Last Update 10 Sep 25

Fair value Increased 4.04%The upward revision in Toro’s price target is primarily driven by improved consensus revenue growth forecasts, while a modestly lower future P/E further supports the higher fair value estimate of $92.60.

What's in the News

- Toro lowered its earnings guidance for fiscal 2025, expecting net sales to be at the lower end of previous guidance (flat to down 3%) due to macroeconomic factors causing reduced volume and increased caution among homeowners and channels.

- Strong demand and stable supply continue for underground construction and golf and grounds businesses.

- Guidance incorporates anticipated tariff impacts and assumes weather patterns remain historically average for the rest of the year.

Valuation Changes

Summary of Valuation Changes for Toro

- The Consensus Analyst Price Target has risen slightly from $89.00 to $92.60.

- The Consensus Revenue Growth forecasts for Toro has significantly risen from 1.6% per annum to 2.3% per annum.

- The Future P/E for Toro has fallen slightly from 19.62x to 18.74x.

Key Takeaways

- Strategic investment in automation, electrification, and productivity initiatives positions Toro for long-term premium growth, margin expansion, and improved profitability across core segments.

- Stabilized professional and recovering residential demand, alongside focus on sustainability and operational streamlining, underpin robust future revenue and earnings potential.

- Toro faces ongoing margin and earnings risks from weak residential demand, weather and macro volatility, cost pressures, rising competition, and limited international diversification.

Catalysts

About Toro- Designs, manufactures, markets, and sells professional turf maintenance equipment and services.

- Ongoing investments and recent product launches in smart, connected, and autonomous turf and irrigation solutions (e.g., GeoLink Mow Autonomous Fairway Mower, TurfRad moisture sensing) directly position Toro to benefit from increasing automation in landscaping and heightened focus on water conservation, supporting future premium product revenue growth and higher net margins.

- Professional segment momentum, driven by record golf participation and sustained infrastructure investment cycles, is providing multi-year order visibility and stable demand for advanced turf, grounds, and underground construction products, setting up for rising revenues and sustained earnings growth as markets recover.

- Acceleration of the AMP productivity program, with $75 million in run-rate cost savings and a longer-term target of $100 million+, is enhancing operating leverage and margins, while ongoing portfolio optimization and selective divestitures streamline core operations for improved future profitability.

- Channel inventory normalization and right-sizing in the residential segment, combined with maintained market share at key retailers, position Toro for a recovery in residential revenue and segment margins approaching historic 8–10% levels once consumer sentiment improves.

- Regulatory and customer shifts toward electrification and sustainability are catalyzing further adoption of Toro's battery-powered and electric equipment lines, leveraging R&D investments to capture market share and drive high-margin growth as emission standards tighten across the industry.

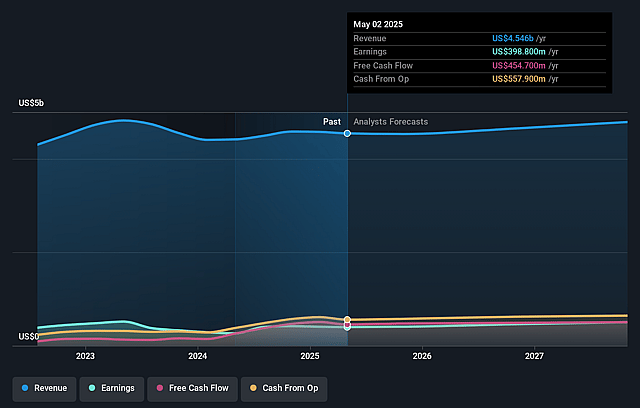

Toro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Toro's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 10.9% in 3 years time.

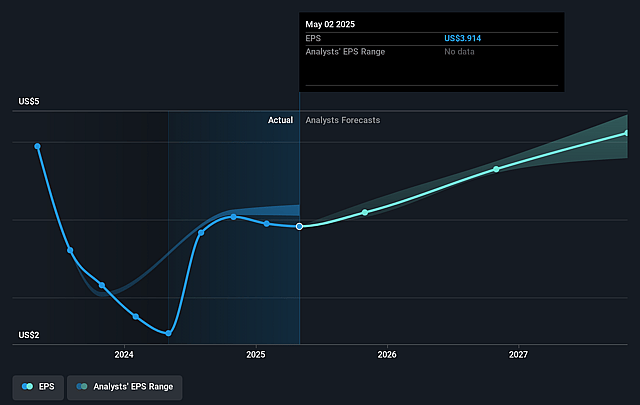

- Analysts expect earnings to reach $526.8 million (and earnings per share of $5.4) by about September 2028, up from $333.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, down from 23.1x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to decline by 4.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.28%, as per the Simply Wall St company report.

Toro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently weak demand in the residential segment, driven by homeowner caution on big-ticket purchases, prolonged low consumer confidence, and dealer hesitancy to restock, creates an ongoing drag on residential revenues and erodes residential margins, as reflected in significant year-over-year declines and the Spartan impairment charge.

- Heavy exposure to macroeconomic cycles and weather volatility, particularly with two consecutive years of low snowfall affecting both residential and BOSS business segments, increases unpredictability in revenue and inventory management, with potential negative impacts on future earnings if weather patterns or housing weakness persist.

- Elevated input costs (materials, manufacturing) and ongoing tariffs (especially on steel and China-sourced products) threaten net margins; despite current productivity and pricing mitigation strategies, future margin improvement could stall or reverse if inflation or new tariffs escalate.

- Rising competition and technological disruption in landscaping equipment (e.g., electrification, automation, smart connected products) requires continuous heavy R&D and capital investment; if competitors innovate more rapidly or Toro's adoption lags, it could result in long-term market share loss and muted earnings growth.

- Continued geographic concentration in North America and limited progress on expanding international professional/municipal markets leaves Toro vulnerable to regional economic slowdowns, shifts in infrastructure investment cycles, or changing regulatory/emissions standards, risking revenue concentration and increased earnings volatility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $92.6 for Toro based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $526.8 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 8.3%.

- Given the current share price of $78.77, the analyst price target of $92.6 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.