Key Takeaways

- Dependence on a few large clients and unpredictable onboarding cycles exposes Innodata to volatile revenue and delayed earnings, despite a growing AI services market.

- Rising automation, regulatory pressures, and competitive threats could limit margin expansion and future growth even with ongoing investment in proprietary platforms.

- Heavy reliance on a single customer, disruptive AI advances, industry competition, regulatory hurdles, and slow platform scaling together threaten future earnings stability and market position.

Catalysts

About Innodata- Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

- Although Innodata is benefitting from a surge in demand for high-quality generative AI training data and is onboarding major global technology and enterprise customers, the company remains highly exposed to customer concentration risk, with significant revenue volatility tied to a small group of large clients—this could lead to unpredictable revenue streams and hinder long-term stability even as the overall market for AI services expands.

- While the explosion of global data volumes and increasing enterprise digital transformation theoretically expand Innodata’s total addressable market, rapid advances in automation and generative AI tools risk reducing future demand for outsourced data annotation and labeling—undermining revenue growth as clients potentially internalize these tasks or require less manual intervention.

- Despite ongoing investments in proprietary AI and automation platforms—which have started to drive higher-margin business and new productized offerings—material cost increases are still likely in order to keep pace with evolving client AI expectations and escalating regulatory requirements, which could cap margin expansion and eventually compress profitability as the industry matures.

- Although Innodata’s pipeline includes high-potential, recurring trust and safety and agentic AI projects that point to future growth, onboarding cycles for new large customers remain uncertain and slow; clients may require lengthy trial periods before ramping up spend, introducing delays and making it difficult to quickly translate pipeline into higher realized earnings.

- While recent results show exceptional revenue and cash growth, quarter-to-quarter topline trends are already uneven and management has signaled upcoming margin impacts due to upfront investment—if customer demand for large, bespoke projects ebbs or competition for big tech clients intensifies, net margins and long-term earnings growth could face sustained headwinds even as secular AI adoption continues.

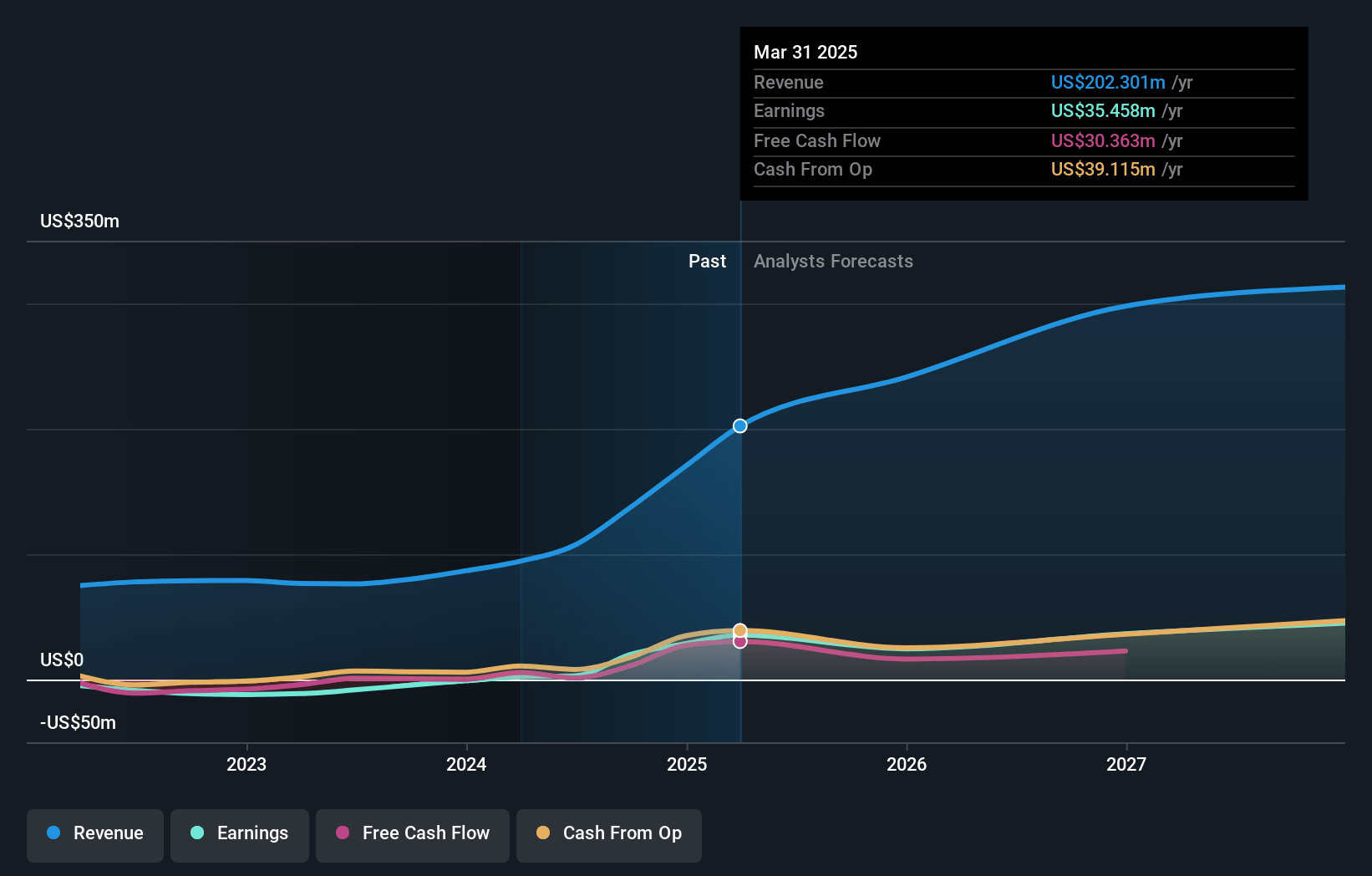

Innodata Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Innodata compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Innodata's revenue will grow by 19.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 17.5% today to 13.7% in 3 years time.

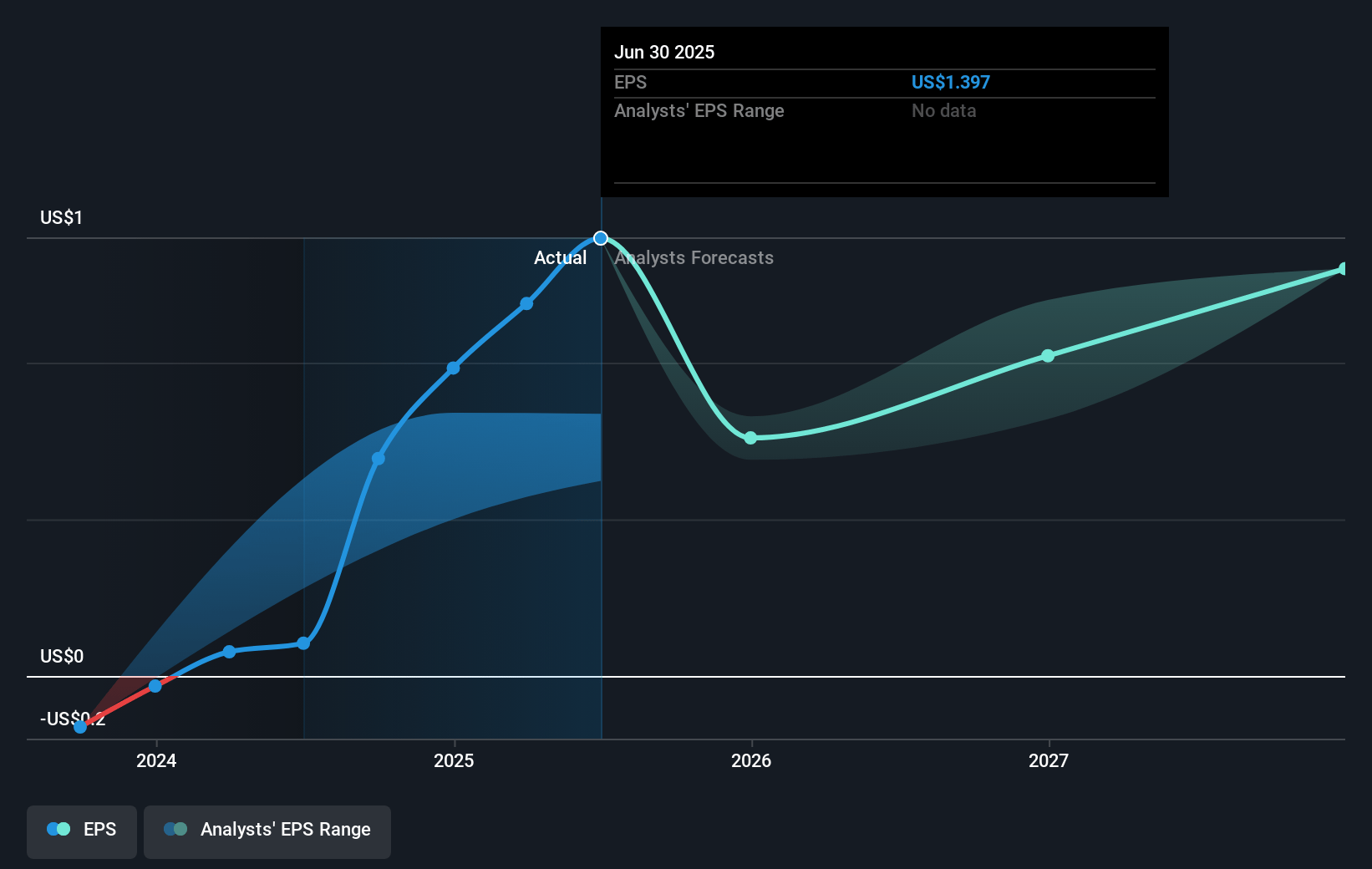

- The bearish analysts expect earnings to reach $46.9 million (and earnings per share of $1.3) by about July 2028, up from $35.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 53.9x on those 2028 earnings, up from 41.6x today. This future PE is greater than the current PE for the US Professional Services industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Innodata Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company continues to depend heavily on its largest customer, with management explicitly choosing to embrace customer concentration and acknowledging quarter-to-quarter revenue volatility as a result, exposing future revenues and earnings to significant risk in the event of client churn or budget shifts.

- Rapid automation and advances in generative AI could reduce the long-term need for external data labeling and annotation services, which would directly threaten Innodata’s foundational business model and pressure both revenues and net margins.

- Intensifying competition and ongoing price pressure in the data annotation and AI services industry, including the risk of large tech companies internalizing more of these capabilities or consolidation among larger competitors, could erode Innodata's pricing power and compress long-term gross margins.

- Scaling up recurring platform revenue, especially around trust and safety evaluation products, requires considerable R&D investment and technological breakthroughs; failure to extend differentiated proprietary AI capabilities may slow the company’s move up the value chain and limit future earnings growth.

- Innodata's international operations, especially with regards to data privacy, face growing regulatory complexities as global laws such as GDPR and CCPA become more stringent, increasing compliance costs and potentially disrupting revenue streams from cross-border data projects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Innodata is $55.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Innodata's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $341.7 million, earnings will come to $46.9 million, and it would be trading on a PE ratio of 53.9x, assuming you use a discount rate of 6.6%.

- Given the current share price of $46.43, the bearish analyst price target of $55.0 is 15.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives