Key Takeaways

- Strong growth in civil, intelligence, and defense sectors driven by IT modernization and strategic support for geopolitical conflicts indicates future revenue and earnings expansion.

- Record backlog and cybersecurity's projected growth highlight an optimistic outlook for sustained financial stability and increased revenue.

- Political and market uncertainties may impact Booz Allen's revenue and profitability due to competition, geopolitical risks, and potential changes in government priorities.

Catalysts

About Booz Allen Hamilton Holding- Provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally.

- Booz Allen Hamilton is expected to benefit from strong demand in its civil portfolio, driven by IT modernization and transformation projects, leading to double-digit revenue growth and strong margins over the medium term. This impacts future revenue growth.

- The intelligence market shows a return to growth with increased revenue from technology-enabled solutions and cyber missions, positioning the company for significant growth in both the near and medium terms. This affects future revenue and earnings.

- The defense business continues to accelerate with 17% year-over-year revenue growth, driven by strategic support for geopolitical conflicts and modernization efforts, suggesting ongoing high demand and revenue expansion. This impacts future revenue and earnings.

- Cybersecurity is projected to be a major growth area, with anticipated revenue reaching up to $2.8 billion by the end of the fiscal year and plans to double in the next five years, contributing to future revenue and net margin increases.

- The company's backlog stands at a record $41 billion, indicating strong future demand and providing a robust foundation for sustained revenue growth and financial stability. This affects future revenue and earnings.

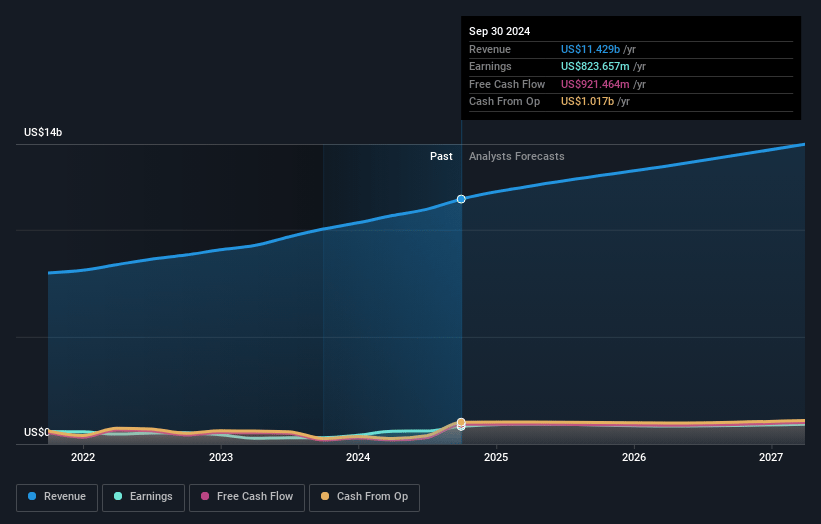

Booz Allen Hamilton Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Booz Allen Hamilton Holding's revenue will grow by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.2% today to 6.3% in 3 years time.

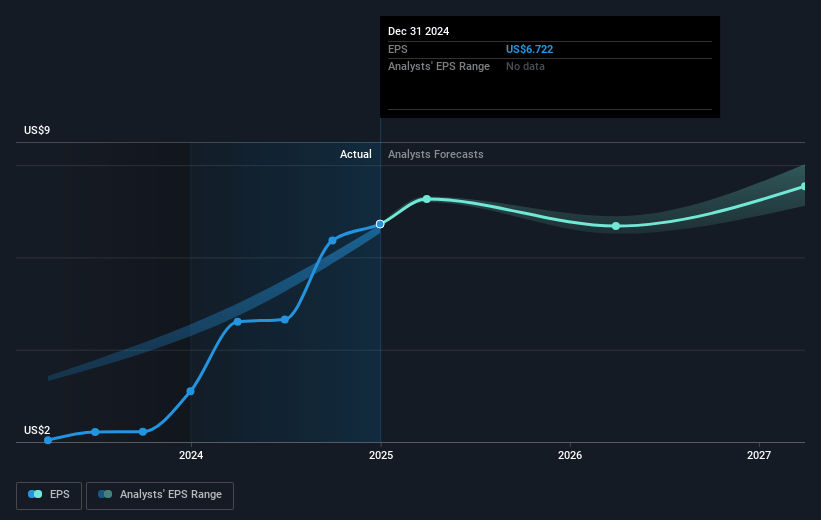

- Analysts expect earnings to reach $903.1 million (and earnings per share of $7.36) by about January 2028, up from $823.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, up from 20.0x today. This future PE is greater than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to decline by 1.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.65%, as per the Simply Wall St company report.

Booz Allen Hamilton Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Booz Allen Hamilton faces potential turbulence in demand and acquisition processes and increased price competition due to political season uncertainties, which could impact the company's revenue growth and net margins.

- The potential change in administration and political priorities could create reduced visibility and demand for Booz Allen's civil business, potentially impacting its revenue projections.

- Exposure to geopolitical conflicts and the reliance on defense and intelligence contracts could pose risks if these conflicts resolve, potentially resulting in a decrease in demand for Booz Allen's services, which would affect its future revenues and profits.

- There are uncertainties regarding the costs related to government audits and potential cash impacts of unresolved rate years, which may affect net income and cash flow projections.

- Increased competition and procurement disruption in the civil market could pose risks to revenue growth, as clients might demand more competitive pricing or alternative solutions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $156.62 for Booz Allen Hamilton Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $210.0, and the most bearish reporting a price target of just $135.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.4 billion, earnings will come to $903.1 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 6.6%.

- Given the current share price of $128.91, the analyst's price target of $156.62 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

SA

Sakura

Community Contributor

Benefiting From Cyber, 5G And AI In Defense And Civil

Benefiting From Cyber, 5G And AI In Defense And Civil (Rating Upgrade) U.S. Army plans to enlist tech contractors for AI development

View narrativeUS$106.90

FV

5.1% overvalued intrinsic discount-1.96%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

8 months ago author updated this narrative