Key Takeaways

- Expansion in emerging markets and focus on high-growth sectors like renewables position Timken for sustained revenue and margin growth above expectations.

- Operational efficiency, innovation, and disciplined capital allocation support higher earnings, premium pricing, and increasing market share in a modernizing global economy.

- Continued reliance on traditional bearings, industry cyclicality, and rising competition threaten revenue growth and margins amid electrification, digitalization, and rising costs.

Catalysts

About Timken- Designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally.

- Timken's expansion and investment in emerging markets—such as their new plant in India and more customer-centric approaches globally—directly position the company to benefit from accelerating global infrastructure investment, likely expanding the addressable market and supporting future revenue growth well above current expectations.

- The company is strategically investing in higher-return product lines, increasing R&D for locally tailored solutions, and strengthening its presence in fast-growing sectors like renewable energy and commercial marine. This focused growth, especially in wind and solar-related product lines, is expected to drive above-average revenue growth and margin expansion, setting the stage for higher long-term earnings.

- Timken's core role as a supplier of precision-engineered motion solutions aligns with the global shift toward industrial automation and modernization. As customers demand more advanced and reliable motion products, Timken's innovation and ability to solve complex technical challenges should support premium pricing and higher-margin growth, directly benefiting both net margins and total earnings.

- Ongoing operational efficiency programs, including a targeted $75 million in annual cost savings for 2025 through footprint optimization, supply chain improvements, and SG&A reduction, are poised to support stable or improving EBITDA margins even in a challenging economic environment. These savings feed directly into higher free cash flow and improved earnings per share, increasing the company’s ability to invest in further growth or return capital to shareholders.

- Timken’s disciplined capital allocation—including value-accretive M&A in adjacent and high-margin businesses, a commitment to share buybacks, and investments in advanced manufacturing capacity—positions the company to broaden its earnings base and capture additional market share as secular trends in electrification, supply chain localization, and demand for aftermarket services accelerate, ultimately driving revenue and long-term EPS growth.

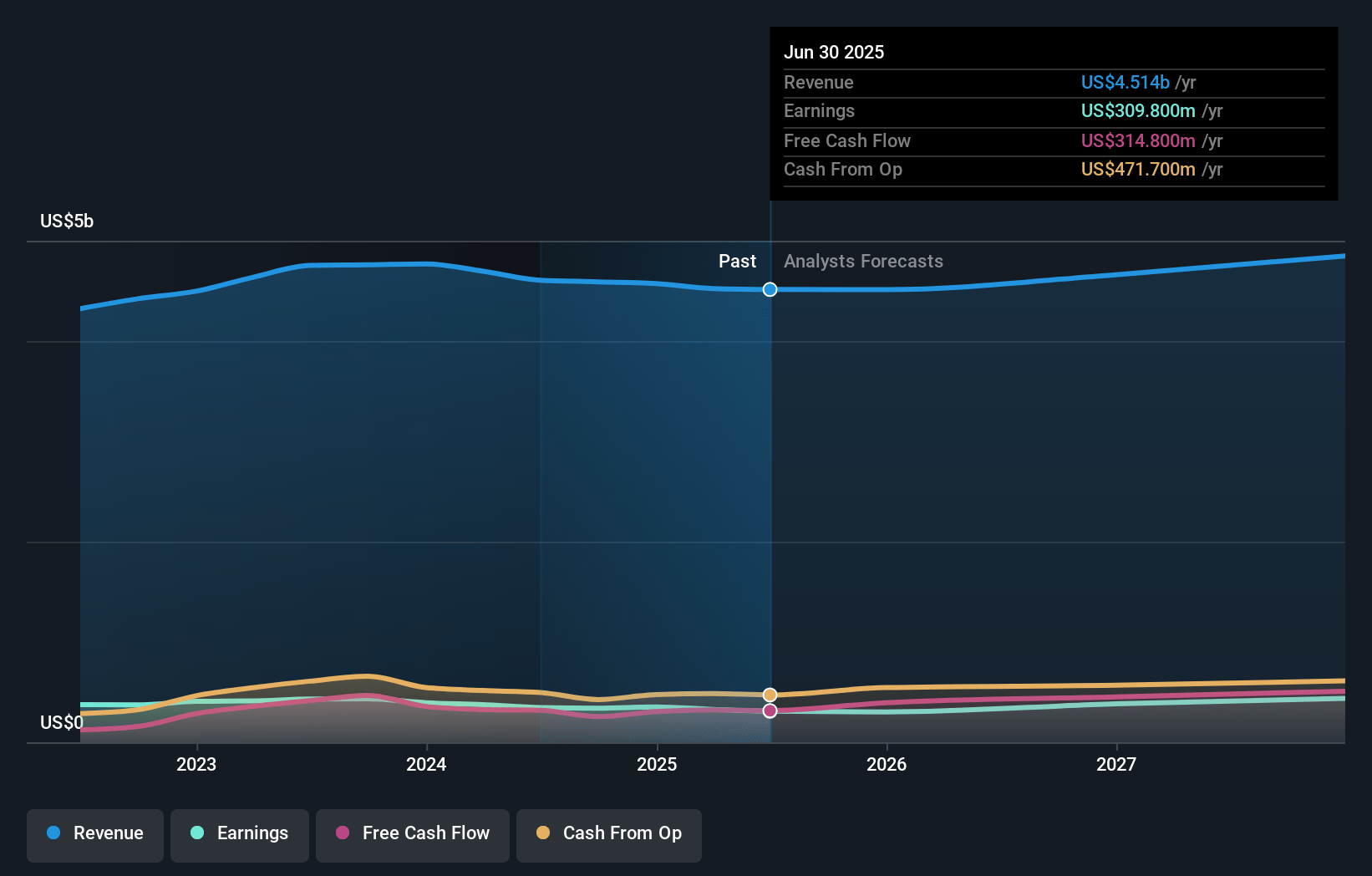

Timken Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Timken compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Timken's revenue will grow by 1.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.7% today to 10.1% in 3 years time.

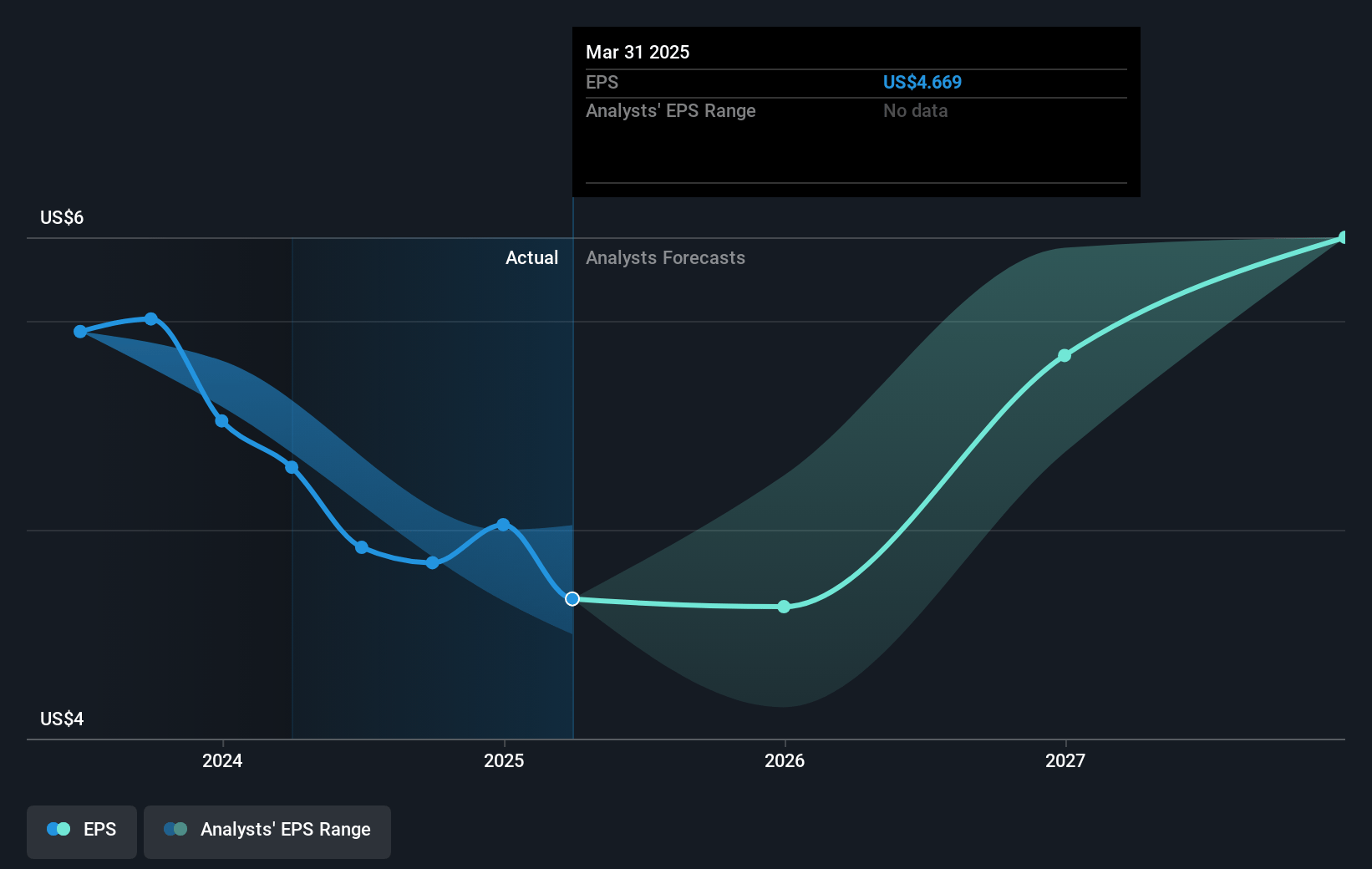

- The bullish analysts expect earnings to reach $483.0 million (and earnings per share of $6.85) by about April 2028, up from $352.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from 12.9x today. This future PE is lower than the current PE for the US Machinery industry at 20.6x.

- Analysts expect the number of shares outstanding to decline by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.15%, as per the Simply Wall St company report.

Timken Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Timken’s heavy reliance on traditional industrial and automotive bearings exposes it to long-term risk from electrification trends in transportation, which may reduce demand in legacy markets and create persistent headwinds for revenue growth.

- The company is overexposed to cyclical and slow-growth sectors such as heavy industry and energy, making its revenues and earnings vulnerable to prolonged industrial downturns or sector stagnation, as highlighted by continued weakness in Europe and ongoing market uncertainty.

- Growing adoption of predictive maintenance and digital technologies in industrial applications could extend replacement cycles and decrease overall volumes for traditional bearing products, putting sustained pressure on Timken’s top-line revenue.

- Increasing competition from lower-cost international players and potential customer consolidation could erode Timken’s market share and pricing power, compressing its net margins, particularly as customers gain more bargaining leverage and pricing pressures intensify in commoditized market segments such as renewables.

- Elevated structural costs, including higher SG&A as a result of legacy pension and labor obligations, along with new capital requirements to comply with ESG and regulatory demands, may limit improvements in net profit margins even if revenue stabilizes or grows modestly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Timken is $100.42, which represents two standard deviations above the consensus price target of $77.15. This valuation is based on what can be assumed as the expectations of Timken's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $102.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $483.0 million, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of $64.99, the bullish analyst price target of $100.42 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:TKR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives