Last Update27 Sep 25Fair value Decreased 4.19%

Concentrix's consensus price target was modestly reduced to $64.83 as analysts factor in compressed valuation multiples from AI-related investor uncertainty and secular headwinds—rather than fundamental weakness—while maintaining confidence in growth reacceleration and strong business fundamentals.

Analyst Commentary

- Compressed valuation multiples attributed to investor uncertainty over the impact of artificial intelligence on labor-intensive business models and broader secular headwinds, not due to fundamental company weakness.

- Expectation of growth reacceleration as the effects of secular headwinds normalize.

- Confidence in the company's ability to monetize artificial intelligence solutions as ramp-up progresses.

- Bullish analysts raising price targets following updates to forecasts and Q3 earnings previews.

- Continued positive ratings supported by underlying business fundamentals and resilient performance.

What's in the News

- Concentrix's Board declared a quarterly dividend of $0.36 per share payable to shareholders of record at the close of business on October 24, 2025.

- The company repurchased 800,000 shares for $42.2 million between June 1 and August 31, completing the buyback of 6,138,578 shares for $458.87 million under the current program.

- Fiscal 2025 guidance projects Q4 reported revenue of $2.525–$2.550 billion and full-year revenue of $9.798–$9.823 billion, with operating income expected at $163–$173 million for Q4 and $627–$637 million for the year.

- Launched the Agentic Operating Framework to address AI pilot failures, offering end-to-end AI services and reporting measurable client gains, such as $150 million in new revenue and $45.8 million in cost savings for a leading North American airline.

- Released a new version of iX Hero, adding Harmony for natural speech and Clarity for noise suppression, resulting in substantial improvements in Communication and Net Promoter Scores, and scaling deployment globally.

Valuation Changes

Summary of Valuation Changes for Concentrix

- The Consensus Analyst Price Target has fallen slightly from $67.67 to $64.83.

- The Net Profit Margin for Concentrix has significantly fallen from 4.82% to 3.40%.

- The Future P/E for Concentrix has significantly risen from 10.13x to 12.90x.

Key Takeaways

- Integrating AI solutions and iX Hello products is expected to drive revenue growth and earnings by enhancing client offerings and operational efficiency.

- The Webhelp acquisition synergies, capital allocation, and share repurchases aim to improve margins and EPS, supporting profitability and shareholder returns.

- Concentrix's growth and profitability are at risk due to modest revenue growth, integration challenges, currency risks, high debt, and client concentration issues.

Catalysts

About Concentrix- Designs, builds, and runs integrated customer experience (CX) solutions worldwide.

- Concentrix is focusing on integrating AI solutions across its operations and client offerings, which is expected to drive revenue growth as it becomes a trusted provider for AI solutions in the market. The adoption of its GenAI platforms is positioned to increase revenue by expanding the share of wallet with current clients.

- The company is monetizing its iX Hello products, designed to be accretive to earnings by the end of fiscal 2025. The transition from pilot phases to deployments is expected to positively impact earnings growth.

- Concentrix is experiencing revenue growth from partner consolidation. By expanding its business solutions and becoming a leading provider of integrated AI and business services, it is positioned to capture more client spending, impacting revenue and potentially improving net margins due to increased efficiency.

- The synergies from the Webhelp acquisition and integration are expected to yield margin expansion, with anticipated savings boosting non-GAAP operating margins over time. This contributes to both profitability and cash flow improvements.

- Concentrix’s capital allocation strategy involves share repurchases, which are likely to enhance EPS as the company takes advantage of perceived undervaluation. This strategy also includes investing for long-term growth while managing debt, enhancing net margins, and maintaining shareholder returns.

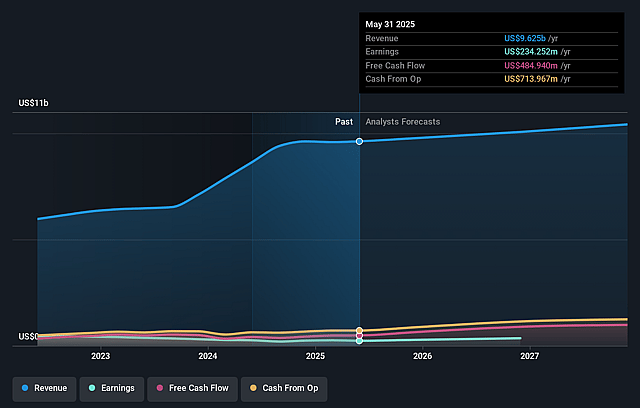

Concentrix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Concentrix's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 4.8% in 3 years time.

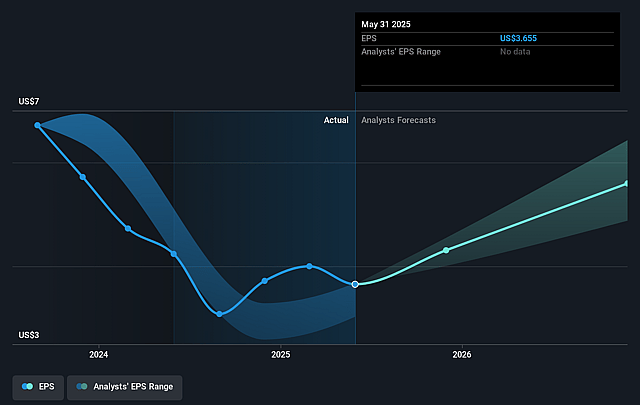

- Analysts expect earnings to reach $509.6 million (and earnings per share of $8.19) by about September 2028, up from $234.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, down from 14.4x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 2.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.22%, as per the Simply Wall St company report.

Concentrix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Although Concentrix experienced a modest revenue growth of 1.3% year-over-year, a low growth rate could indicate potential challenges in maintaining or accelerating revenue growth, particularly if macroeconomic conditions do not improve, impacting future revenues.

- The pressure to integrate and harmonize Webhelp's operations and synergies could lead to increased costs and potential disruptions if not managed effectively. This could impact operating margins and net income if anticipated synergies are not realized timely.

- Concentrix faces potential currency exchange rate risks, with ongoing revenue guidance assuming up to a 135 basis point negative impact on full-year results. This could affect both reported revenues and net earnings.

- The company has a significant debt burden, with total debt standing at $4.9 billion. Rising interest rates or refinancing challenges could increase interest expenses, affecting net income and cash flow available for dividends or reinvestment.

- Dependence on a limited number of top clients, whose revenue growth outpaces the rest of the business, presents concentration risk. Any downturn in a major client's business could materially affect Concentrix's revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $67.667 for Concentrix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $61.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.6 billion, earnings will come to $509.6 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 10.2%.

- Given the current share price of $53.56, the analyst price target of $67.67 is 20.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.