Narratives are currently in beta

Key Takeaways

- Leidos' new growth strategy and focus on AI, health, and digital modernization promise increased revenue and profitability.

- Strong business wins, a robust pipeline, and defense contracts forecast support sustained future growth and earnings.

- Leidos may face revenue and earnings volatility due to budget pressures, competitive challenges in key markets, and reliance on securing new contracts.

Catalysts

About Leidos Holdings- Provides services and solutions in the defense, intelligence, civil, and health markets in the United States and internationally.

- Leidos' new North Star growth strategy, which is set to be detailed at the upcoming Investors Day in March, aims to refocus capital on new growth engines. This strategy is expected to drive future top line and bottom line growth, potentially leading to increased revenue and earnings.

- The Health and Civil segment is identified as a significant growth and margin leader. Investments in AI and virtual health technologies, alongside expanded mobile clinics, position Leidos to sustain and potentially increase margins and volumes, thereby positively impacting future earnings and profitability.

- Recent business wins in digital modernization and full spectrum cyber, including a $700 million contract in cyber solutions, highlight a robust business development pipeline. These wins are expected to enhance the backlog quality, supporting future revenue growth.

- Leidos' strategic focus on defense systems, exemplified by the progress in programs like the IFPC Enduring Shield and Small Glide Munitions, anticipates low rate and full rate production contracts by 2026. This trajectory supports future growth in revenue and earnings in the Defense Systems segment.

- The company's ability to maintain a book-to-bill ratio of over 1.9x, with a growing pipeline of bids awaiting adjudication, indicates strong business capture performance. This positions Leidos for substantial future revenue growth, which should also bolster overall profitability and earnings.

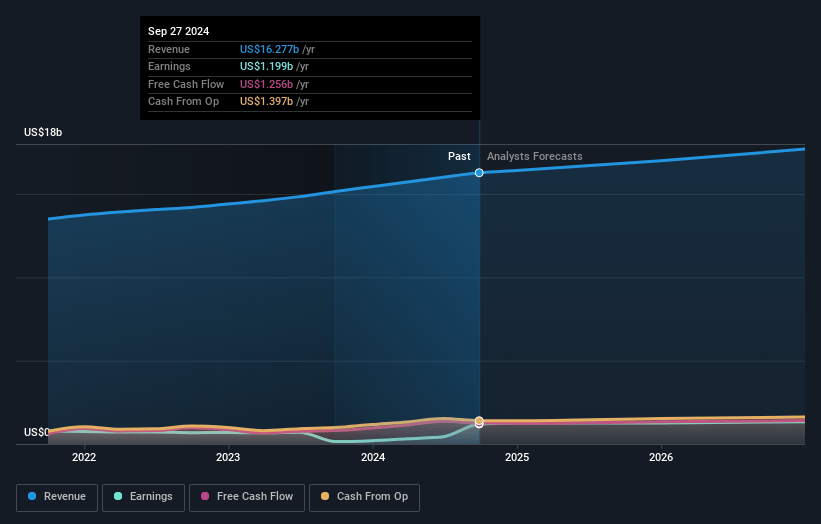

Leidos Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Leidos Holdings's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 7.8% in 3 years time.

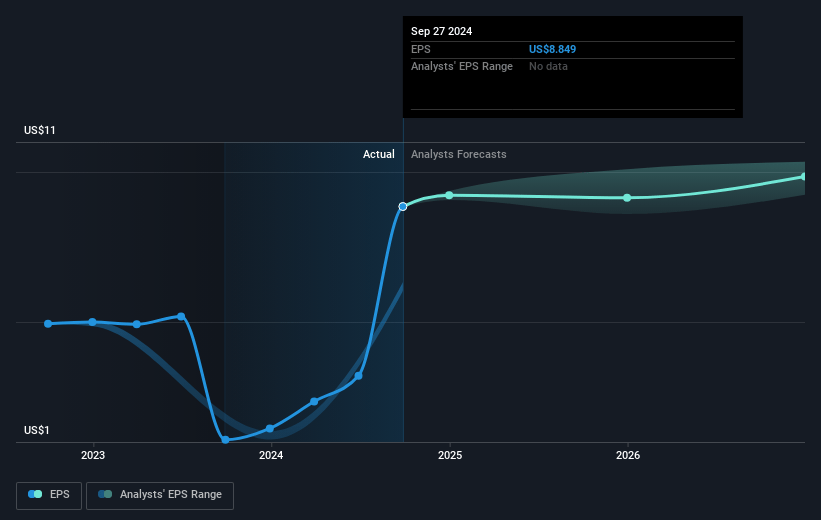

- Analysts expect earnings to reach $1.4 billion (and earnings per share of $11.48) by about January 2028, up from $1.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, up from 15.7x today. This future PE is lower than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to decline by 2.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

Leidos Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue growth may be constrained by pressures on budget allocations, especially in national security and intelligence sectors, limiting top-line growth. This could impact overall revenue expansion.

- Leidos faces potential challenges in maintaining current market share in their Managed Health Services, especially in their upcoming recompete of regions contracts with the VA, which could pressure margins and net income.

- With plans for major expansions in cyber and digital infrastructure solutions amid uncertain defense budgets and competitive pressures, the company risks possible variance in revenue projections and margin projections could lead to earnings volatility.

- Leidos' future growth heavily relies on new business capture and retaining key contracts. Any failure in securing recompetes or winning new contracts could adversely impact future revenue and earnings.

- Given the need for potentially significant investment to grow its air and missile defense systems, Leidos may face challenges in funding these investments, potentially affecting net margins and cash flow, especially if program delays or difficulties arise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $184.38 for Leidos Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $148.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.1 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of $141.49, the analyst's price target of $184.38 is 23.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives