Key Takeaways

- Growth in order backlog and connected device transition signal potential future revenue and margin enhancements.

- New product innovation and international market expansion forecast increased revenue and market share growth.

- Margin pressures and customer order delays signal potential challenges in revenue growth, financial stability, and market demand shifts impacting MSA Safety's future performance.

Catalysts

About MSA Safety- Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures in the fire service, energy, utility, construction, and industrial manufacturing applications, as well as heating, ventilation, air conditioning, and refrigeration industries worldwide.

- MSA Safety's backlog grew sequentially due to favorable trends and order momentum, even in light of delivery timing issues, suggesting potential for future revenue increases as these orders are fulfilled.

- The transition to connected portable detection devices, which have shown rapid growth compared to traditional devices, highlights an opportunity for increased revenue and higher margins due to durable multiyear contracts and service add-ons.

- The introduction of new products like the Carins 1836 helmet and FL5000 Flame Detector, alongside continued innovation in safety solutions, could drive future revenue growth through expansion and increased market share.

- International momentum, particularly in fire services, points towards potential revenue growth, while efforts to capture market share in regions like APAC further support expansion opportunities.

- The company's focus on driving high incremental margins of 30%-40% as it grows, combined with operational improvements and cost management, is likely to enhance net margins and overall earnings going forward.

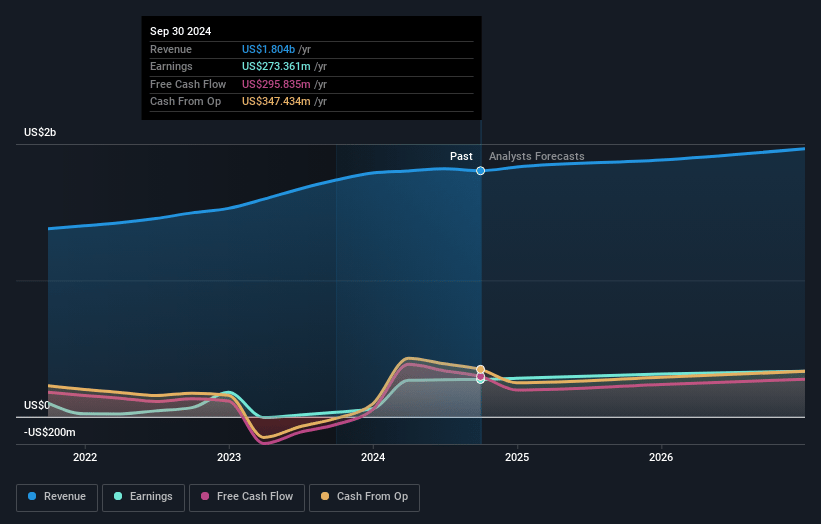

MSA Safety Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MSA Safety's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.2% today to 18.0% in 3 years time.

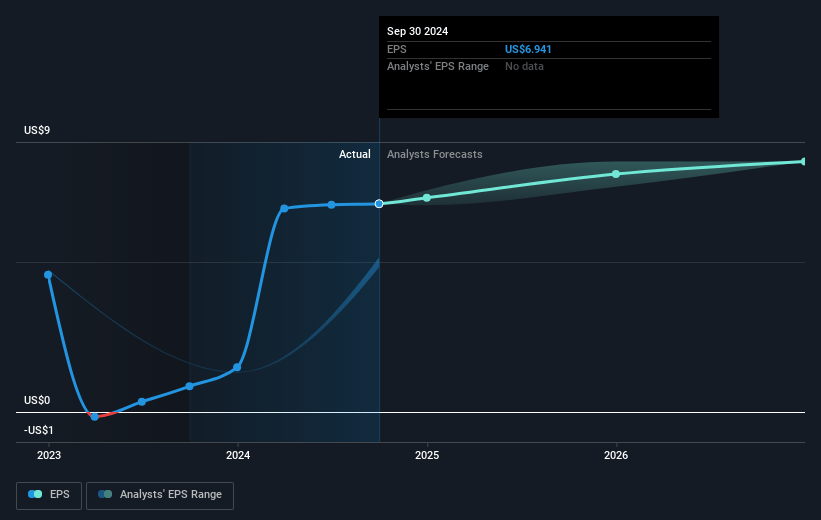

- Analysts expect earnings to reach $363.7 million (and earnings per share of $9.1) by about January 2028, up from $273.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.0x on those 2028 earnings, up from 23.6x today. This future PE is lower than the current PE for the US Commercial Services industry at 32.1x.

- Analysts expect the number of shares outstanding to grow by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

MSA Safety Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sales declined by 3% year-over-year, reflecting potential challenges in revenue growth if shipping delays and customer order timing remain problematic.

- Customer delays, particularly in significant orders like those from the U.S. Air Force and other international government contracts, could impact future revenue recognition and financial stability.

- Declines in specific product categories, such as Fire Services and Industrial PPE, may signal competitive pressures or shifts in market demand influencing revenue and margins.

- The push of certain orders to 2025 due to customer decision timelines indicates potential instability in cash flows and revenue projections.

- Margin pressures and reliance on cost management to achieve earnings targets suggest that unexpected cost increases could strain net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $199.5 for MSA Safety based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $363.7 million, and it would be trading on a PE ratio of 26.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of $163.98, the analyst's price target of $199.5 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives