Last Update07 May 25Fair value Increased 0.85%

Key Takeaways

- Timken's pricing strategy and cost savings aim to offset tariffs and inflation, improving net margins and earnings.

- Focused divestment and renewable energy growth strategies aim to enhance margins and revenues, driving future earnings growth.

- Declining demand and challenging industrial conditions could pressure revenues, while tariff impacts and increased competition complicate margin recovery efforts.

Catalysts

About Timken- Designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally.

- Timken is implementing a pricing strategy to offset the cost impact of tariffs, which is expected to fully mitigate the direct impact from tariffs on a run-rate basis by the end of the year. This proactive approach should help maintain and eventually improve net margins.

- The company is committed to delivering $75 million in cost savings in 2025, which should counteract inflationary pressures and support margin expansion, positively affecting net margins and earnings.

- Timken plans to optimize its automotive OEM business portfolio, targeting more than half for potential divestment or restructuring. This focus is expected to enhance corporate margins starting in 2026 and 2027, contributing to overall earnings growth.

- The company anticipates growth in renewable energy demand, particularly in China, with expectations now set for mid-single-digit growth. This expansion in a high-potential market should positively impact revenues.

- Despite current challenges, Timken's strong cash flow generation and disciplined capital allocation strategy position the company well to create shareholder value. Focused investment in high-return areas should drive future earnings growth.

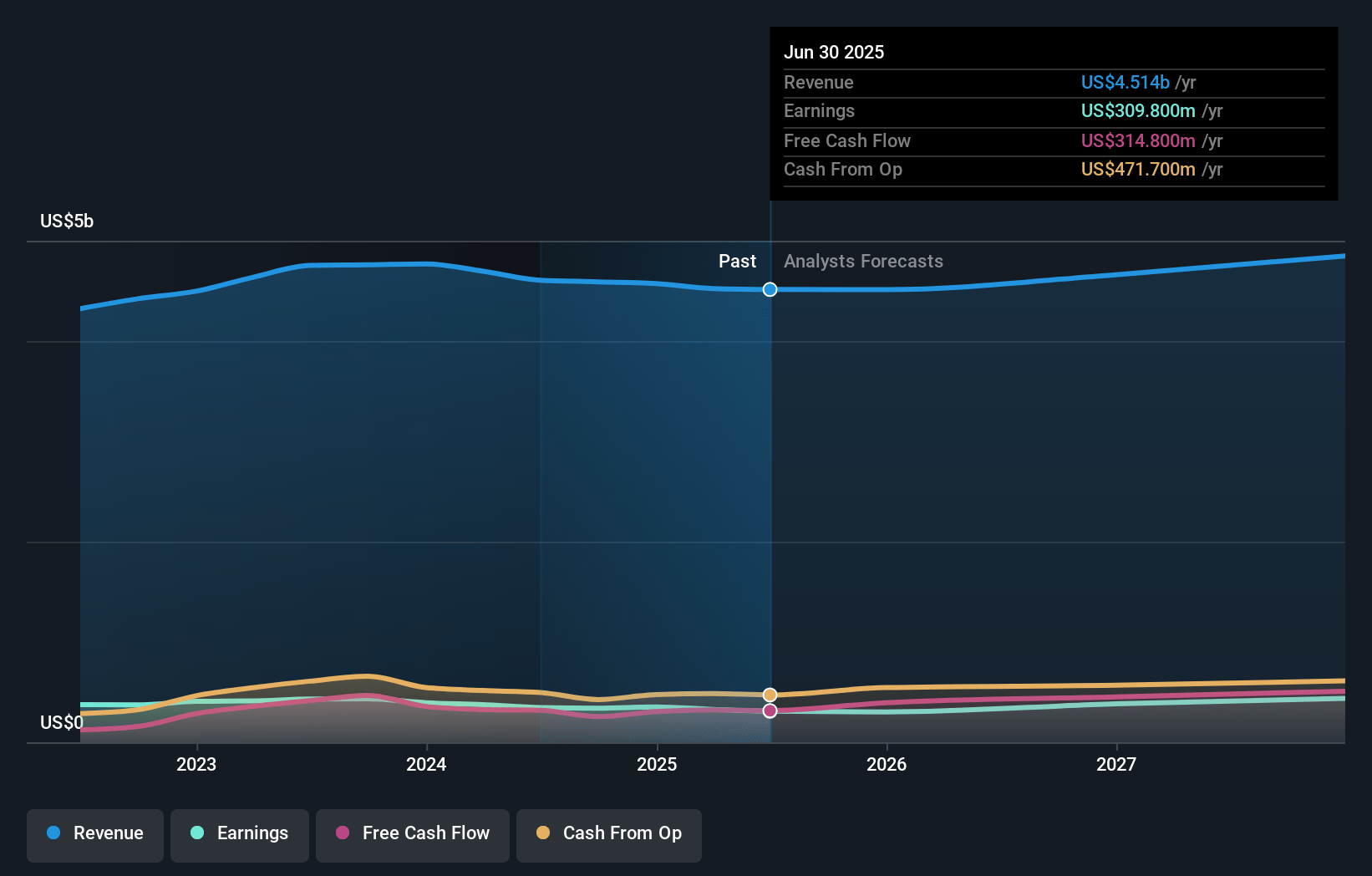

Timken Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Timken's revenue will grow by 1.7% annually over the next 3 years.

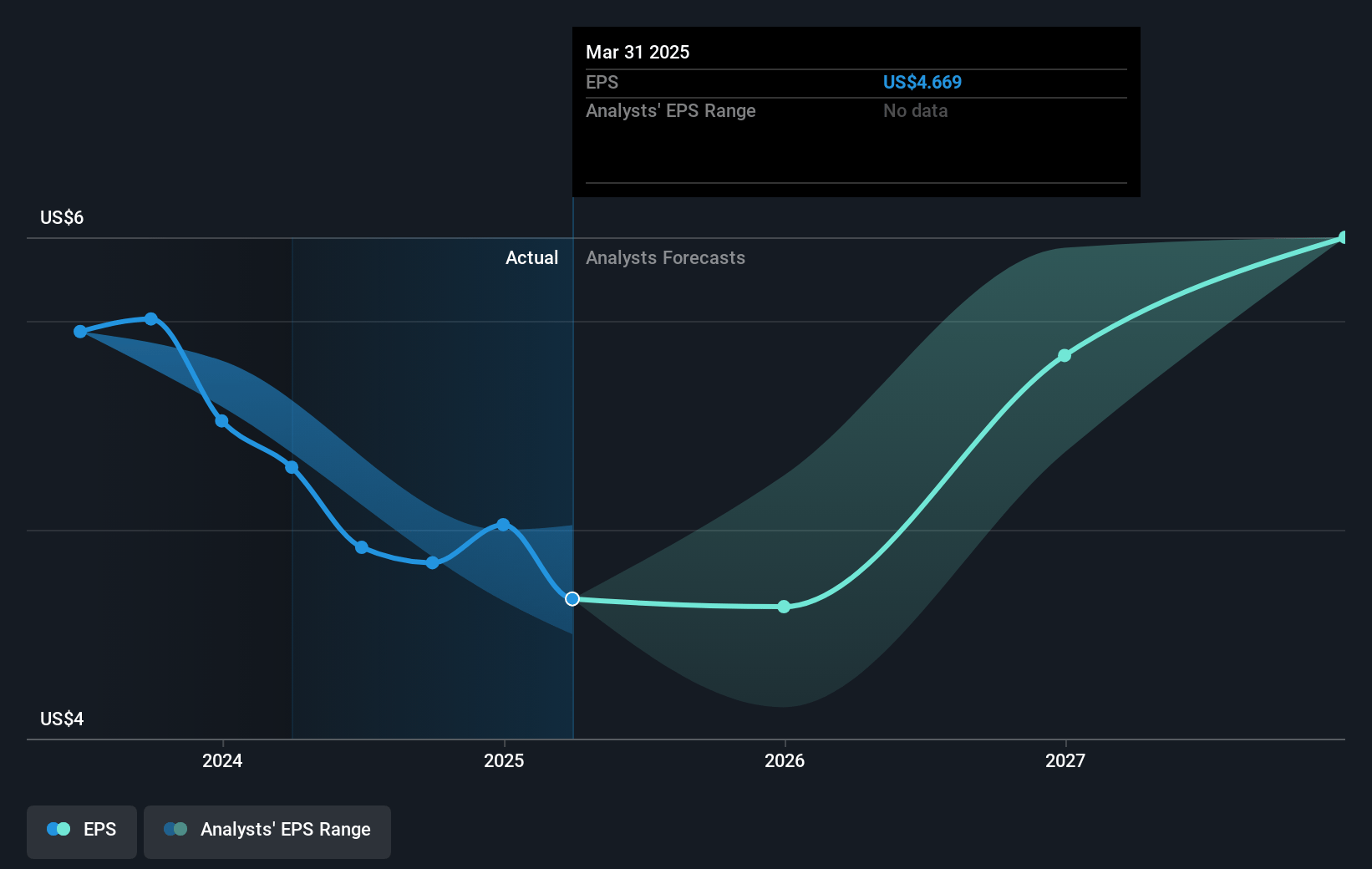

- Analysts assume that profit margins will increase from 7.2% today to 9.7% in 3 years time.

- Analysts expect earnings to reach $459.8 million (and earnings per share of $6.23) by about May 2028, up from $327.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, up from 14.2x today. This future PE is lower than the current PE for the US Machinery industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

Timken Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a decline in organic revenue of 3% from last year, driven by lower demand in key regions, which could pressure future revenues.

- Adjusted EBITDA margins fell to 18.2% from the previous year's 20.7%, largely due to lower sales volumes, higher manufacturing costs, and unfavorable mix, impacting net margins and earnings.

- The ongoing tariff situation presents a net direct impact of approximately $25 million this year, with potential continued volatility impacting revenues and profit margins.

- Industrial market conditions are expected to remain challenging, with a cautious outlook on volume demand, which could hinder revenue growth.

- Increased competition in pricing and potential trade-related economic uncertainty may complicate efforts to achieve planned price increases, affecting revenue and margin recovery plans.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $76.95 for Timken based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $102.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $459.8 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of $66.27, the analyst price target of $76.95 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.