Last Update07 May 25Fair value Decreased 8.44%

Key Takeaways

- Strategic international expansion and LNG projects position KBR for revenue and margin growth amid rising global energy demand.

- Shareholder value could increase through returns, driven by share repurchases, dividends, and enhanced operational efficiency.

- KBR faces earnings uncertainty from geopolitical and economic factors affecting tariffs, government contracts, and defense budgets, impacting revenue growth and net margins.

Catalysts

About KBR- Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

- The ongoing integration of the LinQuest acquisition and its contribution to winning new contracts, like the $970 million ASCEND2 award with the U.S. Space Force, is expected to drive revenue growth and enhance earnings through realized synergies.

- The strong progress on key LNG projects, such as Plaquemines LNG and new developments in Lake Charles, Oman, Indonesia, and Abu Dhabi, positions KBR to capitalize on increasing global demand for energy, impacting future revenue and margin expansion.

- Successful execution and scaling of the HomeSafe program with TRANSCOM could lead to enhanced operational efficiency and customer satisfaction, driving a potential increase in revenue and improved net margins.

- Strategic expansion in international markets, particularly in the Middle East and Asia, and securing new contracts with global energy companies like BP signal potential revenue growth from global energy security and sustainability initiatives.

- Increased capital returns to shareholders through share repurchases and dividends indicate KBR’s commitment to delivering shareholder value, potentially leading to EPS growth due to a reduced share count and strong balance sheet leverage.

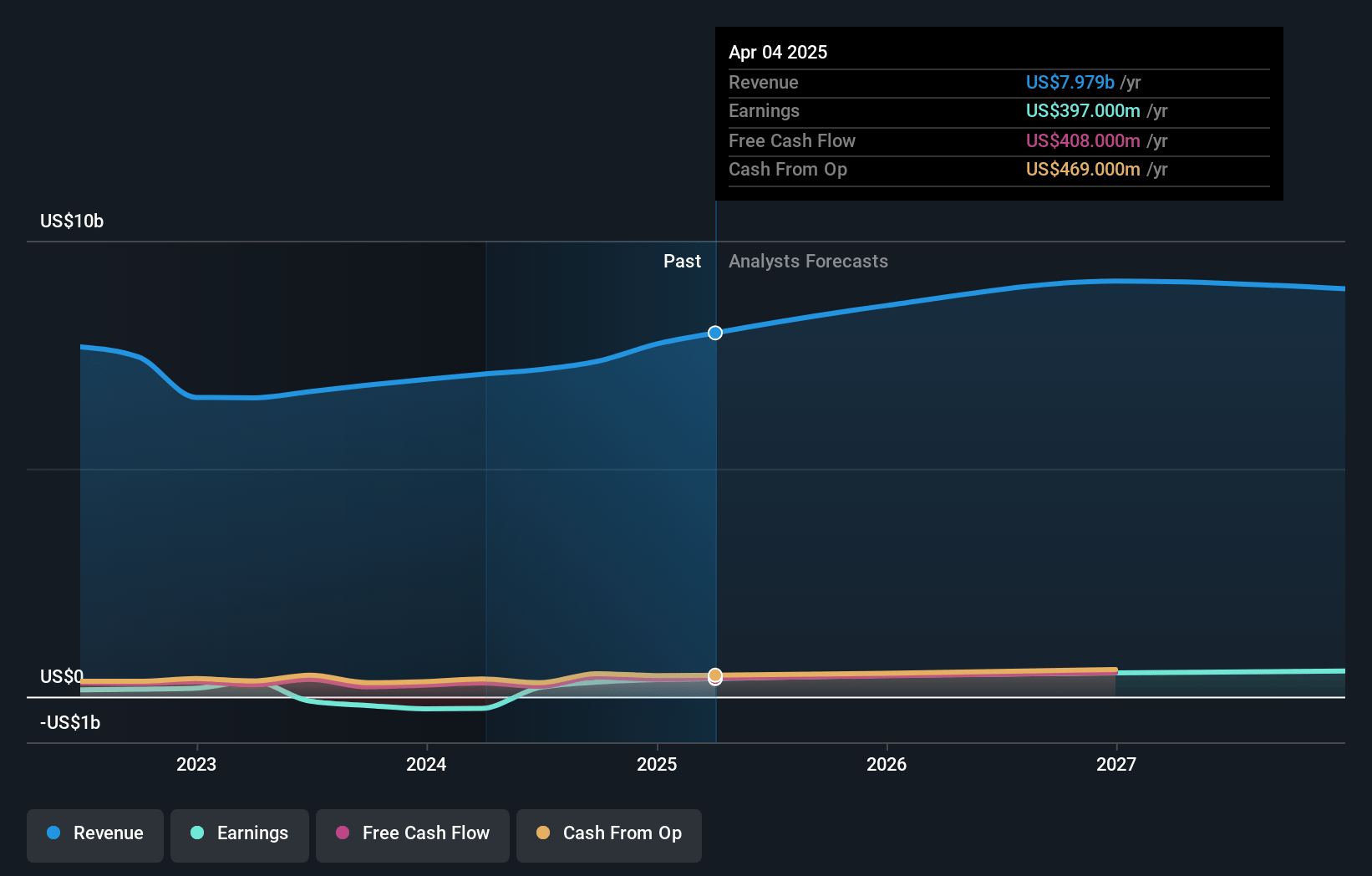

KBR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KBR's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 6.4% in 3 years time.

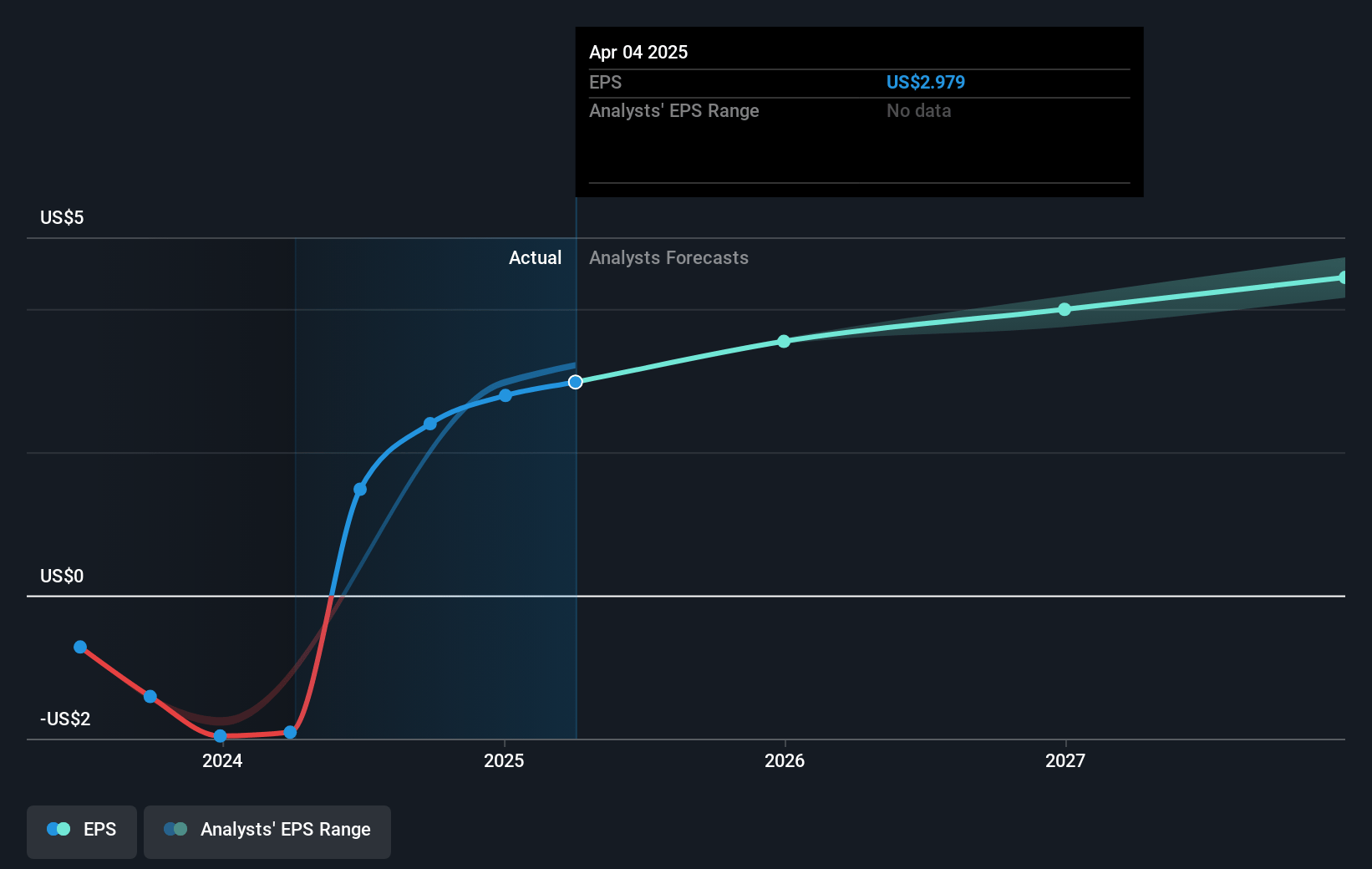

- Analysts expect earnings to reach $675.1 million (and earnings per share of $5.26) by about May 2028, up from $397.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, down from 17.7x today. This future PE is lower than the current PE for the US Professional Services industry at 21.2x.

- Analysts expect the number of shares outstanding to decline by 3.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.2%, as per the Simply Wall St company report.

KBR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- KBR's exposure to tariffs and potential cost increases due to geopolitical shifts could impact capital expenditure budgets for clients, potentially slowing revenue growth.

- The company's reliance on large government contracts, like HomeSafe, comes with inherent uncertainties, including variable ramp-up rates which could affect net margins if volumes fluctuate.

- The competitive and dynamic bidding environment for government contracts, where protests are common, could delay or jeopardize projects and contribute to earnings uncertainty.

- Changes in defense and NASA budgets, while currently aligned with KBR's capabilities, can be subject to political changes or budget cuts, affecting future revenue streams.

- Economic slowdowns or geopolitical tensions could challenge growth, particularly if clients reevaluate their projects or allocate funding differently, which could impact KBR’s overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $66.556 for KBR based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $78.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.6 billion, earnings will come to $675.1 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 7.2%.

- Given the current share price of $54.18, the analyst price target of $66.56 is 18.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.