Key Takeaways

- Strong Australian segment performance and contract renewals in Canada offer revenue stability and growth opportunities.

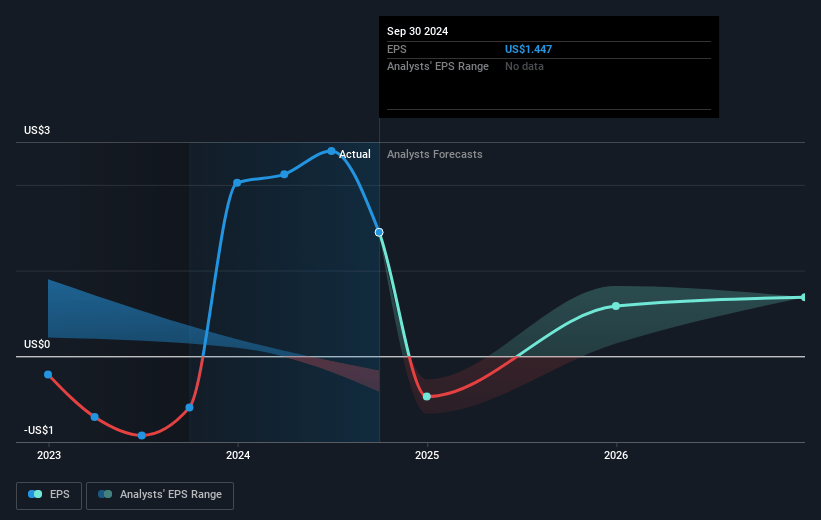

- Operational strategies, including capital allocation and cash flow improvements, are set to enhance EPS and shareholder value.

- Financial performance is impacted by Canadian segment challenges, commodity price volatility, and contract uncertainties, risking future revenue, margins, and earnings.

Catalysts

About Civeo- Provides hospitality services to the natural resource industry in Canada, Australia, and the United States.

- The Australian segment is performing well, with a goal to grow integrated services revenues to AUD 500 million by 2027, driven by competitive wins and expanded existing customer relationships. This is likely to positively impact revenue growth.

- A 33-month contract renewal with a major Canadian oil sands producer, expected to bring in CAD 150 million, provides revenue visibility through to 2027 and might stabilize future revenues.

- The expansion of the Australian integrated services business, backed by continued strong customer demand and competitive wins, should lead to incremental revenue increases.

- The completion of LNG-related mobile camp projects in Canada and contingency payments upon demobilization are improving cash flows, enabling a stronger free cash flow position.

- Operational flexibility and capital allocation plans, including a share repurchase program and maintaining prudent leverage ratios, could enhance EPS by returning capital to shareholders.

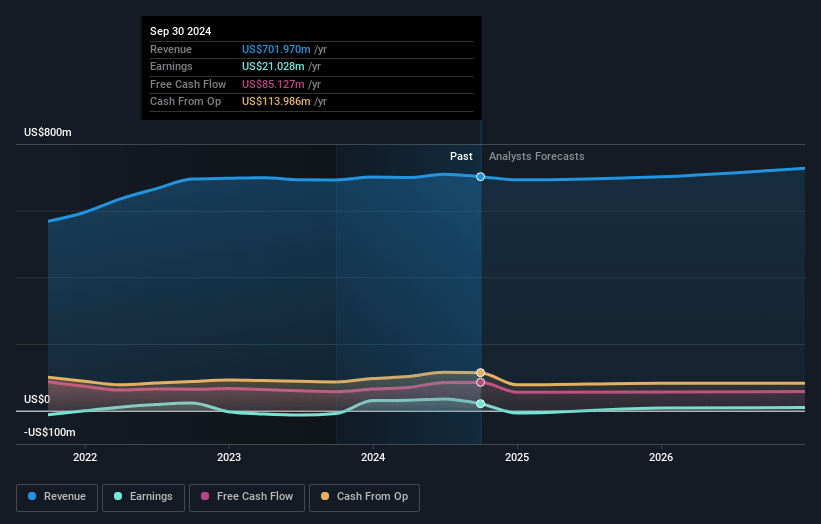

Civeo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Civeo's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.0% today to 0.9% in 3 years time.

- Analysts expect earnings to reach $6.8 million (and earnings per share of $0.53) by about January 2028, down from $21.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 70.3x on those 2028 earnings, up from 15.5x today. This future PE is greater than the current PE for the US Commercial Services industry at 32.1x.

- Analysts expect the number of shares outstanding to decline by 2.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Civeo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Canadian segment experienced a significant year-over-year decrease in revenue and adjusted EBITDA, driven by the wind-down of LNG-related activity and the sale of the McClelland Lake Lodge, impacting overall revenue and earnings.

- Canadian wildfires led to evacuations and delays, negatively affecting the third-quarter financial performance, which presents a risk to revenue and earnings if such disruptions continue or repeat.

- The reduction in Canadian revenues from $95.1 million to $57.7 million, alongside increased competition for contracts, may continue to exert pressure on net margins and future revenue growth.

- The company's financials are vulnerable to the volatility in commodity prices, particularly in the Australian segment, which could impact future revenue and adjusted EBITDA forecasts.

- There are uncertainties related to contract renewals and negotiations in Canada, and any pressure to reduce pricing could negatively impact future earnings and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.5 for Civeo based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $720.3 million, earnings will come to $6.8 million, and it would be trading on a PE ratio of 70.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $23.71, the analyst's price target of $32.5 is 27.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives