Last Update 14 Dec 25

Fair value Increased 1.92%ZWS: Tariff Pricing And Capital Returns Will Support Balanced Performance Ahead

The analyst price target for Zurn Elkay Water Solutions has inched higher to approximately $51.25 per share, with analysts pointing to stronger anticipated organic sales growth into 2026, ongoing tariff driven pricing tailwinds, and confidence in the company’s ability to deliver double digit earnings and cash flow growth, supported by its current valuation.

Analyst Commentary

Recent Street research reflects a generally constructive but balanced stance on Zurn Elkay, with multiple firms lifting price targets in response to the company’s Q3 performance and updated medium term growth outlook. Analysts are increasingly focused on the durability of tariff driven pricing, the visibility into non residential demand, and the company’s ability to convert its strategic initiatives into sustained earnings and cash flow growth.

Bullish Takeaways

- Bullish analysts highlight raised price targets in the mid to low $50s range as evidence that the market is beginning to recognize Zurn Elkay’s potential for double digit earnings and cash flow growth over the next several years.

- The updated outlook for approximately 8% organic sales growth in FY25, followed by mid single digit growth into 2026, is seen as achievable given current non residential construction signals and the company’s strong position in water management and Elkay drinking water platforms.

- Analysts view elevated tariff driven pricing as a key support for near term margin expansion, helping underpin upside to current estimates through at least Q4 while giving management more flexibility to reinvest for growth.

- With what is described as significant balance sheet dry powder, bullish analysts see room for accretive M&A to supplement organic growth, supporting a premium valuation versus peers if execution on capital deployment remains disciplined.

Bearish Takeaways

- More cautious analysts, including those maintaining Neutral ratings, note that while price targets are moving higher, the stock’s recent rally leaves less room for multiple expansion if growth moderates from current expectations.

- There is some concern that a meaningful portion of recent upside is tied to tariff related pricing, which could prove less durable if the pricing environment normalizes or competitive pressure intensifies.

- Visibility into the broader non residential cycle is still not fully clear, and bearish analysts worry that a slower than expected recovery in later cycle projects could challenge management’s mid single digit growth framework for 2026.

- Given the increased reliance on successful execution of M&A to sustain above market growth, skeptics highlight integration risk and the potential for overpaying for assets, which could weigh on returns and compress the valuation premium if not managed carefully.

What's in the News

- Zurn Elkay Water Solutions increased its annual dividend by 22% to $0.44 per share, reflecting management’s positive view of the company’s cash flow outlook (Key Developments).

- The company raised the remaining authorization under its equity repurchase program to $500 million as of October 28, 2025, providing additional flexibility for capital returns (Key Developments).

- Management issued fourth quarter 2025 guidance calling for high single digit core sales growth (Key Developments).

- From July 1 to September 30, 2025, Zurn Elkay repurchased 575,600 shares for $25 million, bringing total buybacks since 2015 to 21,771,728 shares, or 14.61% of shares outstanding (Key Developments).

- Elkay launched the Liv EZ built in filtered water dispenser for residential use, extending its commercial hydration technology into home applications with advanced contaminant reduction (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly from approximately $50.29 to $51.25 per share, reflecting modestly higher long term expectations.

- Discount Rate has increased marginally from about 8.45% to 8.48%, implying a slightly higher required return for investors.

- Revenue Growth assumption has edged higher from roughly 5.77% to 5.93%, indicating a small upgrade to the medium term topline outlook.

- Net Profit Margin forecast has declined slightly from about 15.40% to 15.33%, signaling a minor compression in expected profitability.

- Future P/E multiple has risen modestly from about 33.7x to 34.4x, suggesting a small increase in the valuation investors are willing to pay for forward earnings.

Key Takeaways

- Legislative demand for water quality and filtration advances is expanding market opportunities and ensuring long-term revenue growth through innovative, higher-margin products.

- Supply chain improvements and successful pricing strategies are strengthening cost stability, margin resiliency, and reducing exposure to external market risks.

- Heavy reliance on favorable market timing, policy tailwinds, and price increases leaves growth and margins vulnerable to demand normalization, regulatory delays, cost inflation, or increased competition.

Catalysts

About Zurn Elkay Water Solutions- Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

- Government funding and rising legislative requirements for water quality in schools (such as filter first mandates) are expected to drive broader adoption of advanced filtration and water safety products, expanding Zurn Elkay's addressable market and boosting long-term revenue growth.

- The rollout and market adoption of the new Elkay Pro Filtration platform-with drop-in replacements, longer filter life, proprietary filters, and IoT/connectivity-positions the company to accelerate replacement cycles and sustain double-digit growth in high-margin filtration revenue, supporting higher earnings and margin expansion.

- Continued share gains and unit volume growth, driven by recent product innovation in drinking water, flow systems, and water control, are beginning to hit the market now and are seen as sustainable, which should strengthen both top-line growth and operational leverage in coming years.

- Ongoing supply chain localization and reduced exposure to tariff volatility are enhancing cost stability, which, combined with successful price realization, underpins confidence in staying price/cost positive and promoting net margin resiliency over the mid to long term.

- Growth in nonresidential construction, especially in healthcare and education-key Zurn Elkay end markets with no current signs of slowdown-supports a robust multi-year demand pipeline, providing stable revenue visibility and mitigating cyclical risk.

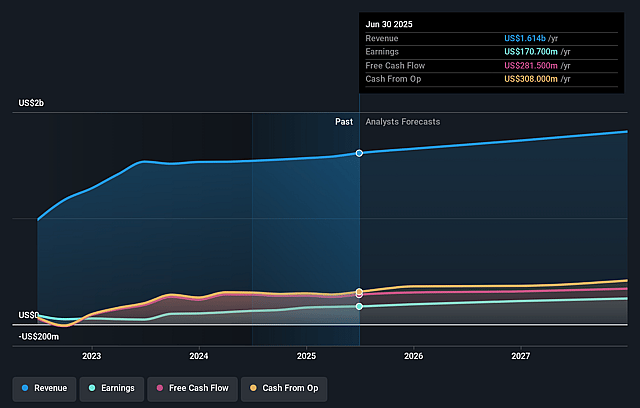

Zurn Elkay Water Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zurn Elkay Water Solutions's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 14.2% in 3 years time.

- Analysts expect earnings to reach $266.9 million (and earnings per share of $1.43) by about September 2028, up from $170.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, down from 45.1x today. This future PE is greater than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

Zurn Elkay Water Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's recent core growth and margin performance were boosted in part by $8–10 million of customers ordering ahead of announced price increases, which may temporarily inflate sales and mask true end-market demand, potentially leading to slower, less predictable revenue growth and margin normalization in future periods.

- While Zurn Elkay has executed well on tariff management and supply chain relocation, ongoing exposure to trade policy volatility-including Section 232 steel tariffs and new copper tariffs-along with continued raw material price fluctuations, pose sustained risk of margin pressure if price increases cannot keep pace or if material costs remain elevated, ultimately affecting net margins and earnings.

- The company remains heavily reliant on non-residential construction, particularly the healthcare and education sectors. Any delayed impact from budgetary pressures or future federal/state funding cuts in these sectors could reduce project activity, leading to revenue shortfalls and weaker earnings growth.

- Zurn Elkay's growth outlook is closely tied to regulatory developments and state legislation mandating filtered water solutions in schools; if legislative momentum stalls, compliance deadlines are extended, or funding does not materialize as expected, the addressable market may expand more slowly than anticipated, directly impacting revenue growth targets.

- Despite success in launching new products and raising average selling prices, intensified industry competition and the potential for disruptive water technologies (such as decentralized, highly efficient systems) could erode market share and exert pricing pressure, thereby constraining both future revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.571 for Zurn Elkay Water Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $41.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $266.9 million, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $45.9, the analyst price target of $45.57 is 0.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zurn Elkay Water Solutions?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.