Narratives are currently in beta

Key Takeaways

- The North Star program and strong Merchant Services growth are set to boost Deluxe's earnings through cost efficiencies and strategic successes.

- Transitioning B2B payments to a recurring revenue model and expanding Data Solutions margins will stabilize revenues and enhance profitability.

- Declining revenues and high debt levels could hinder Deluxe's margins and growth, with risks tied to execution of the North Star program.

Catalysts

About Deluxe- Provides technology-enabled solutions to enterprises, small businesses, and financial institutions in the United States, Canada, and Australia.

- Deluxe anticipates significant long-term improvements from its North Star program, which is expected to generate $80 million in incremental adjusted EBITDA and $100 million in annualized free cash flow by 2026. This is likely to impact earnings positively as cost efficiencies and improved operational leverage are realized over the coming quarters.

- The Merchant Services segment has shown sustained growth and maintains a positive trajectory with a year-to-date growth rate of 7.4%, suggesting continued future revenue expansion despite near-term moderation. This is underpinned by a strong processing volume and strategic wins, which is forecasted to result in high single-digit revenue growth that can help to drive overall company revenue upwards.

- The B2B payments segment is on a recovery path, having moved back to year-over-year growth, with anticipated sequential improvement in Q4 driven by new customer wins and pipeline expansion. This segment's transition towards a more recurring revenue model is expected to stabilize revenues and support future earnings.

- Strong performance and adjusted EBITDA margin expansion in the Data Solutions segment indicate effective management of operating expenses and demand for marketing activities, positioning it for a return to growth. With margins expanding to 28.6%, this suggests potential for sustained high-margin revenue which will support net margins and overall profitability.

- Deluxe's commitment to debt reduction, having decreased net debt by $45 million, accompanied by solid free cash flow generation and improved leverage ratios, positions the company to enhance shareholder value and strengthen its financial health, contributing positively to future earnings and EPS growth.

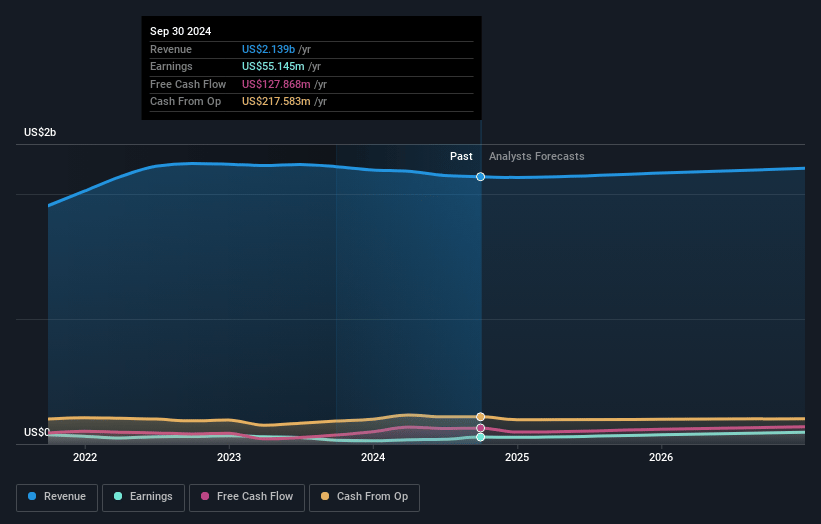

Deluxe Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Deluxe's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 5.0% in 3 years time.

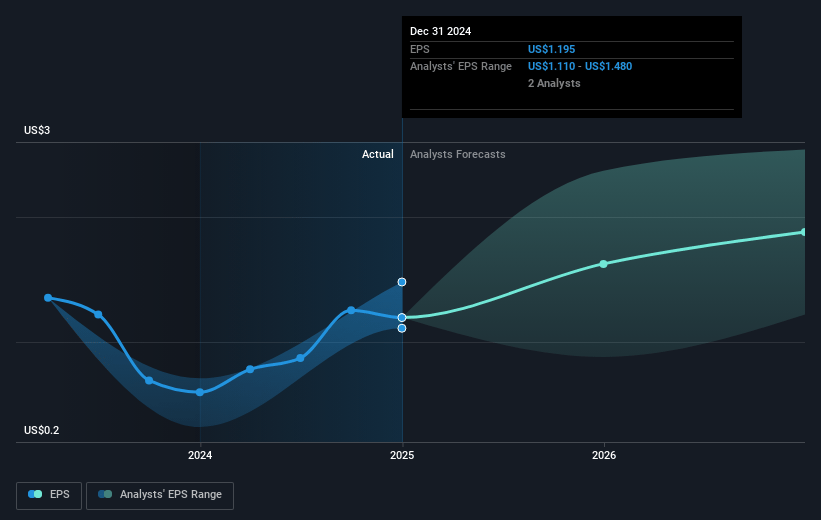

- Analysts expect earnings to reach $111.4 million (and earnings per share of $2.48) by about November 2027, up from $55.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $74.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2027 earnings, down from 18.3x today. This future PE is lower than the current PE for the US Commercial Services industry at 30.6x.

- Analysts expect the number of shares outstanding to grow by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.42%, as per the Simply Wall St company report.

Deluxe Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenue has been declining slightly year-over-year, which could indicate challenges in maintaining or growing sales, potentially impacting future revenue growth.

- The Print segment is experiencing secular declines and is expected to see low

- to mid-single-digit revenue decreases, which could affect overall revenue and operating margins.

- Data Solutions faced a tough comparison year-over-year, with a specific period revenue decline, potentially impacting long-term revenue growth if similar challenges persist.

- There is a reliance on the North Star program to achieve significant EBITDA improvements, and any execution risks or delays could impact the projected margin expansion and free cash flow.

- While free cash flow and net debt improvements are positive, there is a substantial amount of debt ($1.49 billion), and any changes in interest rates or credit conditions could impact net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.75 for Deluxe based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.2 billion, earnings will come to $111.4 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 9.4%.

- Given the current share price of $22.76, the analyst's price target of $30.75 is 26.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives