Narratives are currently in beta

Key Takeaways

- Strong growth potential in institutional markets, with legislative support, positions Zurn Elkay for increased revenue and margin gains.

- Synergies, margin expansion, and a solid balance sheet enable strategic M&A and EPS growth through accretive acquisitions.

- Dependence on Elkay merger synergies and productivity initiatives for margin expansion poses risks if expected results aren't achieved, impacting net margins and earnings.

Catalysts

About Zurn Elkay Water Solutions- Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

- Zurn Elkay sees strong growth potential from institutional end markets, particularly in the education and healthcare sectors. The increasing demand for new school constructions and aging school infrastructure represent a significant market opportunity, expected to drive future revenue growth.

- The company benefits from legislation like Michigan's filter-first regulations, which could lead to increased demand for its drinking water solutions in schools. This regulatory tailwind is expected to enhance both revenue and margins as it further penetrates this market.

- Continuous productivity improvements and the realization of synergies from the Elkay merger have driven margin expansion, positioning Zurn Elkay well to achieve above-industry growth in adjusted EBITDA and profitability.

- The company's focus on retrofit and replacement markets, which comprise nearly 45% of its business, provides a stable revenue stream with opportunities for growth independent of new construction activity. This could bolster earnings growth in the coming years.

- Zurn Elkay's robust balance sheet and low leverage create opportunities for strategic M&A and share repurchases, likely enhancing earnings per share (EPS) and supporting long-term growth through accretive acquisitions.

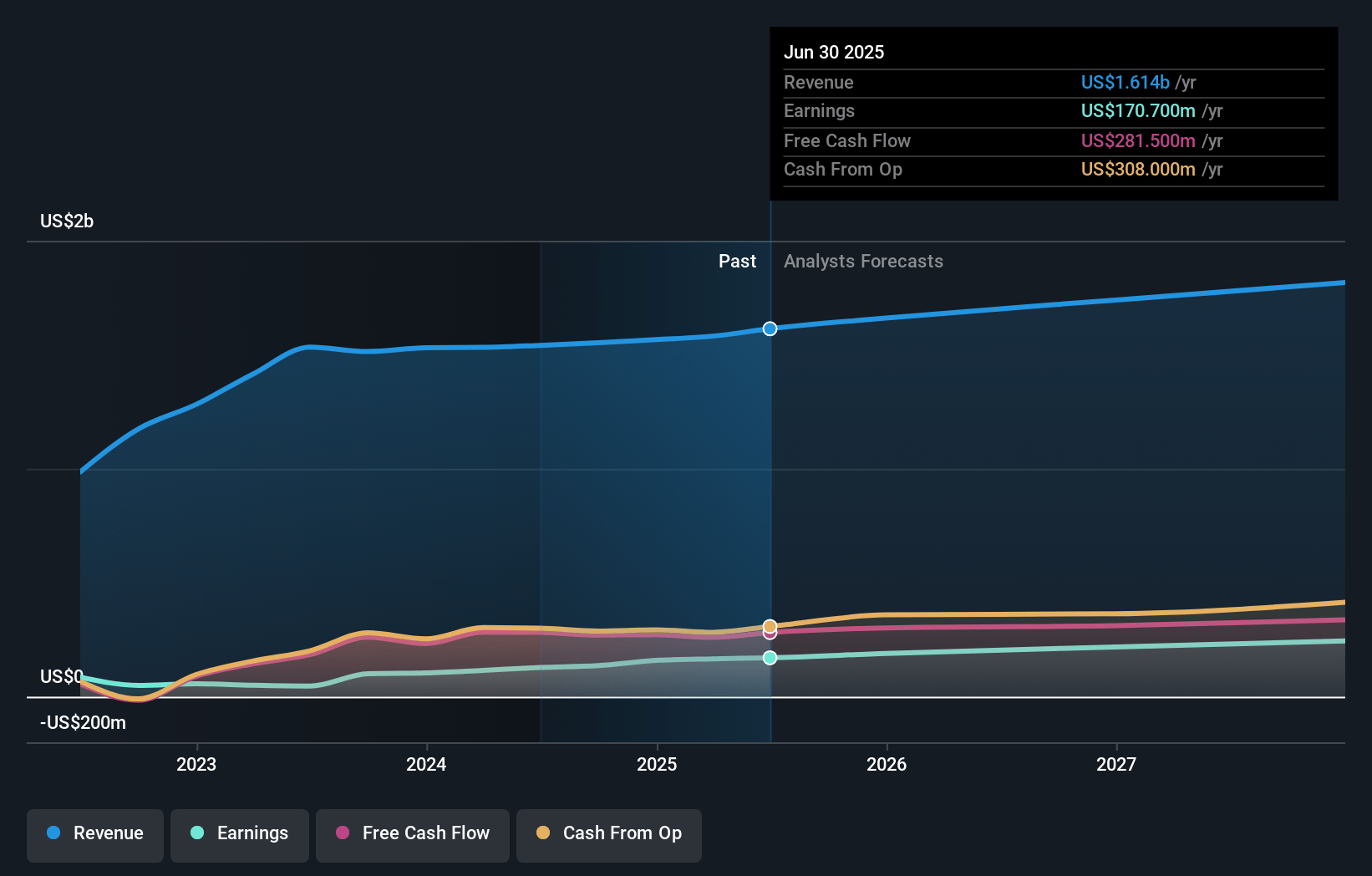

Zurn Elkay Water Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zurn Elkay Water Solutions's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.8% today to 13.5% in 3 years time.

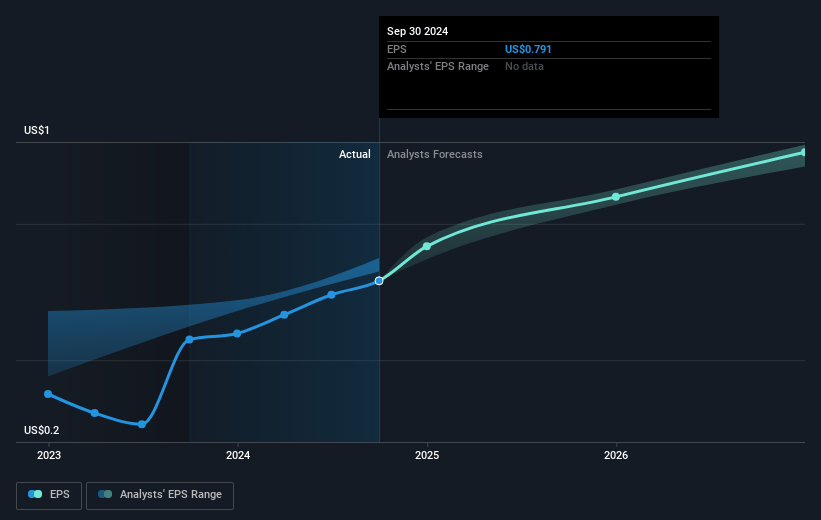

- Analysts expect earnings to reach $239.8 million (and earnings per share of $1.46) by about November 2027, up from $136.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.8x on those 2027 earnings, down from 49.1x today. This future PE is greater than the current PE for the US Building industry at 22.2x.

- Analysts expect the number of shares outstanding to decline by 1.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

Zurn Elkay Water Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Flattish sales in the residential end market could indicate limited growth potential and may negatively impact overall revenue projections if residential demand does not recover significantly.

- The reliance on continuous productivity initiatives and synergies from the Elkay merger for margin expansion implies potential risk if these efforts do not yield the expected results, which could negatively affect net margins and earnings.

- The capital allocation strategy, including share repurchases and dividend increases, could limit funds available for strategic reinvestment or acquisitions, potentially constraining future revenue growth.

- The projections for increased construction starts in 2025 must materialize to drive anticipated growth; otherwise, there is a risk that expected revenue from new projects will not be realized, impacting future revenue and earnings.

- Legislative and regulatory factors such as the Michigan filter-first regulations carry adoption risks over extended time frames, and any delays or changes in legislation could impact anticipated revenue growth in the drinking water category.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.71 for Zurn Elkay Water Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.8 billion, earnings will come to $239.8 million, and it would be trading on a PE ratio of 32.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $39.41, the analyst's price target of $38.71 is 1.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives