Narratives are currently in beta

Key Takeaways

- Recent acquisitions and strategic investments in operations and technology are expected to drive revenue growth and improve operating efficiencies.

- Infrastructure developments and segment optimizations aim to increase waste processing capacity and support EBITDA growth.

- Declining landfill volumes, unexpected expenses, regulatory costs, a high tax rate, and operational challenges are impacting Casella Waste Systems' earnings and revenue growth projections.

Catalysts

About Casella Waste Systems- Operates as a vertically integrated solid waste services company in the United States.

- The company's recent acquisitions, including the entry into the Hudson Valley with Royal, provide opportunities for landfill internalization and targeting commercial and institutional customers. This is expected to drive revenue growth from acquired businesses and organic sales growth.

- Strategic investments in frontline operations, automation, and Power BI tools are improving safety, efficiency, and employee retention. These are expected to increase net margins by reducing costs and improving operating efficiencies.

- The Resource Solutions segment, including recycling and processing facilities like the Boston MRF and upcoming Willimantic facility, will benefit from equipment upgrades and higher commodity prices. This is set to boost revenue and net margins as production, throughput, and material recovery improve.

- Ongoing development of the rail-served McKean landfill and expansion approvals, like Juniper Ridge, aim to increase waste processing capacity. These infrastructure developments are critical for future revenue growth and maintaining competitive positioning in waste management.

- Efforts to integrate and optimize acquisitions while ramping up landfill internalization and exploring additional rail transfer opportunities are expected to support EBITDA growth and enhance operational margins.

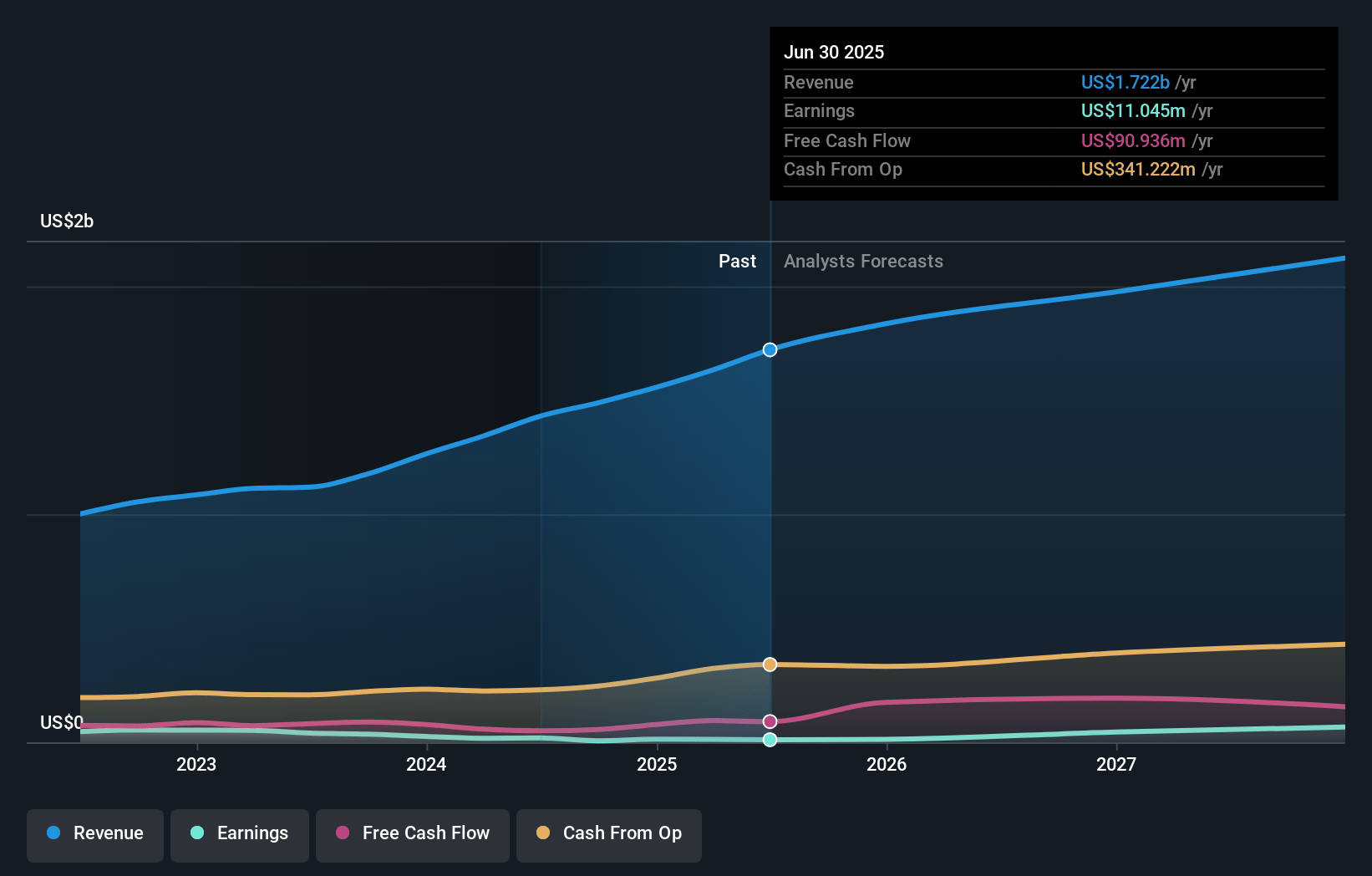

Casella Waste Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Casella Waste Systems's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.5% today to 6.9% in 3 years time.

- Analysts expect earnings to reach $139.3 million (and earnings per share of $2.25) by about January 2028, up from $6.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.5x on those 2028 earnings, down from 984.4x today. This future PE is greater than the current PE for the US Commercial Services industry at 32.1x.

- Analysts expect the number of shares outstanding to decline by 0.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Casella Waste Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in construction and demolition (C&D) landfill volumes has posed a consistent headwind, impacting revenue and margins at Casella Waste Systems. If this trend continues, it could adversely affect earnings.

- Unexpected insurance expenses from discrete events materially impacted quarterly results, which could lead to variability in future margins if similar events recur.

- Higher post-closure costs related to stringent regulatory requirements at the Southbridge landfill, including increased well monitoring and testing for emerging contaminants, are exerting pressure on net margins.

- The company's high effective tax rate, which is above the statutory rate due to nondeductible expenses and discrete items, is reducing net income, thus impacting earnings.

- The closure of the Brookhaven landfill has created volume challenges in the C&D market, and the timeline for market normalization remains uncertain, potentially affecting revenue growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $115.18 for Casella Waste Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $96.64.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $139.3 million, and it would be trading on a PE ratio of 62.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of $106.49, the analyst's price target of $115.18 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives