Key Takeaways

- Increased demand in user experience, product development, and life sciences may drive future revenue growth.

- Expansion in AI and advanced tech expertise signals potential long-term earnings growth through portfolio diversity.

- Persistent challenges in the chemical sector, recruitment issues, and income variability may hinder Exponent's revenue and profitability growth, affecting investor confidence.

Catalysts

About Exponent- Operates as a science and engineering consulting company in the United States and internationally.

- The increased demand for user experience studies, product development consulting in consumer electronics, and growth opportunities intersecting electronics and life sciences indicate potential future revenue growth.

- Exponent's strategic alignment of resources and focus on recruitment for sequential headcount growth in each quarter of 2025 suggests potential for sustainably increasing net revenues in line with rising market demand.

- The proactive engagements and expertise in risk-related work in utilities may drive net margin growth due to increased client dependence on ongoing regulatory and climate change challenges.

- Efforts to capitalize on infrastructure disputes across wind, solar, and large-scale energy storage indicate future revenue growth potential, as Exponent leverages its leading market position in regulatory, safety, and performance challenges.

- The focus on growing their team and expanding multidisciplinary expertise in high-demand areas like artificial intelligence and advanced technology highlights potential for long-term earnings growth, driven by an increasing portfolio diversity and stability.

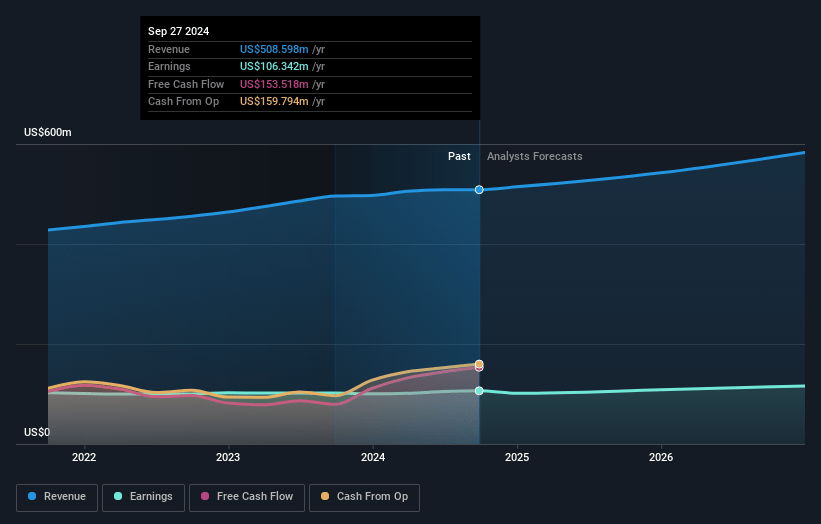

Exponent Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Exponent's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.9% today to 19.7% in 3 years time.

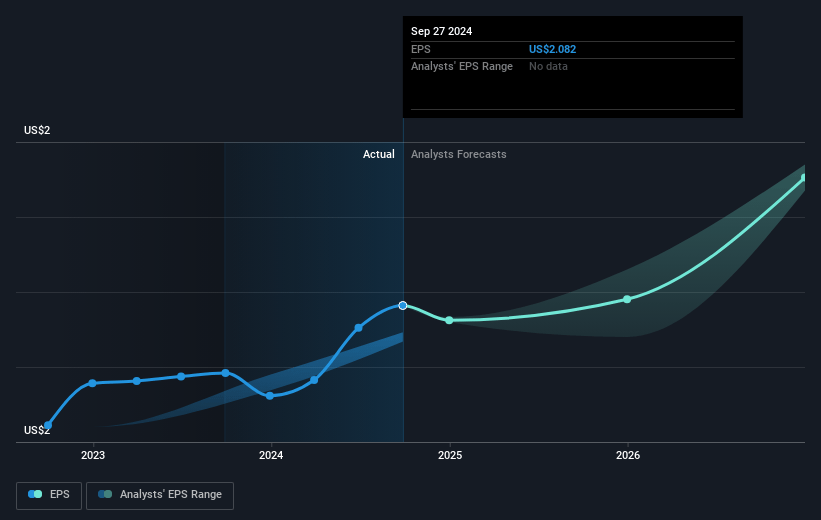

- Analysts expect earnings to reach $119.4 million (and earnings per share of $2.29) by about January 2028, up from $106.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 60.7x on those 2028 earnings, up from 44.1x today. This future PE is greater than the current PE for the US Professional Services industry at 25.1x.

- Analysts expect the number of shares outstanding to grow by 0.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Exponent Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent headwinds in the chemical sector, including significant restructuring among major companies, could lead to clients moderating near-term litigation budgets and regulatory work, potentially impacting Exponent's revenue growth.

- Reactive work is facing moderated activity due to the completion of significant litigation projects, which might slow revenue and profit growth in the short term, especially given the high benchmarks of previous years.

- The decrease in headcount and the associated challenges in strategic recruitment efforts could constrain Exponent's ability to meet market demand, affecting revenue growth prospects if utilization rates cannot be sustained.

- Lower revenues in the environmental and health segment due to chemical and life sciences sector headwinds may continue to drag on overall growth, potentially impacting net margins.

- The variability in miscellaneous income, such as the decrease due to the loss of a tenant in Menlo Park, could introduce additional volatility in earnings, affecting overall profitability and potentially investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.0 for Exponent based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $606.8 million, earnings will come to $119.4 million, and it would be trading on a PE ratio of 60.7x, assuming you use a discount rate of 6.3%.

- Given the current share price of $92.46, the analyst's price target of $116.0 is 20.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives