal to mid-market clients and improve client retention, boosting earnings.

- AI investments are projected to increase operational efficiencies and effectiveness. By leveraging proprietary HR expertise through AI, Insperity aims to enhance client experience and reduce costs, potentially leading to higher net margins.

- The focus on sales and service initiatives, including the role-based approach to sales organization and improved service efficiency, is aimed at long-term growth acceleration. This strategic focus is likely to positively impact revenue and profitability in 2025 and beyond.

- The anticipated stabilization in small business hiring and expected post-election market normalization could improve client acquisition and retention rates, leading to growth in revenue and earnings as confidence in the small to medium-sized business segment strengthens.

- The integration and co-marketing efforts with Workday are expected to create a robust sales pipeline by tapping into Workday’s market presence. This strategic alignment could increase revenue through enhanced sales opportunities and possibly drive an upward trend in earnings.

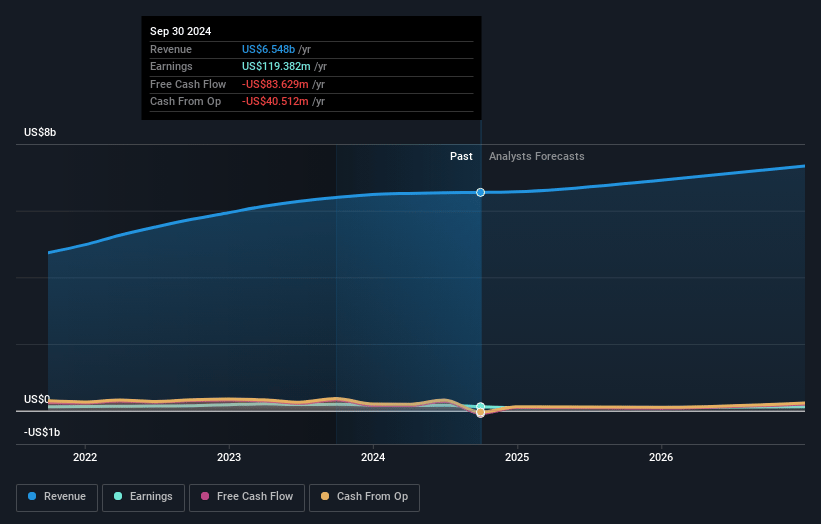

Insperity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Insperity's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 1.8% today to 1.4% in 3 years time.

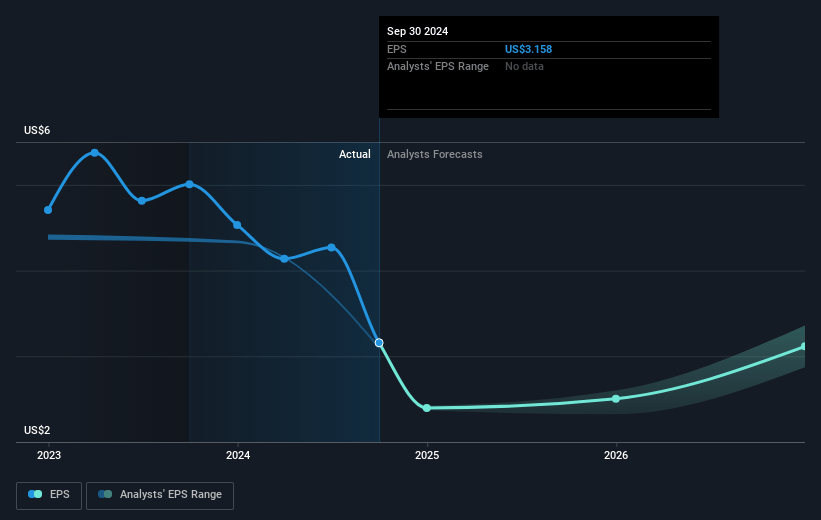

- Analysts expect earnings to reach $110.0 million (and earnings per share of $2.97) by about November 2027, down from $119.4 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $125.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.8x on those 2027 earnings, up from 24.3x today. This future PE is greater than the current PE for the US Professional Services industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Insperity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued softness in client hiring and the loss of several mid-market accounts have led to a decline in worksite employees, which could negatively impact Insperity's revenue growth.

- The uncertainty in the macroeconomic environment, coupled with pre-election hesitancy, has put pressure on the small and medium-sized business marketplace, contributing to lower-than-expected net hiring and potentially affecting future earnings.

- The health care benefit cost trend was slightly above the forecasted range, indicating potential challenges in managing costs effectively, which could affect net margins if these trends continue.

- Elevated healthcare cost trends and specialty drugs cost impacts may pressure Insperity's pricing strategies, possibly affecting client retention and new sales, which could ultimately impact revenue and profit margins.

- The substantial spending on the Workday strategic partnership, approximately $40 million year-to-date, complicates the financial picture; if the anticipated efficiencies and market advantages do not materialize swiftly, this could weigh on operational margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $90.5 for Insperity based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $84.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $7.6 billion, earnings will come to $110.0 million, and it would be trading on a PE ratio of 36.8x, assuming you use a discount rate of 6.5%.

- Given the current share price of $77.56, the analyst's price target of $90.5 is 14.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives