Narratives are currently in beta

Key Takeaways

- Focus on customer experience and production efficiency is expected to improve revenue, customer retention, and net margins through cost reduction.

- Expansion into complex and growing product categories aims to boost revenue and increase customer lifetime value, especially among small and medium-sized businesses.

- Challenges in profitability and financial flexibility, despite growth investments, due to product mix shifts, increased working capital outflows, and market fluctuations, impacting margins and earnings.

Catalysts

About Cimpress- Provides various mass customization of printing and related products in North America, Europe, and internationally.

- Continuous improvement in customer experience, efficiency, quality, and delivery speed across the value chain is expected to increase long-term revenue and improve net margins through reduced costs and better customer retention.

- Expansion into complex product categories such as flexible and corrugated packaging, which are growing at over 25% a year, is anticipated to boost revenue and increase the lifetime value of customers, particularly from small

- and medium-sized businesses.

- The modernization of Vista's technology, product development, and rebranding efforts is expected to enhance customer experience and attract higher-value clients, potentially improving revenue growth and net margins.

- Strategic integration of capabilities and cross-segment collaboration, such as increased cross Cimpress fulfillment, is likely to enhance production efficiency and lower costs, positively impacting net margins.

- Share repurchase programs at attractive price multiples are intended to return value to shareholders and increase earnings per share (EPS), driven by a belief in the company’s undervalued market position and robust cash flow generation.

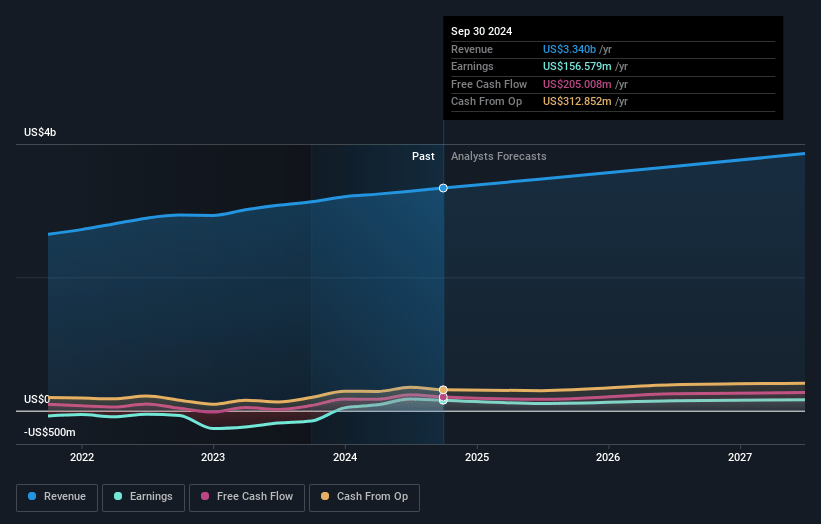

Cimpress Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cimpress's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.7% today to 4.4% in 3 years time.

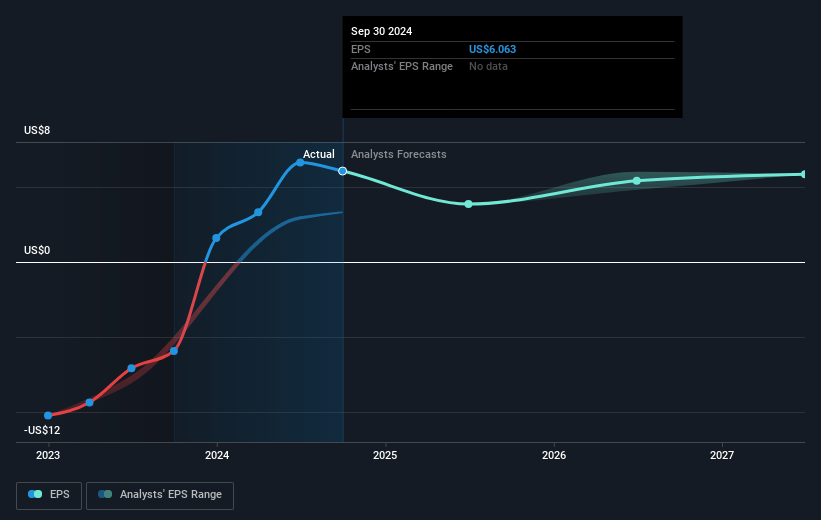

- Analysts expect earnings to reach $173.1 million (and earnings per share of $6.14) by about January 2028, up from $156.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, up from 11.7x today. This future PE is lower than the current PE for the US Commercial Services industry at 32.1x.

- Analysts expect the number of shares outstanding to grow by 3.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.55%, as per the Simply Wall St company report.

Cimpress Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's adjusted EBITDA declined slightly year-over-year in Q1, despite solid revenue growth, which suggests challenges in translating revenue growth into profitability. This could impact earnings.

- There were higher outflows from working capital compared to the previous year, including increased cash interest payments, which negatively impacted free cash flow. This could impact net margins.

- Although the company has been executing improvements and investing in growth, they noted headwinds, such as pressure on gross margins due to product mix changes like a decline in high-margin business card sales. This could affect future profitability.

- The plan to maintain leverage while investing heavily in share buybacks and growth investments may limit financial flexibility and increase risk if market conditions worsen. This could impact earnings and financial stability.

- The company highlighted concerns about market fluctuations and potential dampening effects on demand due to fewer selling days between American Thanksgiving and Christmas, plus the U.S. election, which could impact revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $114.5 for Cimpress based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.9 billion, earnings will come to $173.1 million, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 9.5%.

- Given the current share price of $72.85, the analyst's price target of $114.5 is 36.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives