Key Takeaways

- Equifax's cloud transformation and AI-driven innovation are set to drive revenue growth through new, differentiated services and higher-margin revenue streams.

- Strategic acquisitions, partnerships, and a share repurchase program aim to accelerate cash flow, strengthen earnings, and boost shareholder returns.

- The company's dependency on declining markets, foreign exchange risks, and high pricing limits revenue growth and market share despite cloud initiatives.

Catalysts

About Equifax- Operates as a data, analytics, and technology company.

- Equifax's migration to its New Equifax Cloud positions the company for growth, innovation, and new AI-driven products, potentially boosting revenue through differentiated services.

- EFX 2027 strategic priorities, including targeted bolt-on acquisitions and completion of the cloud transformation, are expected to accelerate free cash flow generation and strengthen earnings.

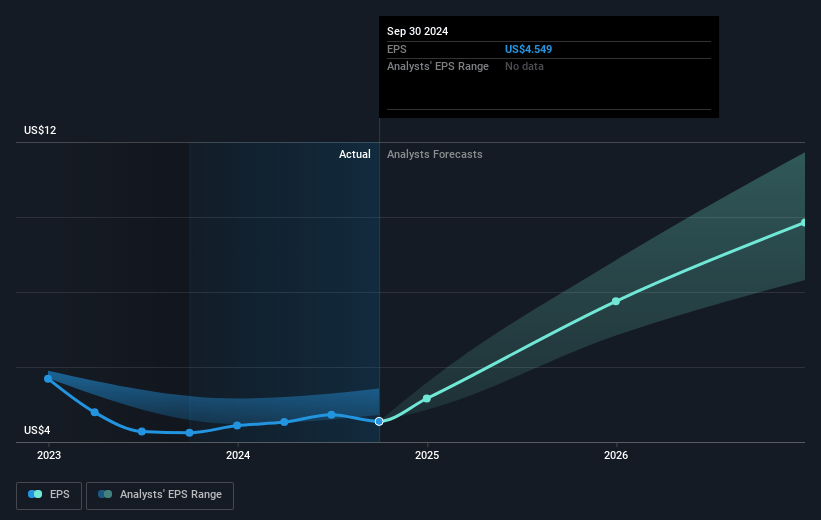

- The multiyear share repurchase program planned for 2025 aims to return capital to shareholders, potentially driving EPS growth.

- New partnerships and significant record growth in EWS Verification Services, especially with companies like Workday, are anticipated to fuel revenue growth in 2025 and beyond.

- Continued product innovation, leveraging Equifax Cloud capabilities and EFX.AI to deliver new solutions, is expected to drive higher margins by increasing higher-margin revenue streams.

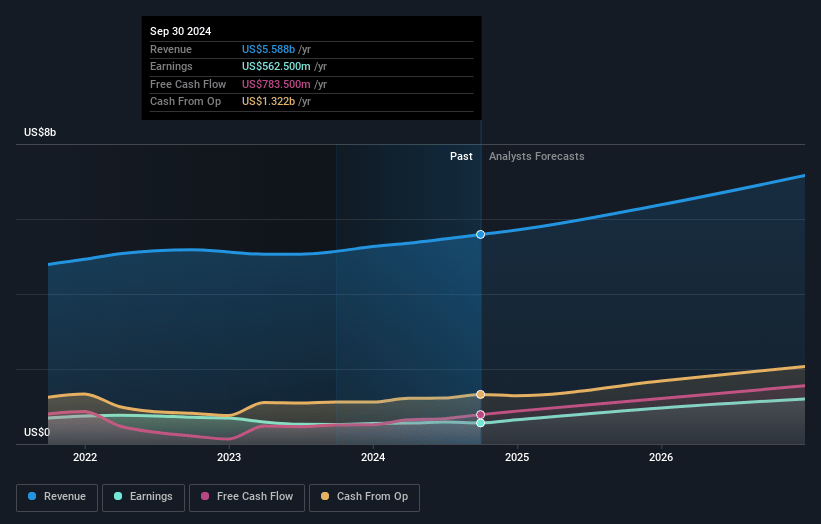

Equifax Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Equifax's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 17.1% in 3 years time.

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $10.44) by about April 2028, up from $604.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.4 billion in earnings, and the most bearish expecting $1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, down from 42.2x today. This future PE is greater than the current PE for the US Professional Services industry at 19.8x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

Equifax Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth is heavily dependent on the U.S. mortgage and hiring markets, which are currently experiencing declines, leading to a lower revenue growth forecast. (Impact: Revenue, Earnings)

- There is a significant risk related to foreign exchange impacts, which could negatively affect international revenue, as the strengthening U.S. dollar reduces revenue generated in foreign currencies. (Impact: Revenue, Earnings)

- High pricing in mortgage credit reports may lead to shifts in lender behaviors, such as using fewer credit bureaus or soft pulls, which could impact the company's market share and revenue from this segment. (Impact: Revenue)

- Decreases in government funding and changes in funding practices, such as CMS reducing reimbursement rates, could affect revenue growth in government sectors. (Impact: Revenue, Net Margins)

- Despite cloud initiatives, the expected margin expansion is lower than previously anticipated, potentially due to unexpected costs or slower cost reductions impacting overall profitability. (Impact: Net Margins, Earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $284.216 for Equifax based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $315.11, and the most bearish reporting a price target of just $250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.5 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of $205.5, the analyst price target of $284.22 is 27.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.