Narratives are currently in beta

Key Takeaways

- The acquisition of ESG is likely to enhance earnings immediately and contribute to future revenue growth through significant operational synergies.

- Strong backlog and strategic investments in technology and infrastructure are expected to drive long-term growth and improve operational efficiency.

- The acquisition of ESG, strategic legislative opportunities, and operational efficiencies position Terex for improved margins, cost synergies, and revenue growth amidst market uncertainties.

Catalysts

About Terex- Manufactures and sells aerial work platforms and materials processing machinery worldwide.

- The acquisition of ESG is expected to be financially accretive from day one, adding approximately $40 million in EBITDA in the fourth quarter alone. This bolsters EBITA projections and suggests future revenue growth from ESG’s integration into Terex.

- Operational synergies from the ESG acquisition, projected to deliver at least $25 million in run-rate synergies by the end of 2026, could positively impact net margins, driving future earnings growth.

- Terex’s strong backlog of $1.6 billion, especially in the AWP segment, suggests continued high revenue, supported by resilient demand in core markets despite current macro challenges.

- Onshoring, technology advancements, and substantial infrastructure investments such as the Infrastructure Investment and Jobs Act, are expected to drive long-term growth beyond 2025, enhancing revenue and profitability.

- Initiatives to shift higher-cost production to lower-cost facilities like Monterrey, coupled with investments in robotics and digital technology, are aimed at reducing fixed costs and improving operational efficiency, positively influencing net margins and earnings over time.

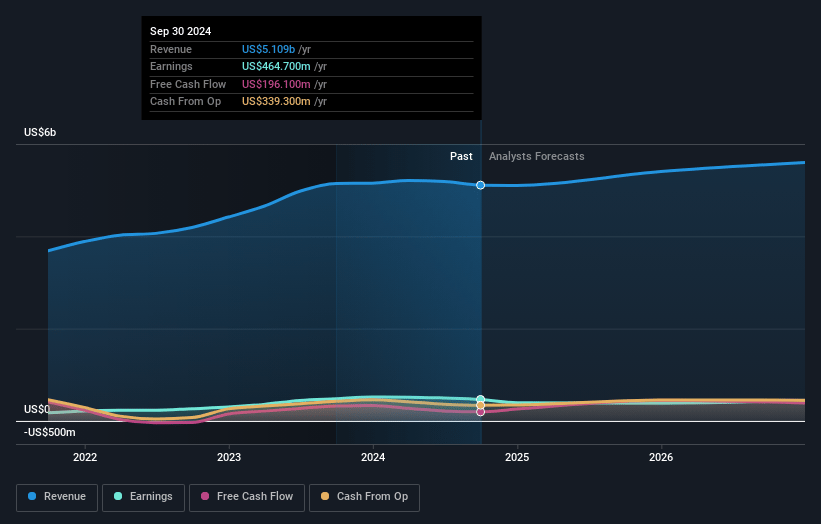

Terex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Terex's revenue will decrease by -0.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.6% today to 7.0% in 3 years time.

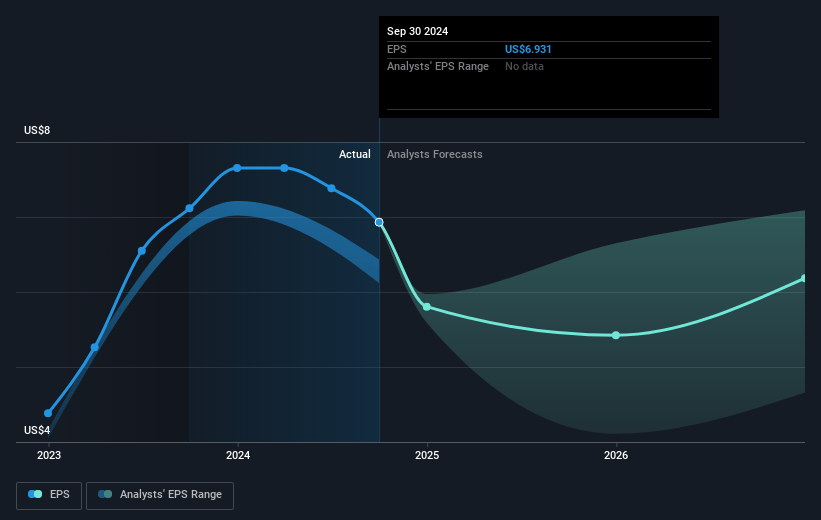

- Analysts expect earnings to reach $354.8 million (and earnings per share of $5.97) by about October 2027, down from $496.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2027 earnings, up from 7.3x today. This future PE is lower than the current PE for the US Machinery industry at 21.3x.

- Analysts expect the number of shares outstanding to decline by 3.89% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Terex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of ESG, a leader in the waste and recycling industry, is expected to be financially accretive from Day 1, adding approximately $40 million in EBITDA in the fourth quarter alone, which can positively impact overall EBITDA and net margins.

- The integration of ESG into Terex is anticipated to deliver at least $25 million in operational run rate synergies by the end of 2026, which could improve cost efficiencies and enhance earnings.

- Terex continues to execute its growth strategies through operational improvements and innovative product development, which could lead to increased revenues and market competitiveness.

- Legislative environments, such as the Infrastructure Investment in Jobs Act, Inflation Reduction Act, and the CHIPS Act, are creating opportunities for Terex to benefit from megatrends, potentially driving strong revenue growth despite short-term uncertainties.

- Terex's strong balance sheet and improved production efficiency, particularly through leveraging its Monterrey facility, position the company to maintain healthy financial performance and support profit margins even during periods of adjusted demand.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.5 for Terex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $46.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.1 billion, earnings will come to $354.8 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of $54.26, the analyst's price target of $58.5 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives