Last Update 15 Dec 25

Fair value Increased 0.29%WMS: End Market Outperformance Will Sustain Future Margin Resilience

Analysts have nudged up their price target on Advanced Drainage Systems by about $0.50 per share to reflect stronger than expected EBITDA growth, resilient pricing, and consistent outperformance compared with building products peers.

Analyst Commentary

Bullish analysts are framing the modest price target increase as a validation of Advanced Drainage Systems' ability to consistently outperform both internal plans and broader building products peers.

Bullish Takeaways

- Stronger than expected adjusted EBITDA growth, including 17% year over year expansion in FY26, supports a higher valuation multiple and underpins upward revisions to price targets.

- Broad based upside across business segments and continued positive price cost dynamics suggest the company can sustain margin resilience even as input costs and demand conditions evolve.

- Management's reiterated end market outlook, despite ongoing concerns around residential exposure, is seen as a sign of execution confidence and visibility into the demand pipeline.

- Recent fiscal results are viewed as "hitting the mark" on end market outperformance, reinforcing the narrative that the company can continue to gain share versus building products peers.

Bearish Takeaways

- Bearish analysts remain focused on the risk of further declines in residential exposed businesses, which could pressure volume growth and challenge the sustainability of recent margin strength.

- The stock's rerating following a period of outperformance leaves less room for multiple expansion if growth normalizes, which could make future returns more dependent on continued execution beats.

- Reliance on favorable price cost contributions introduces downside if input costs rise faster than anticipated or competitive pressures limit further pricing actions.

- Any weakening in end market trends relative to the reiterated outlook could undermine confidence in management guidance and prompt a reset in growth and valuation expectations.

What's in the News

- Completed share repurchase program first announced on February 3, 2022, with a total of 8,244,000 shares bought back, representing 11.41% of shares outstanding for $852.26 million (company buyback update).

- No additional shares repurchased between July 1, 2025 and September 30, 2025, signaling the formal conclusion of the previously authorized buyback tranche (company buyback update).

Valuation Changes

- The fair value estimate has risen slightly from $171.10 to $171.60 per share, reflecting a modest upward adjustment in intrinsic value.

- The discount rate has increased slightly from 8.59% to about 8.63%, implying a marginally higher required return and risk assumption in the valuation model.

- The revenue growth forecast is effectively unchanged, remaining around 5.09% annually, indicating stable top line growth expectations.

- The net profit margin outlook is essentially flat at approximately 17.18%, suggesting no material shift in long term profitability assumptions.

- The future P/E multiple has risen slightly from about 28.7x to 28.8x, signaling a modest uptick in the valuation investors are expected to assign to future earnings.

Key Takeaways

- Heightened demand for innovative stormwater solutions and regulatory pressures are driving growth in high-margin products, supporting revenue acceleration and expanding profit margins.

- Strategic investments in automation, segment expansion, and geographic reach are improving operational efficiency and positioning the company for sustained earnings and margin gains.

- Revenue and margin growth face risks from weak demand, rising input costs, dependence on acquisitions, pricing pressures, and uncertain infrastructure investment trends.

Catalysts

About Advanced Drainage Systems- Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

- Ongoing climate change and increasing frequency/severity of extreme weather events are driving up the necessity for advanced stormwater management and resilient drainage infrastructure, underpinning structural, long-term volume growth – supporting sustained revenue acceleration.

- Rising regulatory emphasis on water quality and sustainable construction (with more stringent stormwater and pollution controls) is increasing adoption of high-margin, innovative solutions such as the recently launched Arcadia hydrodynamic separator and EcoStream Biofiltration products, which is likely to expand net margins and boost revenue mix over time.

- Continuous expansion of the Allied Products and Infiltrator segments, both of which command higher margins and are growing faster than the core Pipe business, is shifting product mix toward higher profitability, resulting in improved EBITDA margins and long-term earnings power.

- Strategic investments in manufacturing automation, logistics, and operational efficiency (including new technology centers and line upgrades) have significantly increased production per line and lowered fixed costs, positioning the company to achieve sustained margin expansion even in tepid end market demand environments.

- ADS's flexibility for geographic and product expansion-supported by a robust balance sheet, strong free cash flow, and liquidity-enables opportunistic acquisitions and organic penetration in high-growth regions (e.g., Southeast, South, and West), further underpinning top-line growth and scale-driven margin improvement.

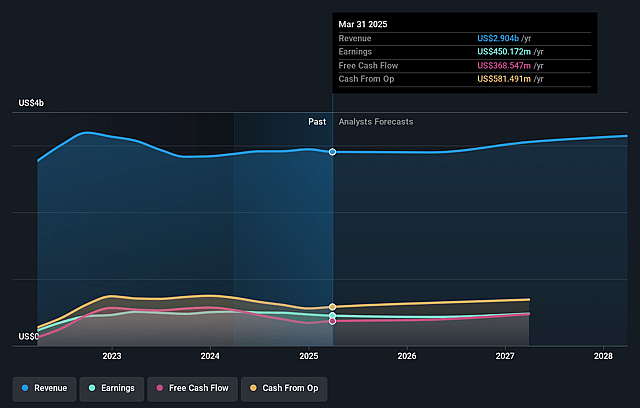

Advanced Drainage Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Advanced Drainage Systems's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 16.8% in 3 years time.

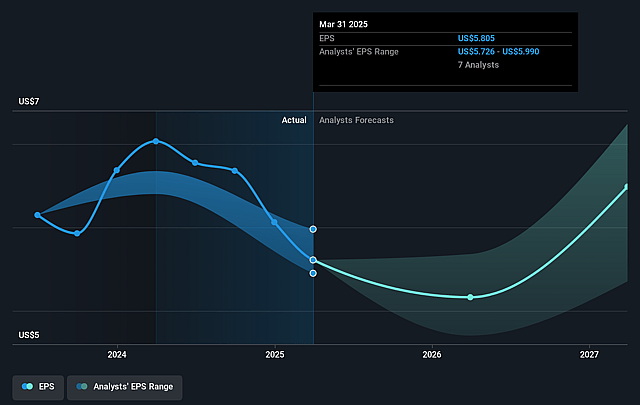

- Analysts expect earnings to reach $558.3 million (and earnings per share of $7.4) by about September 2028, up from $432.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.5x on those 2028 earnings, up from 24.8x today. This future PE is greater than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Advanced Drainage Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management repeatedly emphasizes a tepid, flattish, and choppy demand environment across core end markets (residential, nonresidential, infrastructure), with particular concern around the sustainability of future demand growth; protracted softness or stagnation in construction and infrastructure spending would directly constrain revenue growth.

- There is significant ongoing reliance on favorable input costs, particularly resin and other raw materials. Persistent or unexpected increases in these commodity input prices could quickly compress net margins and earnings, as margin expansion in recent quarters was partially attributed to lower material costs.

- The company's organic growth is lagging while recent revenue growth is heavily driven by acquisitions like Orenco, suggesting that if acquisition-driven expansion cannot be sustained or fails to deliver expected synergies, overall top-line growth may underperform, impacting both revenue and long-term earnings.

- Long-term uncertainty remains regarding the ability to increase or even maintain price levels in a highly competitive environment, especially if end-market demand weakens further or new competitors (or alternative products) pressure pricing; this poses ongoing risk to both revenue and operating margins.

- Despite positive long-term secular water infrastructure trends, end-market dynamics such as delayed project starts, uneven government infrastructure outlays, and shifting public/private investment priorities could result in structurally lower or slower-than-expected volume growth, ultimately limiting realized revenue and margin expansion over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $154.5 for Advanced Drainage Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $167.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $558.3 million, and it would be trading on a PE ratio of 27.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $138.2, the analyst price target of $154.5 is 10.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Advanced Drainage Systems?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.