Narratives are currently in beta

Key Takeaways

- Investment in AI and technology aims to boost client engagement and revenue growth through enhanced product penetration and customer adoption.

- Strategic expansion in sales, digital offerings, and risk management is positioned to bolster market share, client retention, and sustained earnings growth.

- Macroeconomic challenges, healthcare inflation, and moderated job growth could pressure revenue growth, with healthcare cost management and disciplined growth as mitigating factors.

Catalysts

About Paychex- Provides integrated human capital management solutions (HCM) for payroll, benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

- Paychex is investing in AI and technology enhancement, such as Paychex Recruiting Copilot and HR Analytics solutions, to better serve clients in a competitive labor market. These new solutions can drive increased client engagement and potentially enhance revenue growth through higher product penetration and customer adoption.

- The expansion in advertising and sales efforts, specifically in PEO and middle-market HCM sectors, is expected to improve awareness and adoption of Paychex's comprehensive suite of HR and technology solutions, potentially boosting revenue and market share.

- The introduction of digital marketplace offerings like Paychex Flex Perks aims to increase employee and client engagement by providing accessible employee benefits at no extra cost to employers, which could enhance client retention, open new revenue streams, and support sustainable revenue growth.

- Improved client retention rates, higher than pre-pandemic levels, and the strategic focus on acquiring and retaining high-value clients in the HR outsourcing space suggest better net margins and stable revenue in the future.

- Paychex's disciplined risk management in their PEO insurance offerings, including choices that favor low-risk revenue, and leveraging a vast data set with AI for better business insights promise operational efficiencies and might result in sustained earnings growth.

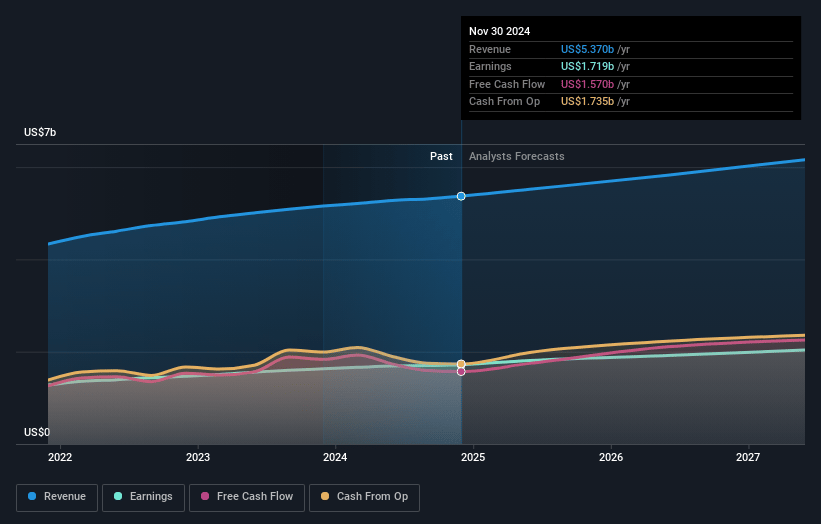

Paychex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Paychex's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 32.0% today to 33.4% in 3 years time.

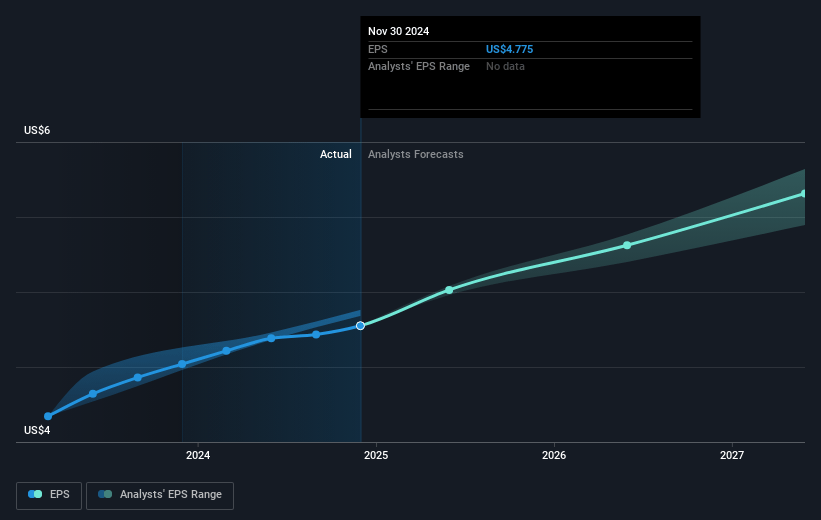

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $5.9) by about January 2028, up from $1.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.4x on those 2028 earnings, down from 30.9x today. This future PE is greater than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Paychex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expiration of the ERTC program has created a headwind to revenue growth, impacting overall revenue performance in the short term.

- Health insurance enrollment in Florida was flat year-over-year, and employees are opting for lower-cost health plans, creating a headwind to pass-through revenue without affecting earnings.

- The pace of U.S. job growth has moderated, and while small and mid-size businesses remain generally optimistic, this could potentially slow revenue growth if hiring intentions do not translate into action.

- Rising PEO direct insurance costs due to health care inflation may put pressure on net margins, although this is being managed through disciplined growth and cost control measures.

- The macroeconomic environment, including inflation impacting client and employee behavior, could affect future revenue growth if clients and their employees continue to seek cost savings over comprehensive service adoption.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $139.47 for Paychex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of just $120.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.4 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 28.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of $147.48, the analyst's price target of $139.47 is 5.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives