Narratives are currently in beta

Key Takeaways

- Transitioning to subscription and investing in tech globally aims to boost market share and revenue growth.

- Education division expansion with large contracts enhances revenue growth and improves margins through economies of scale.

- Transitioning to a new sales model carries execution risks that could impact revenue, earnings, and the realization of assumed returns from growth investments.

Catalysts

About Franklin Covey- Provides training and consulting services in the areas of execution, sales performance, productivity, customer loyalty, leadership, and educational improvement for organizations and individuals worldwide.

- Franklin Covey is making significant investments in transforming its sales structure to focus on expanding within existing clients and landing new clients, which is expected to accelerate revenue growth from single-digit to consistent double-digit levels, thereby enhancing earnings.

- The shift to a subscription-based model, along with heavy investment in technology to deliver solutions on a global scale, positions the company to increase market share, which should drive revenue growth.

- The expansion of their Education Division, particularly with large district and state-level contracts, is contributing to strong revenue growth, which should lead to improved net margins as economies of scale are realized.

- The launch of new content offerings and products tailored to scale within client organizations is aimed at increasing average annual revenue per client, which would positively impact both revenue and net margins.

- Accelerated go-to-market strategies and a tightened comp structure for sales teams are targeted to achieve higher client acquisition and retention, which should lead to increased revenue and adjusted EBITDA growth.

Franklin Covey Future Earnings and Revenue Growth

Assumptions

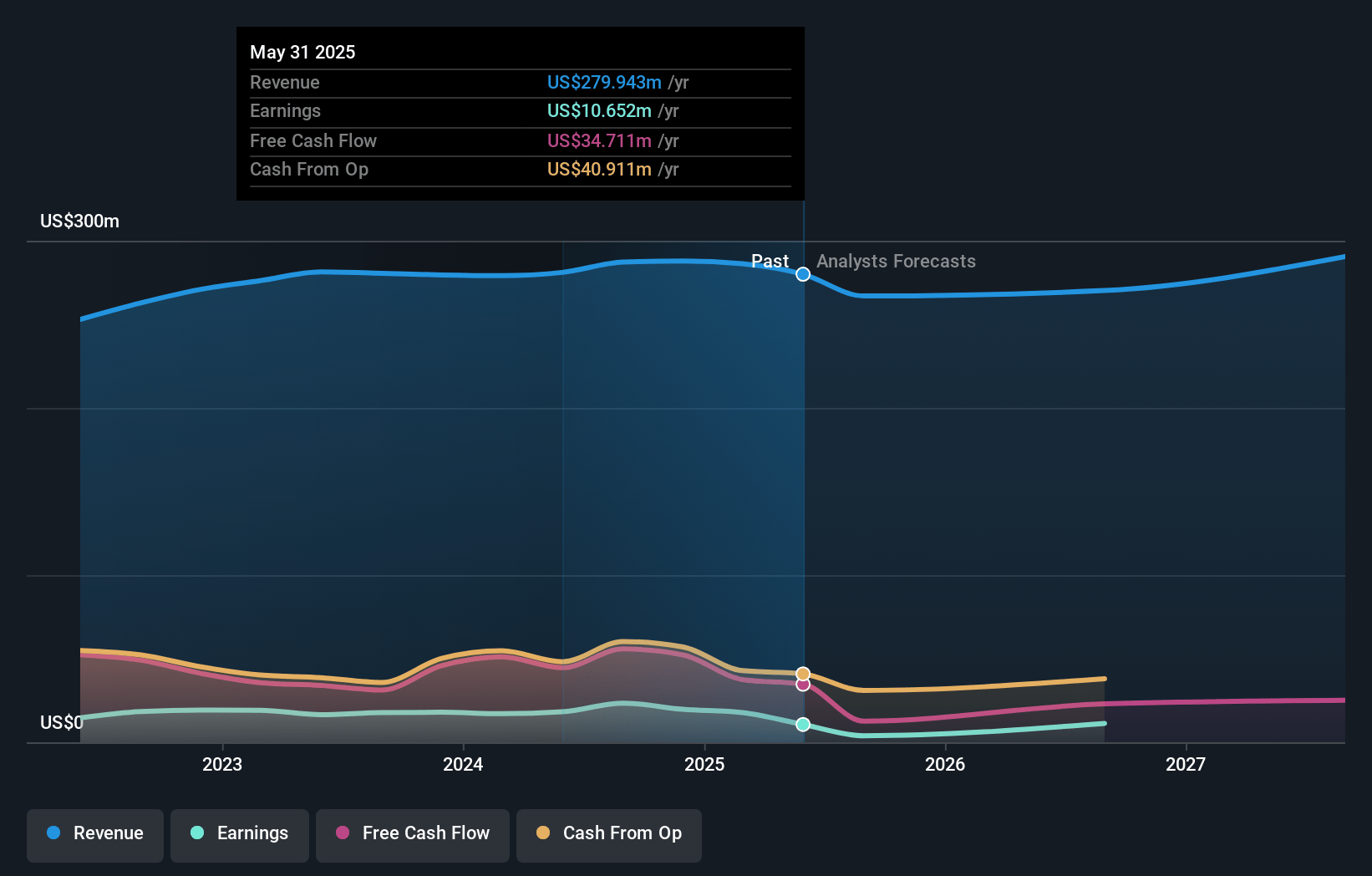

How have these above catalysts been quantified?- Analysts are assuming Franklin Covey's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.9% today to 3.8% in 3 years time.

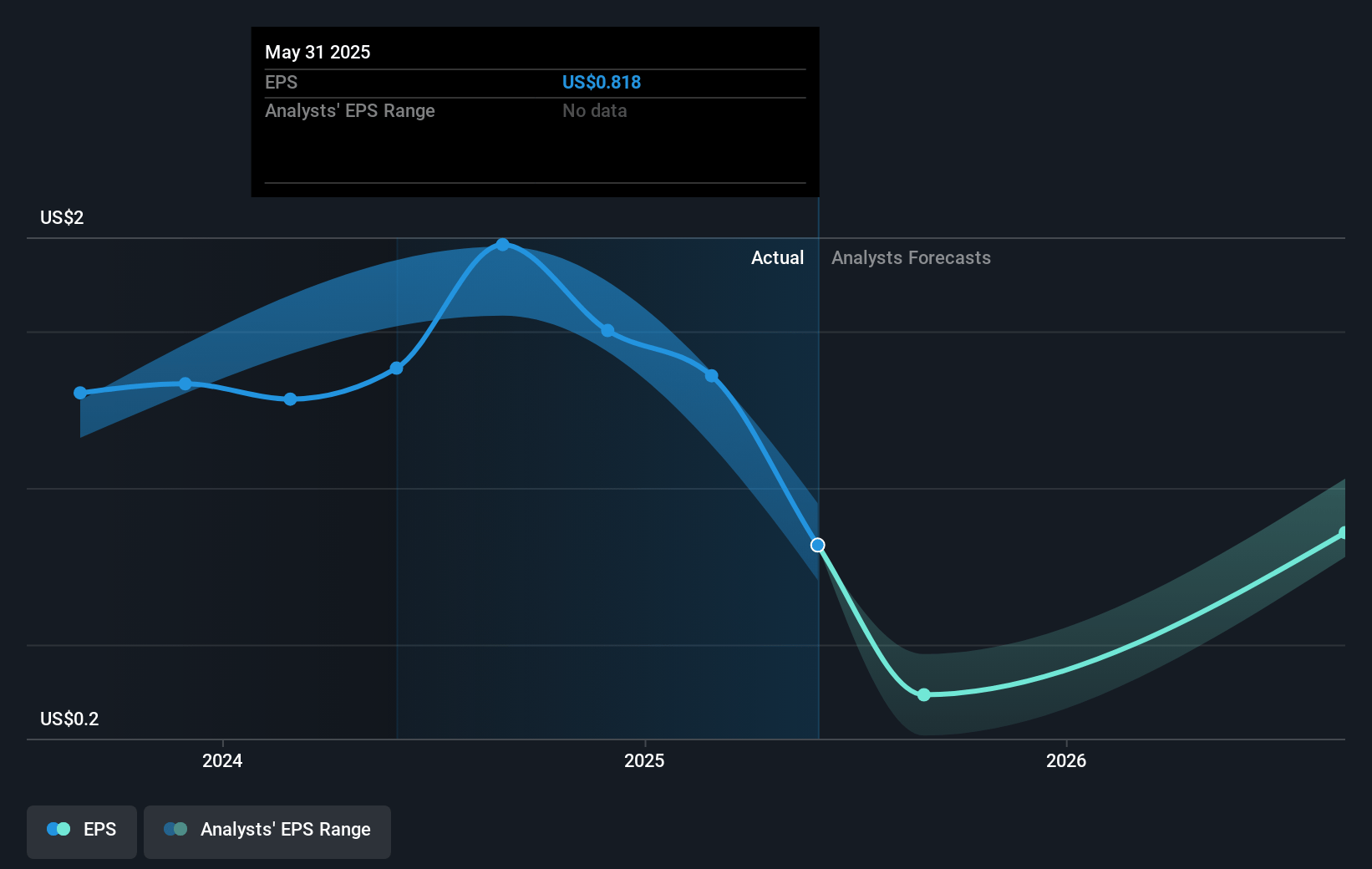

- Analysts expect earnings to reach $14.0 million (and earnings per share of $0.95) by about January 2028, down from $19.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 66.1x on those 2028 earnings, up from 24.2x today. This future PE is greater than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to grow by 3.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

Franklin Covey Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to a new sales model, although promising, involves execution risks that could disrupt revenue flow or fail to deliver expected pipeline and invoiced sales growth, impacting revenue and earnings.

- The company's growth investments, which are subtracting from current adjusted EBITDA, assume significant future returns that may not materialize as anticipated, affecting net margins and cash flow.

- Sluggish growth in the Enterprise Division's revenue, a significant portion of Franklin Covey's overall revenue, could indicate challenges in adapting to competitive market conditions, affecting future revenue streams.

- International operations, especially in Asia, are facing difficult business conditions, which have already led to declines and could pose further risks to the company's international revenue growth.

- Heavy reliance on government and educational contracts may expose the company to risks from potential policy changes or economic downturns, affecting subscription revenue and deferred revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.0 for Franklin Covey based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $371.2 million, earnings will come to $14.0 million, and it would be trading on a PE ratio of 66.1x, assuming you use a discount rate of 6.3%.

- Given the current share price of $36.12, the analyst's price target of $55.0 is 34.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives