Narratives are currently in beta

Key Takeaways

- Expansion in automated photo enforcement and new contracts is set to increase recurring revenue and drive future earnings growth.

- Strong free cash flow generation enables potential capital returns and strategic acquisitions, enhancing earnings per share.

- Revenue growth faces challenges due to natural disasters affecting travel, intense competition in key contracts, and transitions in business strategy impacting net margins.

Catalysts

About Verra Mobility- Provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe.

- Strong demand for automated photo enforcement is expected to drive recurring revenue growth, particularly through new contracts and legislative expansions, impacting revenue positively.

- Continuation of resilient travel demand, as indicated by TSA volume growth, is expected to boost RAC tolling revenue within the Commercial Services segment, contributing to overall revenue growth.

- Measures to stabilize and rejuvenate growth in the T2 Parking business, along with shifts towards software and mobile payment solutions, are expected to improve long-term revenue and potentially net margins.

- Winning contracts for new speed enforcement programs internationally and in the U.S., such as those in California, are expected to generate substantial incremental annual recurring revenue, which will positively impact future earnings.

- Record generation of free cash flow provides significant optionality for future capital allocation, potentially supporting share buybacks or M&A activities that could enhance earnings per share (EPS).

Verra Mobility Future Earnings and Revenue Growth

Assumptions

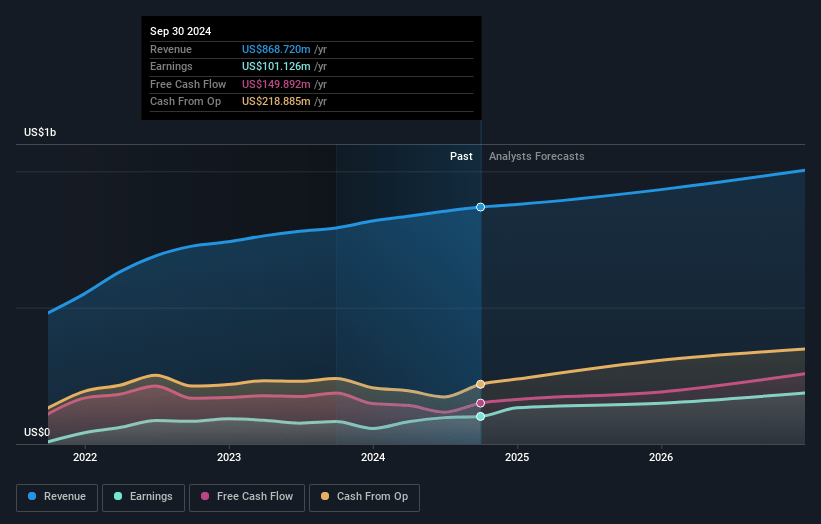

How have these above catalysts been quantified?- Analysts are assuming Verra Mobility's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.6% today to 20.9% in 3 years time.

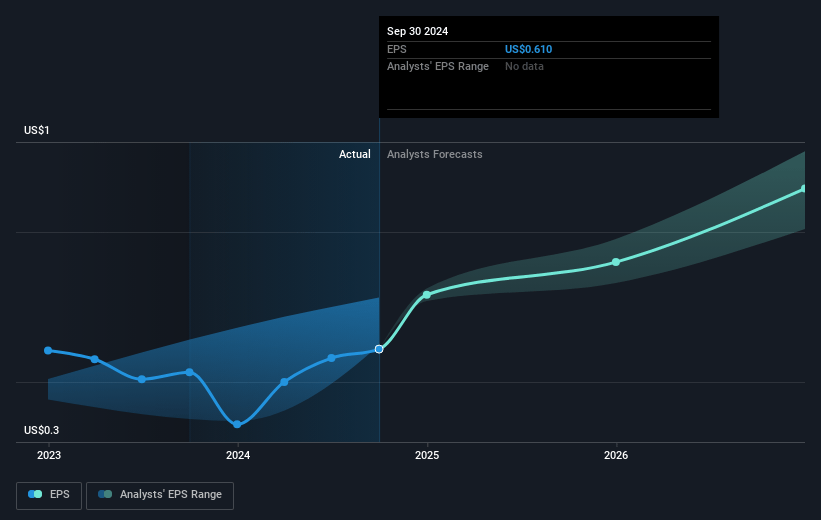

- Analysts expect earnings to reach $219.5 million (and earnings per share of $1.35) by about November 2027, up from $101.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.3x on those 2027 earnings, down from 37.5x today. This future PE is greater than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to decline by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.76%, as per the Simply Wall St company report.

Verra Mobility Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The deceleration in travel volumes due to natural disasters like hurricanes in September and October presents a revenue risk for Verra Mobility’s Commercial Services, impacting RAC tolling revenues negatively.

- The T2 Parking business faced revenue challenges, specifically a transition away from hardware towards software and mobile payment solutions, impacting short-term growth and potentially affecting segment revenue and net margins.

- The intense competition in the New York City automated enforcement RFP process presents a risk to securing this key contract, which could affect future revenue growth in the Government Solutions segment.

- Incremental costs, such as TAM execution and financial infrastructure investments, may lead to margin compression in 2025, indicating potential impacts on net margins and earnings.

- The anticipation of travel slowing to GDP-like growth rates in 2025 limits the upside potential for revenue growth in the Commercial Services segment, which could impact overall revenue growth expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.33 for Verra Mobility based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.0 billion, earnings will come to $219.5 million, and it would be trading on a PE ratio of 26.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $23.01, the analyst's price target of $29.33 is 21.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives