Key Takeaways

- Anticipated resolution of delays and the initiation of large projects are expected to drive strong future revenue growth.

- Strategic acquisitions and focus on operational efficiencies aim to lower costs and enhance earnings growth, supporting market expansion and portfolio diversification.

- Delays and acquisition risks may impact revenue stability and margins, while increased leverage could strain earnings if cash flow does not support debt needs.

Catalysts

About CECO Environmental- Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions worldwide.

- CECO Environmental expects significant revenue recovery in future quarters due to the resolution of customer-driven delays and the initiation of larger projects, which were previously stalled. This resolution is anticipated to boost revenue figures as these projects commence and advance through Q4 2024 and into 2025.

- The company achieved record-breaking new orders, with over $160 million in Q3 alone and expectations of more than $100 million in October. This impressive bookings momentum and expanded backlog, which surpassed $438 million, implies strong future revenue growth prospects.

- CECO's ongoing M&A strategy, aiming to expand market reach and diversify its portfolio, includes acquisitions such as WK Group and Profire Energy. These strategic moves are anticipated to unlock new industrial and geographical markets, enhancing revenue channels and potentially boosting overall earnings.

- Anticipated synergies from the Profire Energy acquisition, such as cost reductions and operational efficiencies, are expected to lower the EBITDA multiples from around 9 times to between 7 and 7.5 times, thus positively impacting net margins and earnings growth.

- CECO's focus on operational excellence, including portfolio transformation and organizational efficiencies, continues to yield improved gross profit and adjusted EBITDA margins. This improvement is projected to facilitate sustainable margins, benefiting long-term earnings growth.

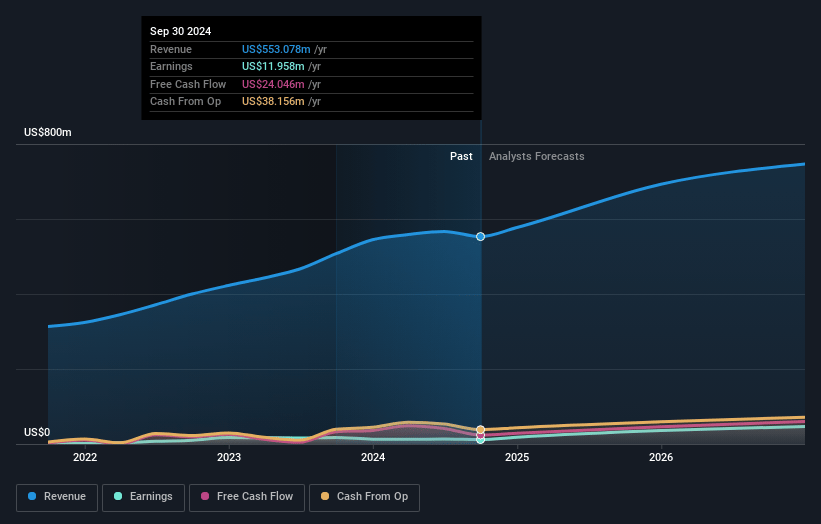

CECO Environmental Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CECO Environmental's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 7.4% in 3 years time.

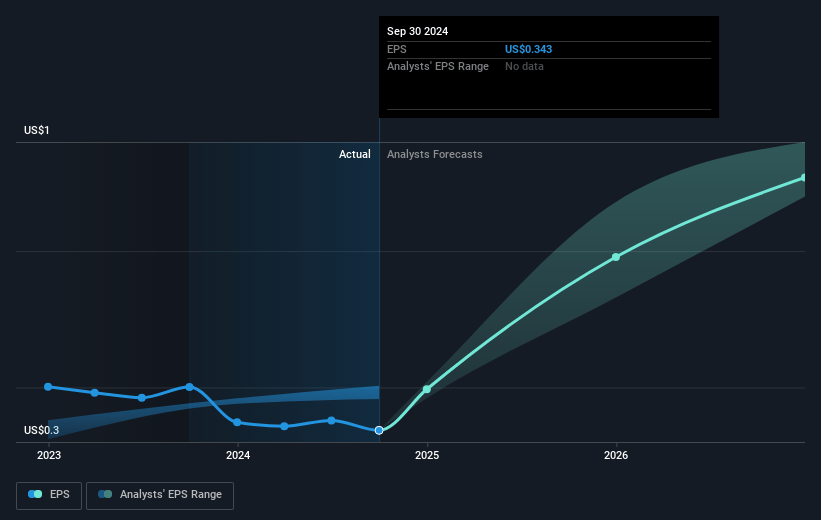

- Analysts expect earnings to reach $60.3 million (and earnings per share of $1.64) by about January 2028, up from $12.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.3x on those 2028 earnings, down from 82.9x today. This future PE is lower than the current PE for the US Commercial Services industry at 32.1x.

- Analysts expect the number of shares outstanding to grow by 1.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.8%, as per the Simply Wall St company report.

CECO Environmental Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Softer than expected third-quarter revenues and income due to customer-driven delays in project execution could lead to uncertainties in future revenue recognition and net margins.

- Execution delays in large projects may result in continued revenue shortfalls if similar issues persist, potentially impacting earnings stability.

- The acquisition of Profire Energy and associated funding could introduce integration risks and financial strain, affecting net margins and earnings projections.

- Dependence on securing and executing large energy transition projects poses the risk of fluctuating order volumes and inconsistent revenue streams.

- Increased leverage from upsizing the credit facility may lead to higher interest expense, affecting net earnings if cash flow generation does not align with debt servicing needs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.2 for CECO Environmental based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $33.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $817.4 million, earnings will come to $60.3 million, and it would be trading on a PE ratio of 26.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $28.35, the analyst's price target of $36.2 is 21.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives