Narratives are currently in beta

Key Takeaways

- Expansion into Mexico and synergy initiatives from Kimball acquisition are key drivers of future earnings growth, focusing on cost efficiencies and cross-selling.

- Profit transformation in Workplace Furnishings segment leads to record-high margins without relying on revenue growth, indicating sustained earnings improvement.

- Economic uncertainty and market volatility in key segments are dampening HNI's revenues and margins, with risk of extended impact on future earnings.

Catalysts

About HNI- Engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada.

- HNI is undertaking two major initiatives: Mexico expansion and KII synergies, which are expected to contribute significantly to EPS growth in 2025 and 2026, impacting earnings positively.

- The profit transformation plan in the Workplace Furnishings segment is showing significant benefits, with operating profit margins reaching a 20-year high. This plan does not rely on revenue growth, indicating ongoing margin improvement and earnings growth.

- The acquisition of Kimball International is providing new growth opportunities and is expected to deliver synergies, contributing $60 million in total with a focus on earnings through cost efficiencies and cross-selling opportunities.

- The Workplace Furnishings segment is seeing encouraging demand outlooks, with segment orders improving and backlog increasing, which bodes well for future revenue growth.

- In Residential Building Products, anticipated interest rate reductions are expected to enhance housing turnover and demand, leading to potential revenue growth as market conditions improve.

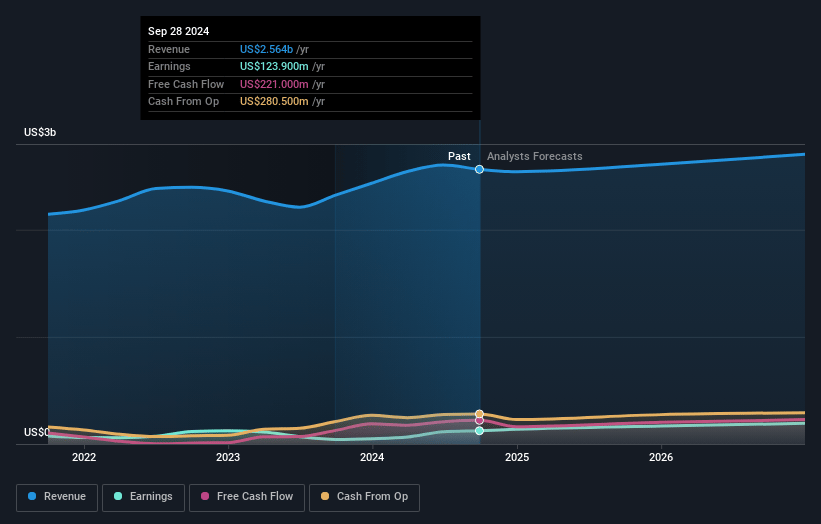

HNI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HNI's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 8.1% in 3 years time.

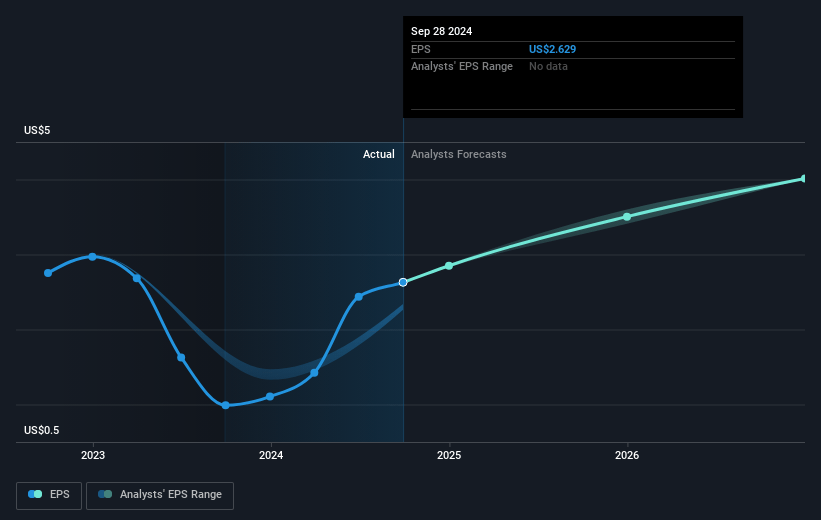

- Analysts expect earnings to reach $222.2 million (and earnings per share of $4.61) by about January 2028, up from $123.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, down from 19.5x today. This future PE is lower than the current PE for the US Commercial Services industry at 32.1x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

HNI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing a near-term demand pause, impacting current revenue and profits, particularly with small

- to medium-sized business customers in its Workplace Furnishings segment.

- The transactional business within Workplace Furnishings, which is susceptible to economic fluctuations, is currently soft and may negatively affect future revenues if this volatility persists.

- Ongoing housing market volatility, interest rate volatility, and economic uncertainty are negatively impacting the Residential Building Products segment, which could lead to lower revenues and narrower margins in the near term.

- The lengthening selling cycle in the contract furniture space, due to project delays and cautious customer behavior, could slow down revenue recognition and impact earnings.

- Small business leader hesitancy and high uncertainty indices, especially around the U.S. elections, may lead to suppressed discretionary spending, impacting revenue generation and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.0 for HNI based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $222.2 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $50.65, the analyst's price target of $61.0 is 17.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives