Narratives are currently in beta

Key Takeaways

- Upwork's AI innovation and strategic acquisitions are expected to boost platform efficiency, attract users, and drive revenue growth.

- Expanding partnerships and new client solutions enhance revenue potential, market share, and profitability through large enterprise market capitalization.

- Macroeconomic pressures, organizational changes, and reliance on new initiatives could challenge Upwork's revenue growth, efficiency, and profitability despite potential cost savings.

Catalysts

About Upwork- Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

- Upwork is focusing on AI innovation, such as the acquisition of AI-native search company Objective, aiming to enhance search and match capabilities and customer productivity. This is expected to drive growth in revenue by improving the platform's efficiency and attractiveness to users.

- The introduction and traction of the Business Plus plan, which serves larger clients more cost-effectively and with a higher take rate than traditional offerings, suggest increased revenue potential and improved margins from these client segments.

- Organizational changes, including a significant reduction in headcount, are expected to realize $60 million in annualized cost savings, which should positively impact net margins and overall profitability.

- Expanding partnerships, such as embedding Upwork technologies into third-party platforms like Lettuce and Ocoya, could lead to significant client acquisition at scale and cost-effective revenue growth, which might enhance revenue and market share.

- Upwork’s continued emphasis on Managed Services and enterprise solutions, using AI to expedite results, can capitalize on the large Enterprise Total Addressable Market (TAM), which could drive substantial growth in revenue and profitability.

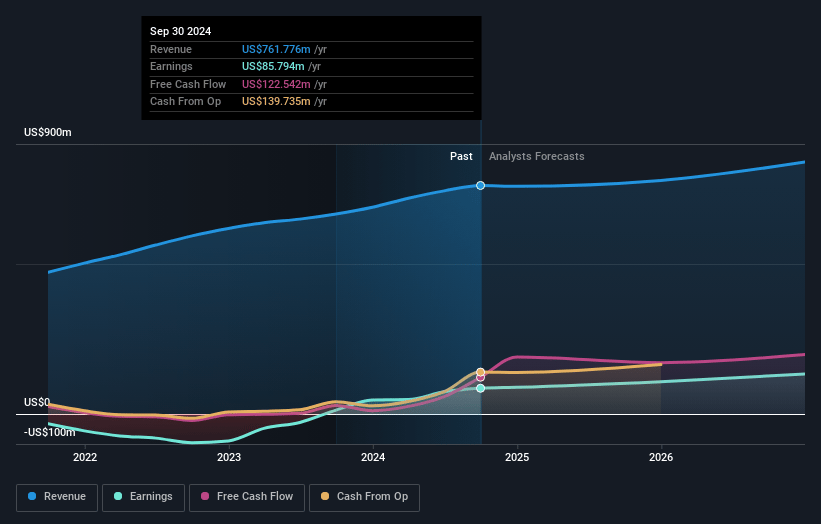

Upwork Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Upwork's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.3% today to 17.9% in 3 years time.

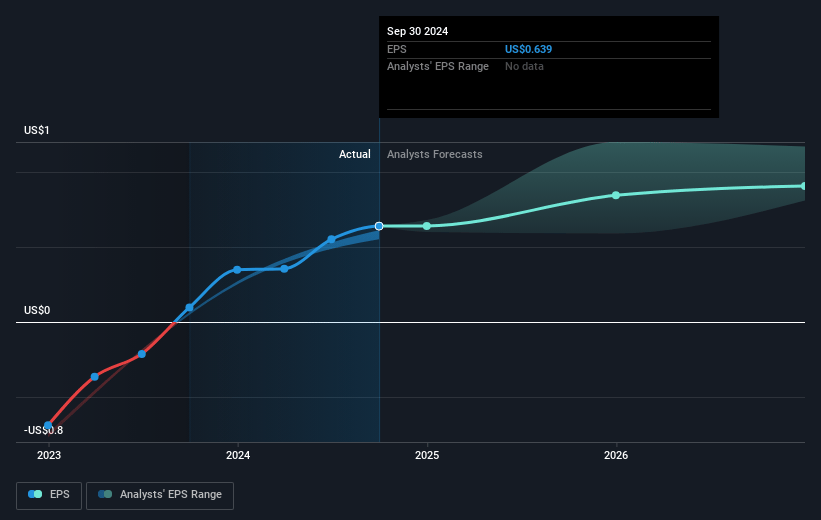

- Analysts expect earnings to reach $160.3 million (and earnings per share of $1.07) by about January 2028, up from $85.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $103.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, down from 26.8x today. This future PE is lower than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to grow by 3.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

Upwork Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenging macroeconomic environment, including low new tech job openings and inflationary pressures, could suppress demand and negatively impact revenue growth and GSV.

- The company's organizational changes, including a 21% reduction in headcount, may result in short-term disruptions and could impact operating efficiency despite the expected $60 million in annualized cost savings, potentially affecting net margins.

- Upwork acknowledges ongoing macroeconomic pressures and has expressed caution about top-line growth in coming quarters, which could result in stagnant or declining revenue.

- The reliance on relatively new revenue streams such as AI integration and Managed Services may carry execution risks, potentially affecting overall earnings if these initiatives do not perform as expected.

- While investments in AI and acquisitions might foster growth, they also come with the risk of not delivering expected synergies or returns, potentially impacting profitability and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.82 for Upwork based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $895.4 million, earnings will come to $160.3 million, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of $17.19, the analyst's price target of $18.82 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives