Narratives are currently in beta

Key Takeaways

- Implementation of new technology platforms is expected to boost efficiency, reduce costs, and improve revenues and margins.

- Diversified services and a holistic client approach aim to enhance client retention and sustain revenue growth and margins over time.

- Reliance on Europe and Asia-Pacific for growth may pose risks due to macroeconomic and geographic challenges, potentially impacting revenue stability and earnings.

Catalysts

About Resources Connection- Engages in the provision of consulting services to business customers under the Resources Global Professionals (RGP) name in North America, the Asia Pacific, and Europe.

- The successful implementation of a new technology platform in North America, including Workday Financials and Salesforce, is expected to increase operational efficiency, streamline processes, and accelerate the speed to market, which can positively impact revenue and net margins by reducing costs and improving service delivery.

- Diversified service offerings, including professional staffing, consulting, and outsourcing, position RGP as a flexible partner capable of meeting various client needs, which can enhance revenues and client retention, thereby potentially improving net margins through economies of scale and cross-selling opportunities.

- Growth in consulting capabilities, particularly in finance transformation, digital transformation, and supply chain modernization, along with higher bench utilization and billing rates, indicate potential for increased revenue and earnings growth as the company addresses evolving client demands.

- The company's focus on expanding client relationships through a holistic service approach is expected to deepen trust and lead to long-term collaborations, which can result in sustained revenue growth and improved net margins over time as client loyalty increases.

- RGP's strong financial position, with significant cash reserves and a focus on stock buybacks, reflects confidence in future growth and can contribute to enhanced earnings per share, as excess capital is utilized to return value to shareholders.

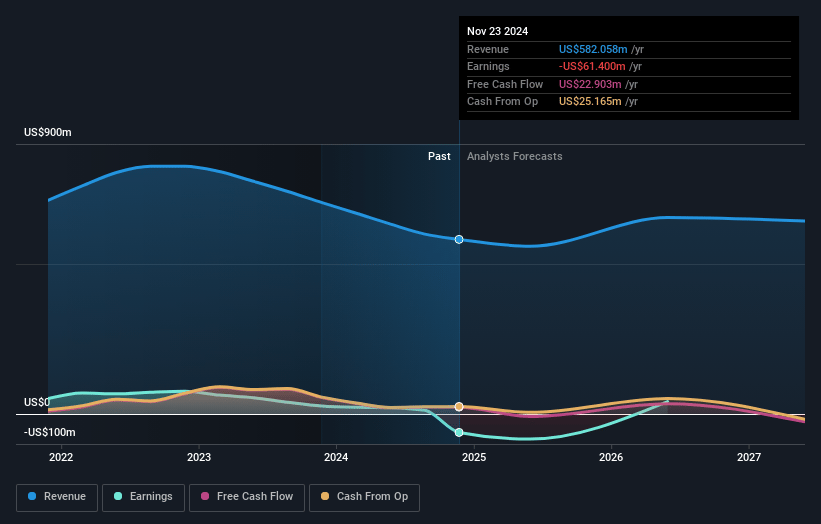

Resources Connection Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Resources Connection's revenue will grow by 6.0% annually over the next 3 years.

- Analysts are not forecasting that Resources Connection will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Resources Connection's profit margin will increase from -10.5% to the average US Professional Services industry of 6.1% in 3 years.

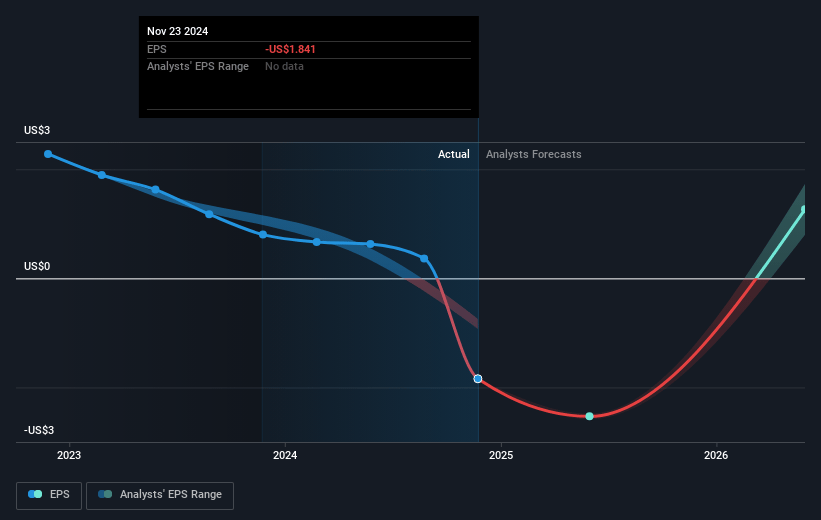

- If Resources Connection's profit margin were to converge on the industry average, you could exepct earnigns to reach $42.3 million (and earnings per share of $1.37) by about January 2028, down from $-61.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, up from -4.6x today. This future PE is lower than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to decline by 1.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

Resources Connection Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on Europe and Asia-Pacific segments for growth may pose risks due to potential macroeconomic challenges and geographic complexities, potentially impacting revenue stability.

- Despite reporting sequential improvements, the company faces competitive pricing pressures and talent shortages, especially internationally, which could affect net margins and bench utilization adversely.

- Revenue for key segments like On-Demand has declined significantly year-over-year, indicating potential vulnerabilities in sustaining growth and affecting overall earnings.

- A noncash goodwill impairment charge was recorded due to a drop in market capitalization and delayed recovery in business performance, which may suggest potential risks to financial outlook and earnings stability.

- The company has executed a reduction in force recently, which may indicate cost-saving pressures that could impact operational efficiency and future SG&A expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.12 for Resources Connection based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $693.6 million, earnings will come to $42.3 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $8.49, the analyst's price target of $13.12 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives