Narratives are currently in beta

Key Takeaways

- Rising utility CapEx and demand for telecom infrastructure drive long-term growth in revenue and operating margins for Valmont.

- Strategic solar and agricultural expansions promise enhanced revenues and margins through market demand shifts and Brazilian opportunities.

- Challenges in maintaining revenue growth, affected by declining agricultural sales, steel cost pressures, and strategic deselection of solar projects, may impact future profitability.

Catalysts

About Valmont Industries- Operates as manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally.

- Increasing utility CapEx spending driven by electrification, industrial development, and expansion of data centers suggests sustained growth in the utility segment, positively impacting Valmont's revenue and operating margins.

- The anticipated recovery in the housing market and increased transportation spending due to DOT infrastructure investments and IIJA funding is expected to boost revenue in the Lighting & Transportation business, enhancing overall operating margins.

- Rising demand for telecommunications infrastructure, driven by the adoption of advanced technologies like 5G, positions Valmont to capture long-term growth, contributing to steady revenue growth and improving earnings.

- Valmont's strategic entry into higher-margin solar tracker solutions could enhance revenue and expand margins in the Solar business as market demand shifts towards distributed generation and select utility-scale applications.

- Expectations of significant growth opportunities in Brazil's agricultural sector from an increase in irrigated land offers potential for revenue growth and margin expansion in the Agriculture segment.

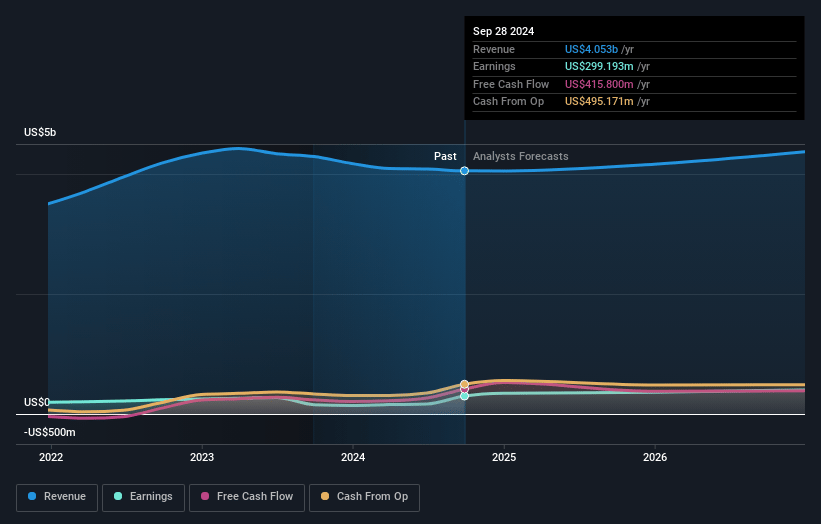

Valmont Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Valmont Industries's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 9.4% in 3 years time.

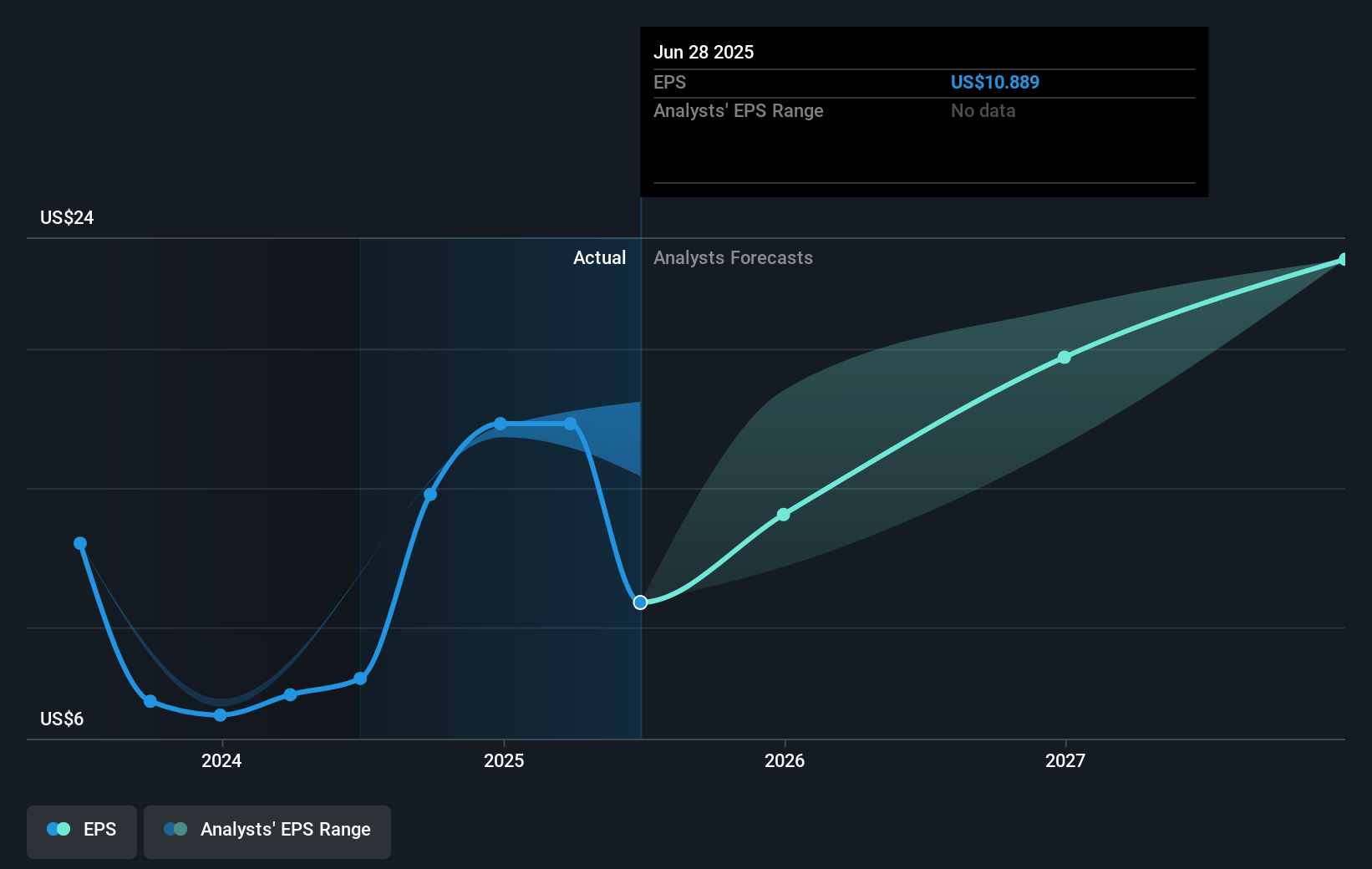

- Analysts expect earnings to reach $413.6 million (and earnings per share of $20.43) by about November 2027, up from $299.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.5x on those 2027 earnings, down from 22.8x today. This future PE is lower than the current PE for the US Construction industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

Valmont Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite improved operating margins, Valmont Industries experienced a 2.9% decline in net sales for the third quarter, highlighting potential ongoing challenges in maintaining revenue growth, particularly in international markets.

- Valmont's agriculture segment saw a substantial decline in sales and operating income due to lower grain prices impacting grower purchases, especially in Brazil, which could continue to weigh on revenue and margins in this division.

- The company faces ongoing pressure from steel cost fluctuations, with near-term gross margins affected by steel deflation, posing a risk to consistent margin expansion moving forward.

- Valmont has elected to deselect low-margin solar projects, leading to decreased revenues in this sector; a conservative recovery in solar revenues is anticipated only in the second half of 2025, impacting short-term revenue growth.

- Economic pressures on North American farmers, including reduced net farm income and low crop prices, could dampen demand for agricultural equipment, possibly affecting future revenue and profitability in this market segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $362.0 for Valmont Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.4 billion, earnings will come to $413.6 million, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of $340.24, the analyst's price target of $362.0 is 6.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives