Key Takeaways

- TaskUs is leveraging strategic growth levers, including AI tools and geographic diversification, to drive revenue and expand its client base across industry verticals.

- Expanding specialized services and client relationships in high-growth sectors, TaskUs aims to improve earnings and enhance operational efficiency through significant investments.

- TaskUs faces risks from revenue concentration, competitive pricing pressure, geopolitical dependencies, and rising expenses impacting profitability and margin stability.

Catalysts

About TaskUs- Provides digital outsourcing services for companies in Philippines, the United States, India, and internationally.

- TaskUs is leveraging four strategic growth levers—taking share from competitors, cross-selling specialized services, diversifying client base and industry verticals, and deploying AI and automation tools—which are expected to drive future revenue growth and expansion.

- There is a focus on investing in and expanding specialized service lines like Trust and Safety and AI services, which are projected to continue double-digit revenue growth and positively impact earnings over time.

- TaskUs is capitalizing on geographic diversification, especially in Latin America, India, and the Philippines, which are demonstrating strong revenue growth and are expected to enhance net margins due to typically lower operating costs in these regions.

- The company is expanding relationships with large clients, particularly in high-growth sectors like generative AI and autonomous vehicles, which could substantially increase revenue contributions and support long-term earnings growth.

- Significant investments in sales and marketing, coupled with growth in complex service offerings, provide potential for sustained high-margin business, improving operational efficiency and positively affecting adjusted EBITDA margins.

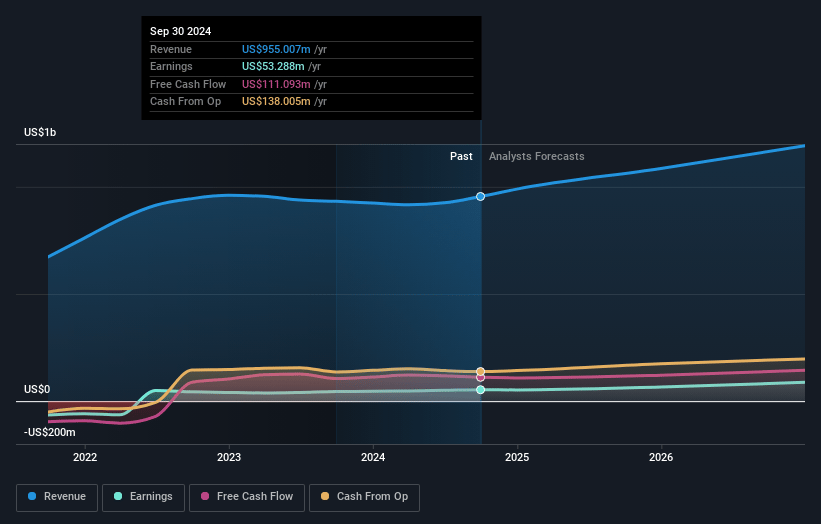

TaskUs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TaskUs's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.6% today to 7.9% in 3 years time.

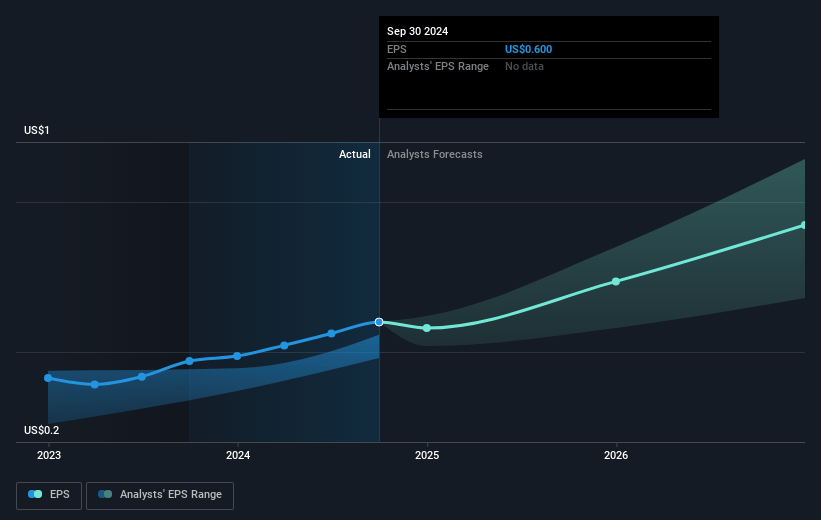

- Analysts expect earnings to reach $101.5 million (and earnings per share of $1.06) by about January 2028, up from $53.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $64 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, down from 28.2x today. This future PE is lower than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to grow by 2.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.65%, as per the Simply Wall St company report.

TaskUs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TaskUs's heavy reliance on its largest client, contributing 23% of total revenue, poses a risk of revenue concentration which can lead to volatility and unpredictability in future revenue streams if the relationship changes or dissolves.

- The ongoing investment in operations, specialized services, and AI tools, while strategic for growth, is expected to negatively impact margins in the near term, affecting overall profitability and net margins.

- Pricing pressure from larger competitors due to a competitive market environment could lead to reduced profitability and pressurize net income margins, especially in basic services which are easier to automate.

- High dependency on offshore revenue and the decline in U.S. delivery could expose TaskUs to geopolitical risks and foreign exchange fluctuations, impacting revenue stability and operating margins.

- The increased investment in facilities and workforce to accommodate growth expectations, while necessary, poses a risk of increased operating expenses that may outpace revenue growth, affecting net earnings in the short to medium term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.17 for TaskUs based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $101.5 million, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of $16.83, the analyst's price target of $18.17 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

NA

NateF

Community Contributor

TASK Market Outlook

Digital outsourcing company that provides next-generation customer experience and back-office support for innovative and disruptive technology Sector: Technology Industry: Business Process Outsourcing (BPO) Market Capitalization: $1.5b (Small-cap) Major Competitors: Its competitors range from large, diversified BPO providers to smaller, niche players specializing in customer experience (CX), back-office support, and digital transformation. Below are TaskUs’s major and direct competitors: Teleperformance: A global leader in outsourced CX management and back-office services.

View narrativeUS$18.93

FV

24.1% undervalued intrinsic discount9.80%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

3users have followed this narrative

about 1 month ago author updated this narrative