Key Takeaways

- Advances in AI and increased regulation threaten revenue, profitability, and the freelance market's size, elevating operational and compliance risks.

- Growing competition, market commoditization, and hurdles in enterprise scaling limit long-term growth prospects and expose the firm to reputational and legal challenges.

- Multiple innovative revenue streams, upmarket enterprise focus, AI-powered platform enhancements, and global expansion position Fiverr for sustained growth, margin improvement, and resilience against market volatility.

Catalysts

About Fiverr International- Operates an online marketplace worldwide.

- The rapid advancement in AI-driven automation for professional and creative services poses a significant threat to Fiverr's core business, with AI potentially replacing many freelance jobs, diminishing the addressable market, and leading to sustained declines in long-term revenue growth and margin expansion.

- Growing regulatory pressures in the US and EU centered on gig worker classification, benefits, and taxation are likely to result in increasing compliance requirements, higher platform operating costs, reduced freelancer participation rates, and a squeeze on net margins going forward.

- The continued commoditization of freelance services, alongside the rise of highly specialized niche platforms, is intensifying price competition, risking lower take rates and resultant margin compression despite the company's efforts to move upmarket.

- Fiverr's heavy reliance on repeat buyers and challenges in scaling enterprise adoption mean that growth from high-value transactions may be capped, limiting the company's ability to achieve long-term revenue scalability and challenging its current premium valuation.

- As the gig economy matures, greater scrutiny on data security and intellectual property issues across freelance platforms exposes Fiverr to reputational, legal, and financial risks, increasing the potential for adverse impacts to earnings and future cash flow.

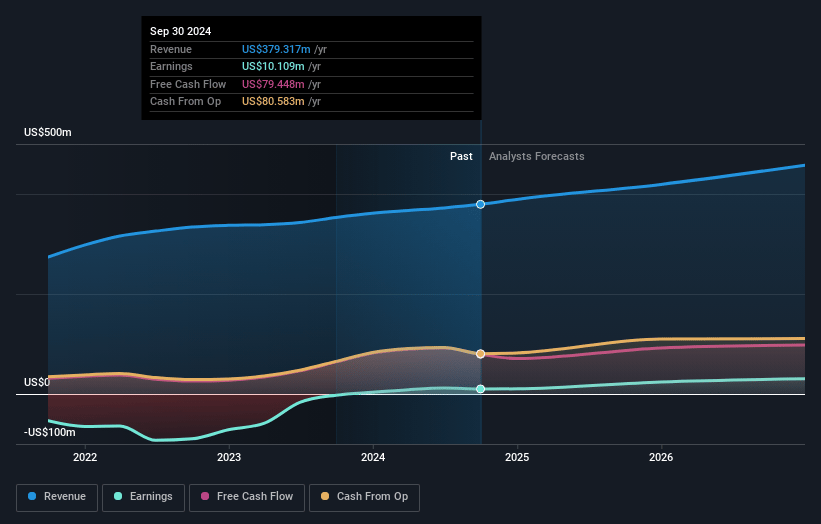

Fiverr International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fiverr International compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fiverr International's revenue will grow by 6.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.5% today to 9.2% in 3 years time.

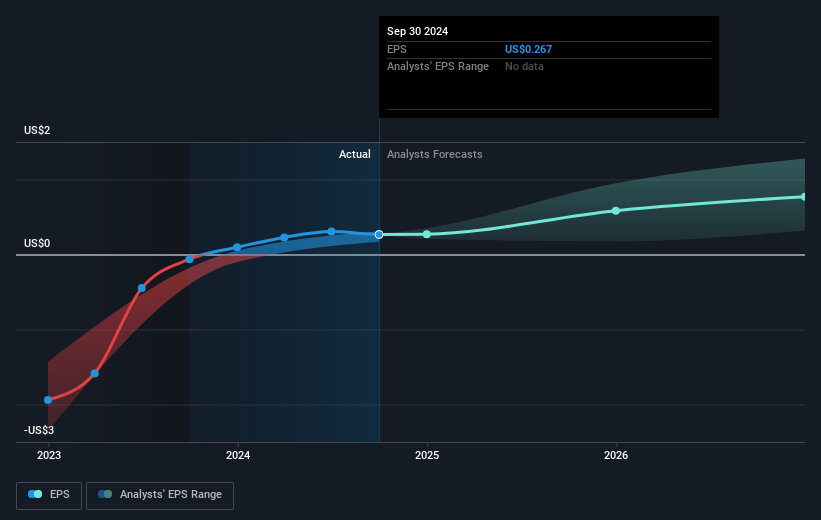

- The bearish analysts expect earnings to reach $45.1 million (and earnings per share of $0.6) by about June 2028, up from $18.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.9x on those 2028 earnings, down from 63.8x today. This future PE is greater than the current PE for the US Professional Services industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 5.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.44%, as per the Simply Wall St company report.

Fiverr International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fiverr is experiencing strong revenue growth both in its core Marketplace and in value-added Services, such as Fiverr Ads, Seller Plus, and AutoDS, with services revenue growing 94% year over year and expected to comprise over 30% of total revenue by year-end, indicating multiple durable engines of top-line growth that could support long-term increases in overall revenue.

- Expansion into large enterprise clients through Fiverr Pro and the upmarket strategy is producing six-figure deals and higher spend per buyer, which, if sustained and scaled, may drive higher profit margins and significantly lift earnings over time.

- The early success and rapid adoption of Fiverr Go, powered by AI-driven personalized assistants that materially improve conversion rates and buyer satisfaction, positions Fiverr at the forefront of platform innovation, potentially enhancing customer retention and lowering customer acquisition costs, which would support expansion in net margins.

- Strategic flexibility and highly data-driven marketing enable Fiverr to opportunistically allocate spend, improving return on marketing investment and helping to maintain strong Adjusted EBITDA margins-even as the company scales, this trend could yield sustained improvements in profitability.

- Ongoing international expansion and efforts to reach high-value buyers diversify Fiverr's revenue streams, reduce exposure to any single market's macroeconomic volatility, and could ensure stable or rising earnings despite changes in broader industry or economic conditions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fiverr International is $32.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fiverr International's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $47.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $488.0 million, earnings will come to $45.1 million, and it would be trading on a PE ratio of 27.9x, assuming you use a discount rate of 9.4%.

- Given the current share price of $32.42, the bearish analyst price target of $32.0 is 1.3% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.